Netcome for the rest?

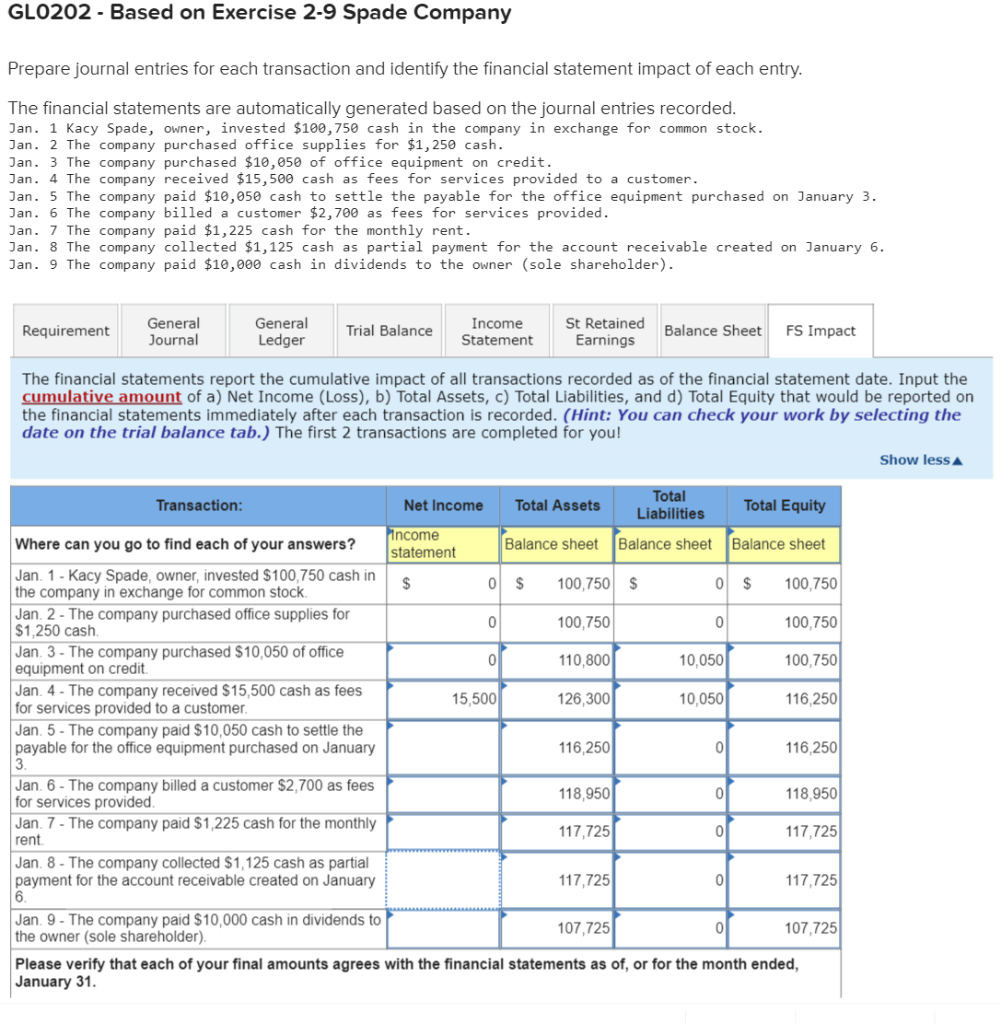

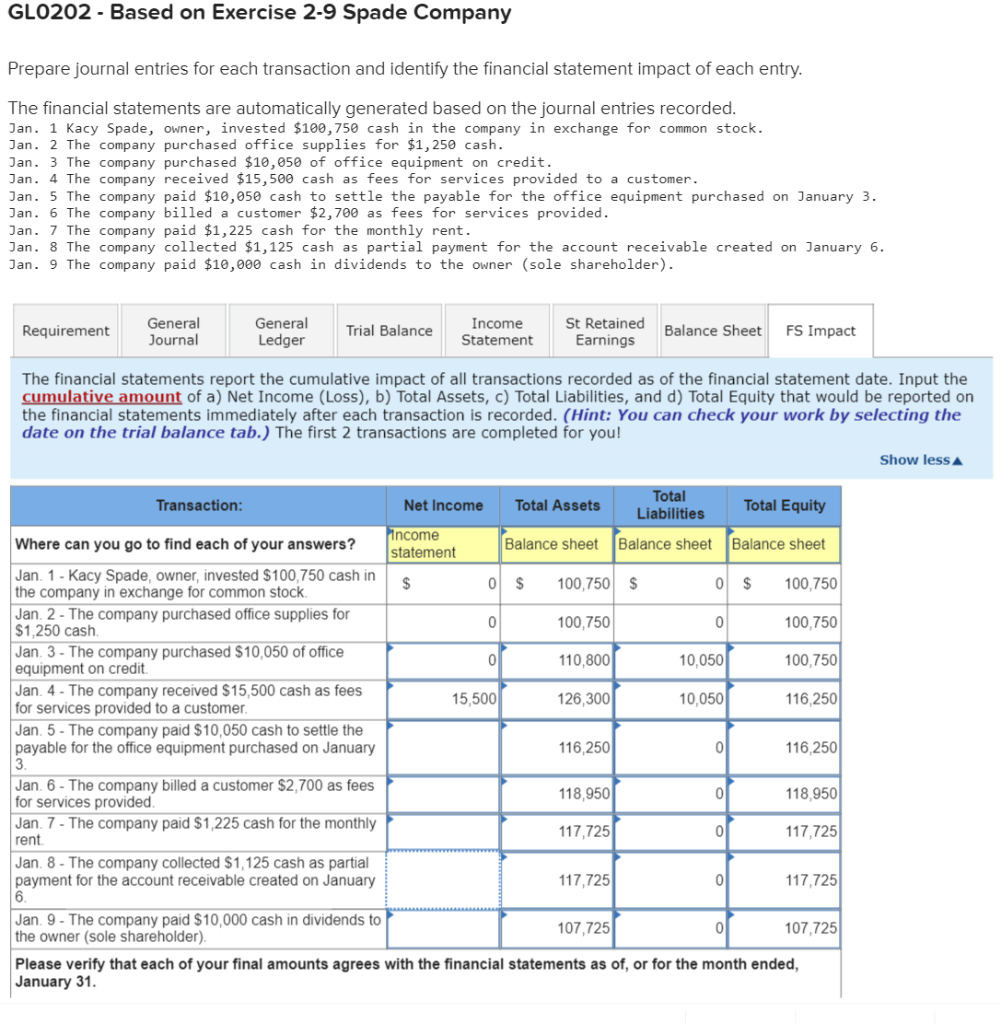

GLO202 - Based on Exercise 2-9 Spade Company Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. Jan. 1 Kacy Spade, owner, invested $100,750 cash in the company in exchange for common stock. Jan. 2 The company purchased office supplies for $1,250 cash. Jan. 3 The company purchased $10,050 of office equipment on credit. Jan. 4 The company received $15,500 cash as fees for services provided to a customer. Jan. 5 The company paid $10,050 cash to settle the payable for the office equipment purchased on January 3. Jan. 6 The company billed a customer $2,700 as fees for services provided. Jan. 7 The company paid $1,225 cash for the monthly rent. Jan. 8 The company collected $1,125 cash as partial payment for the account receivable created on January 6. Jan. 9 The company paid $10,000 cash in dividends to the owner (sole shareholder). Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet FS Impact The financial statements report the cumulative impact of all transactions recorded as of the financial statement date. Input the cumulative amount of a) Net Income (Loss), b) Total Assets, c) Total Liabilities, and d) Total Equity that would be reported on the financial statements immediately after each transaction is recorded. (Hint: You can