Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of

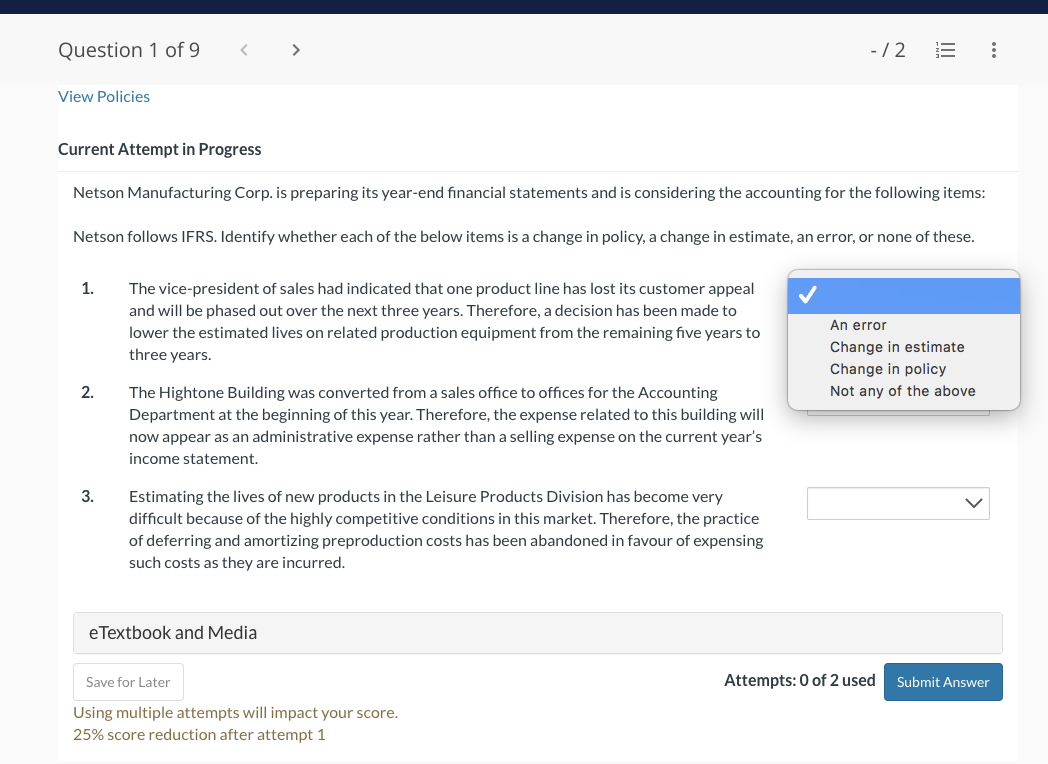

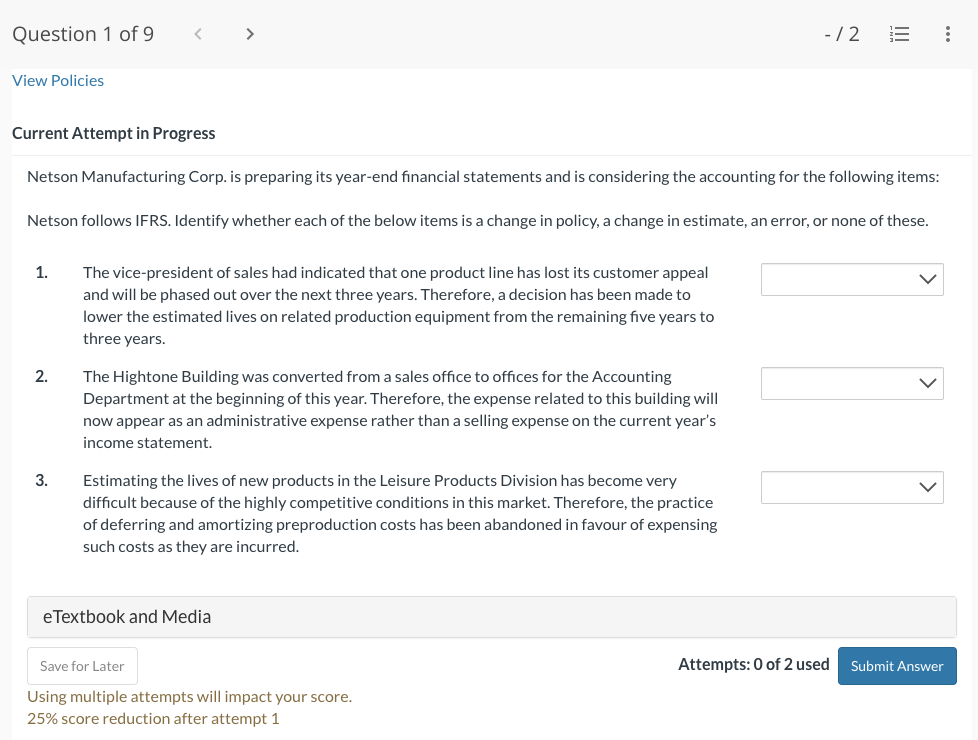

Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1

Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Netson Manufacturing Corp. is preparing its year-end financial statements and is considering the accounting for the following items: Netson follows IFRS. Identify whether each of the below items is a change in policy, a change in estimate, an error, or none of these. 1. The vice-president of sales had indicated that one product line has lost its customer appeal and will be phased out over the next three years. Therefore, a decision has been made to lower the estimated lives on related production equipment from the remaining five years to three years. 2. The Hightone Building was converted from a sales office to offices for the Accounting Department at the beginning of this year. Therefore, the expense related to this building will now appear as an administrative expense rather than a selling expense on the current year's income statement. 3. Estimating the lives of new products in the Leisure Products Division has become very difficult because of the highly competitive conditions in this market. Therefore, the practice of deferring and amortizing preproduction costs has been abandoned in favour of expensing such costs as they are incurred. eTextbook and Media Attempts: 0 of 2 used Using multiple attempts will impact your score. 25% score reduction after attempt 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started