Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Netson Manufacturing Corp. is preparing its year - end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether

Netson Manufacturing Corp. is preparing its yearend financial statements and is considering the accounting for the following items:

Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these.

The vicepresident of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years.

The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement.

Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing

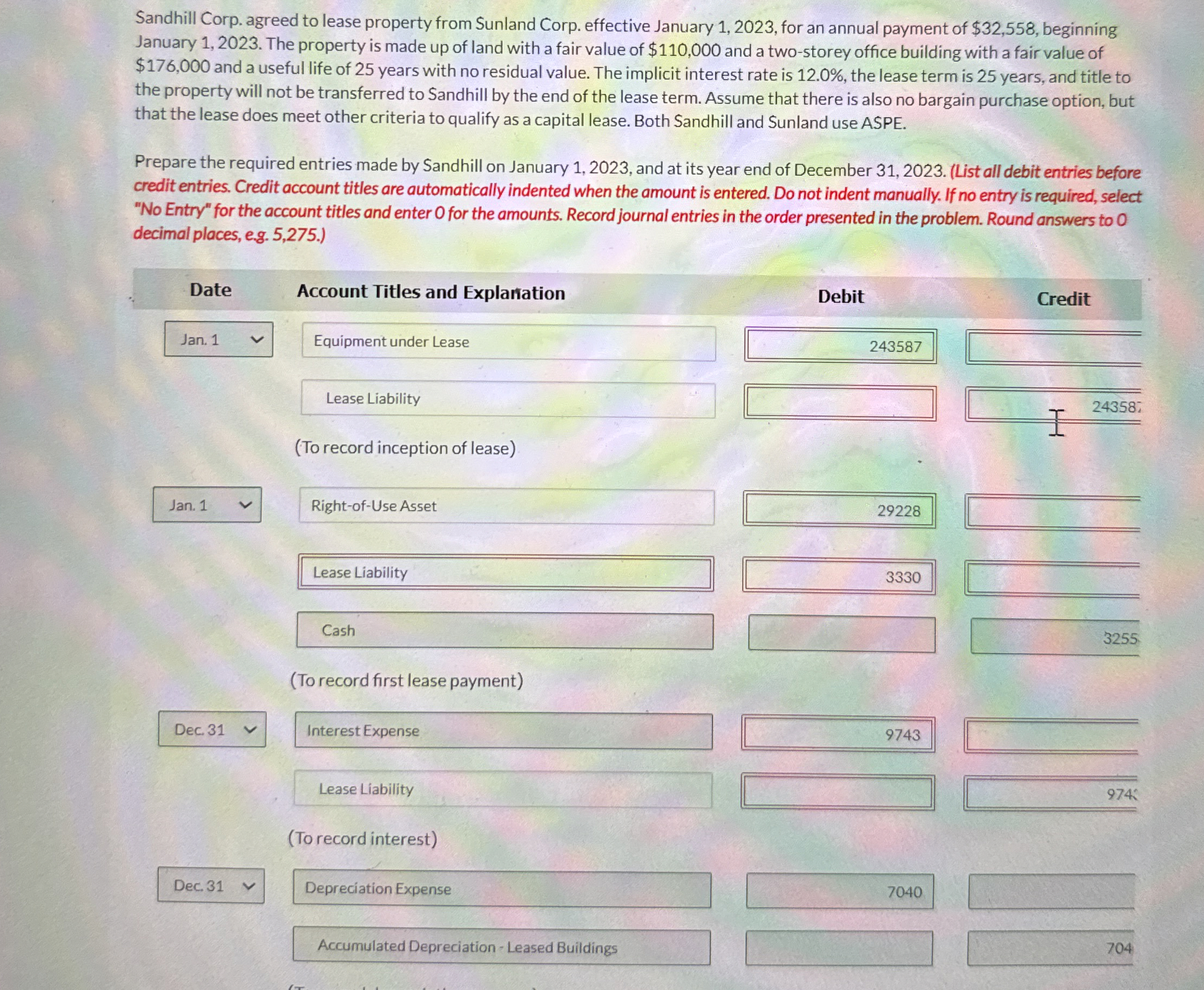

Sandhill Corp. agreed to lease property from Sunland Corp. effective January for an annual payment of $ beginning January The property is made up of land with a fair value of $ and a twostorey office building with a fair value of $ and a useful life of years with no residual value. The implicit interest rate is the lease term is years, and title to the property will not be transferred to Sandhill by the end of the lease term. Assume that there is also no bargain purchase option, but that the lease does meet other criteria to qualify as a capital lease. Both Sandhill and Sunland use ASPE.

Prepare the required entries made by Sandhill on January and at its year end of December List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem. Round answers to decimal places, eg

Account Titles and Explartation

Debit

Credit

To record inception of lease

To record first lease payment

To record interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started