check your work by selecting the date on the trial balance tab.) The first 2 transactions are completed for you! Show less Transaction: Net Income Total Assets Total Liabilities Total Equity Where can you go to find each of your answers? income statement Balance sheet Balance sheet Balance sheet $ 0 $ 100,750 $ 0 $ 100,750 Jan. 1 - Kacy Spade, owner, invested $100,750 cash in the company in exchange for common stock Jan. 2 - The company purchased office supplies for $1,250 cash Jan 3 - The company purchased $10,050 of office equipment on credit. Jan. 4 - The company received $15,500 cash as fees for services provided to a customer. Jan. 5 - The company paid $10,050 cash to settle the payable for the office equipment purchased on January o op 15,500 100,750 110,800 126,300 0 10,050 10,050 100,750 100,750 116,250 116,250 116,250 118,950 118,950 Jan. 6 - The company billed a customer $2,700 as fees for services provided Jan. 7 - The company paid $1,225 cash for the monthly rent Jan. 8- The company collected $1,125 cash as partial payment for the account receivable created on January of 01 117,725 117,725 117,725 117,725 Jan. 9 - The company paid $10,000 cash in dividends to 107,725 107,725 the owner (sole shareholder). Please verify that each of your final amounts agrees with the financial statements as of, or for the month ended, January 31