Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Netflix Mansfield Today - Mail-Mansfield Converse C NEWS Translate M Gmail Income Statement For the Year Ended December 31, 20X2 Sales $ 3.650.000 Cost of

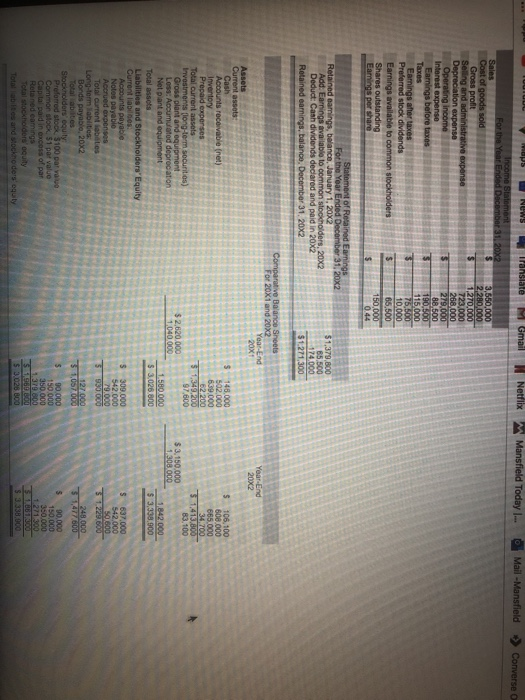

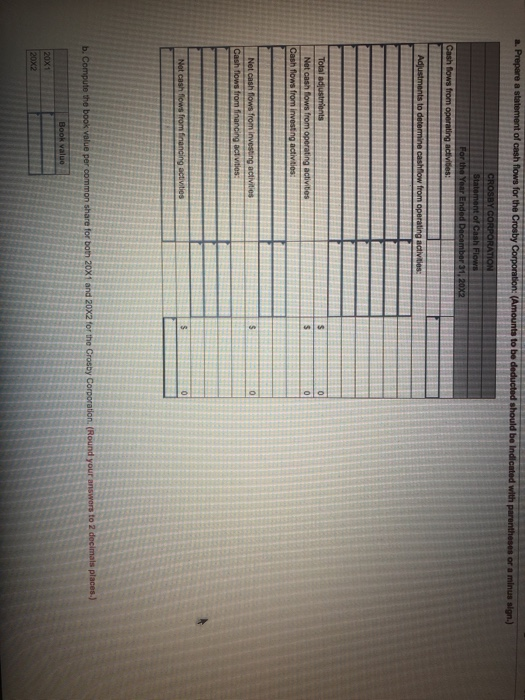

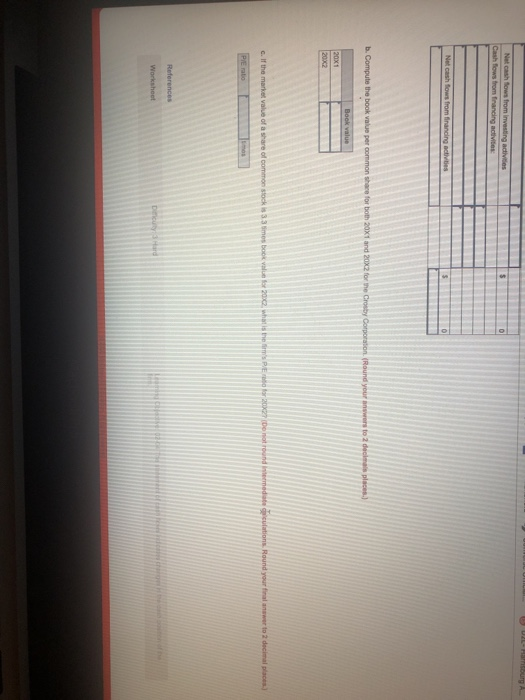

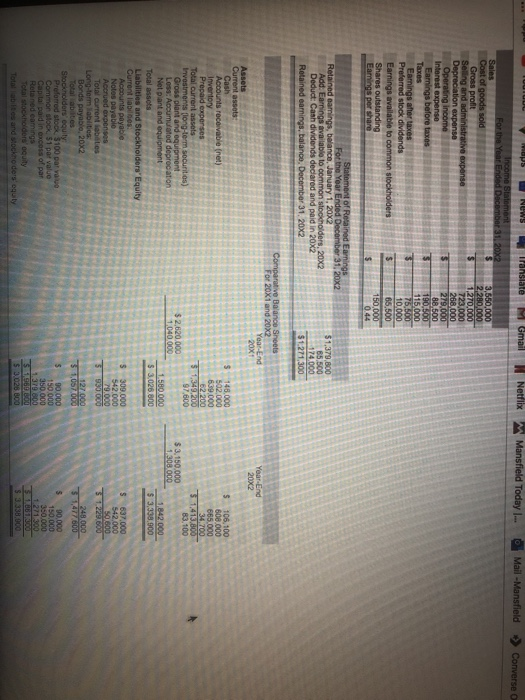

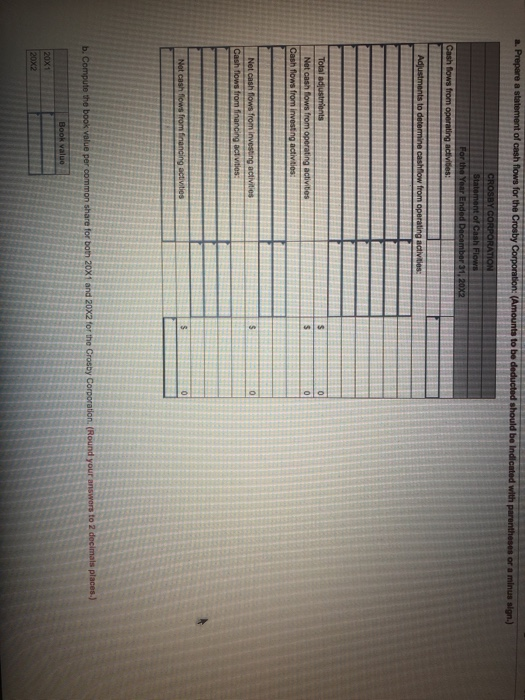

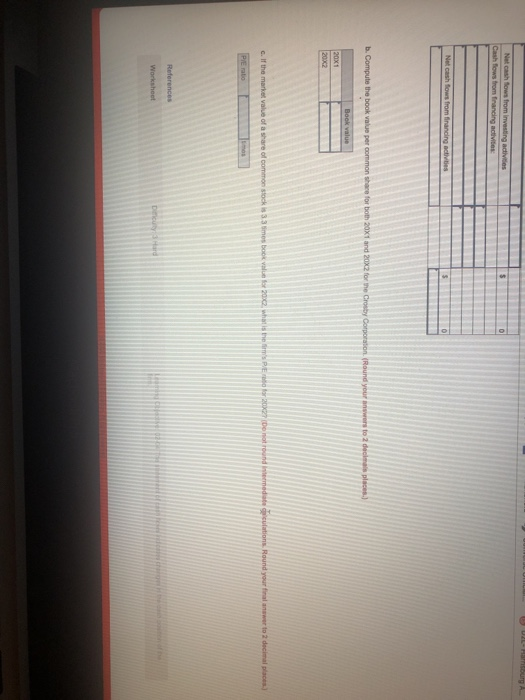

Netflix Mansfield Today - Mail-Mansfield Converse C NEWS Translate M Gmail Income Statement For the Year Ended December 31, 20X2 Sales $ 3.650.000 Cost of goods sold 2280,000 Gross profit $ 1270.000 Selling and administrative expense 723,000 Depreciation expense 268,000 Operating income 279.000 Interest expense 88.500 Earnings before taxes 13 190,500 Taxes 115,000 Earnings after taxes $ 75,500 Preferred stock dividends 10.000 Earnings available to common stockholders $ 65.500 Shares outstanding 150,000 Eamings per share $ 0.44 Statement of Retained Earnings For the Year Ended December 31, 20X2 Retained earings, balance, January 1, 20X2 Add. Earnings available to common stockholders, 20X2 Deduct: Canh dividends declared and paid in 20X2 Retained earnings, balance, December 31, 20X2 $1,379,800 85.500 174.000 $1.271,300 Comparative Balance Sheets For 20X1 and 20X2 Year-End 20x1 Year-End 20x2 $ $ 148.000 502,000 639,000 62,200 $ 1,349.200 97,600 106, 100 600.000 665.000 34 700 3 1,413,800 83.100 $ 2,620.000 1,040,000 $ 3,150.000 1,308,000 1.580.000 $ 3.026 800 1.842.000 $ 3.338.900 Assets Current assots: Cash Accounts receivable (net) Inventory Prepaid expenses Total current assets Investments [long-term socuritis) Gross plant and equipment Loss: Accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabdos Accounts payable Notos payablo Accrued expenses Total current labels Long-term labities Bonds payablo, 20x2 Total abilities Stockholders equity Preferred stock $100 par rawe Common stock 51 par value Capital paid in excess of par Hola 90 W T Total stockholders oquity Total abilities and stockholders' oquity $ 637.000 542.000 50 600 $ 309.000 542.000 79.000 3 B30.000 127.000 31.057.000 5 90.000 150 000 350.000 1.379.800 S860000 $ 3.028 800 248.000 51,477600 5 90.000 150.000 350,000 1 271 300 $ 3.338.000 2. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be Indicated with parentheses or a minus sign.) CROSBY CORPORATION Statement of Cash Flows For the Year Ended December 31, 20X2 Cash flows from operating activities: Adjustments to determine cashflow from operating activities Total adjustments Net cash flows from operating activities Cash flows from investing activities: $ $ 0 0 $ 0 Net cash flows from investing activities Cash flows from financing actvities: Net cash flows from financing activities $ b. Compute the book value per common share for both 20X1 and 20x2 for the Crosby Corporation. (Round your answers to 2 decimals places.) Book value 20X1 20X2 Natashows from investing activities Cash flows from financing activities $ Net cash flows from financing activities b. Compute the book value per common share for both 20%1 and 20X2 for the Crosby Corporation (Round your answers to 2 decimal places.) Book value 20X1 20x2 c. If the market value of a share of common stock 33 mos book value for 2002. what for 20x2T (Do not found intermediate alculations. Round your final anwer to decimal places PIE References Worksheet Dincity

Netflix Mansfield Today - Mail-Mansfield Converse C NEWS Translate M Gmail Income Statement For the Year Ended December 31, 20X2 Sales $ 3.650.000 Cost of goods sold 2280,000 Gross profit $ 1270.000 Selling and administrative expense 723,000 Depreciation expense 268,000 Operating income 279.000 Interest expense 88.500 Earnings before taxes 13 190,500 Taxes 115,000 Earnings after taxes $ 75,500 Preferred stock dividends 10.000 Earnings available to common stockholders $ 65.500 Shares outstanding 150,000 Eamings per share $ 0.44 Statement of Retained Earnings For the Year Ended December 31, 20X2 Retained earings, balance, January 1, 20X2 Add. Earnings available to common stockholders, 20X2 Deduct: Canh dividends declared and paid in 20X2 Retained earnings, balance, December 31, 20X2 $1,379,800 85.500 174.000 $1.271,300 Comparative Balance Sheets For 20X1 and 20X2 Year-End 20x1 Year-End 20x2 $ $ 148.000 502,000 639,000 62,200 $ 1,349.200 97,600 106, 100 600.000 665.000 34 700 3 1,413,800 83.100 $ 2,620.000 1,040,000 $ 3,150.000 1,308,000 1.580.000 $ 3.026 800 1.842.000 $ 3.338.900 Assets Current assots: Cash Accounts receivable (net) Inventory Prepaid expenses Total current assets Investments [long-term socuritis) Gross plant and equipment Loss: Accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabdos Accounts payable Notos payablo Accrued expenses Total current labels Long-term labities Bonds payablo, 20x2 Total abilities Stockholders equity Preferred stock $100 par rawe Common stock 51 par value Capital paid in excess of par Hola 90 W T Total stockholders oquity Total abilities and stockholders' oquity $ 637.000 542.000 50 600 $ 309.000 542.000 79.000 3 B30.000 127.000 31.057.000 5 90.000 150 000 350.000 1.379.800 S860000 $ 3.028 800 248.000 51,477600 5 90.000 150.000 350,000 1 271 300 $ 3.338.000 2. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be Indicated with parentheses or a minus sign.) CROSBY CORPORATION Statement of Cash Flows For the Year Ended December 31, 20X2 Cash flows from operating activities: Adjustments to determine cashflow from operating activities Total adjustments Net cash flows from operating activities Cash flows from investing activities: $ $ 0 0 $ 0 Net cash flows from investing activities Cash flows from financing actvities: Net cash flows from financing activities $ b. Compute the book value per common share for both 20X1 and 20x2 for the Crosby Corporation. (Round your answers to 2 decimals places.) Book value 20X1 20X2 Natashows from investing activities Cash flows from financing activities $ Net cash flows from financing activities b. Compute the book value per common share for both 20%1 and 20X2 for the Crosby Corporation (Round your answers to 2 decimal places.) Book value 20X1 20x2 c. If the market value of a share of common stock 33 mos book value for 2002. what for 20x2T (Do not found intermediate alculations. Round your final anwer to decimal places PIE References Worksheet Dincity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started