Answered step by step

Verified Expert Solution

Question

1 Approved Answer

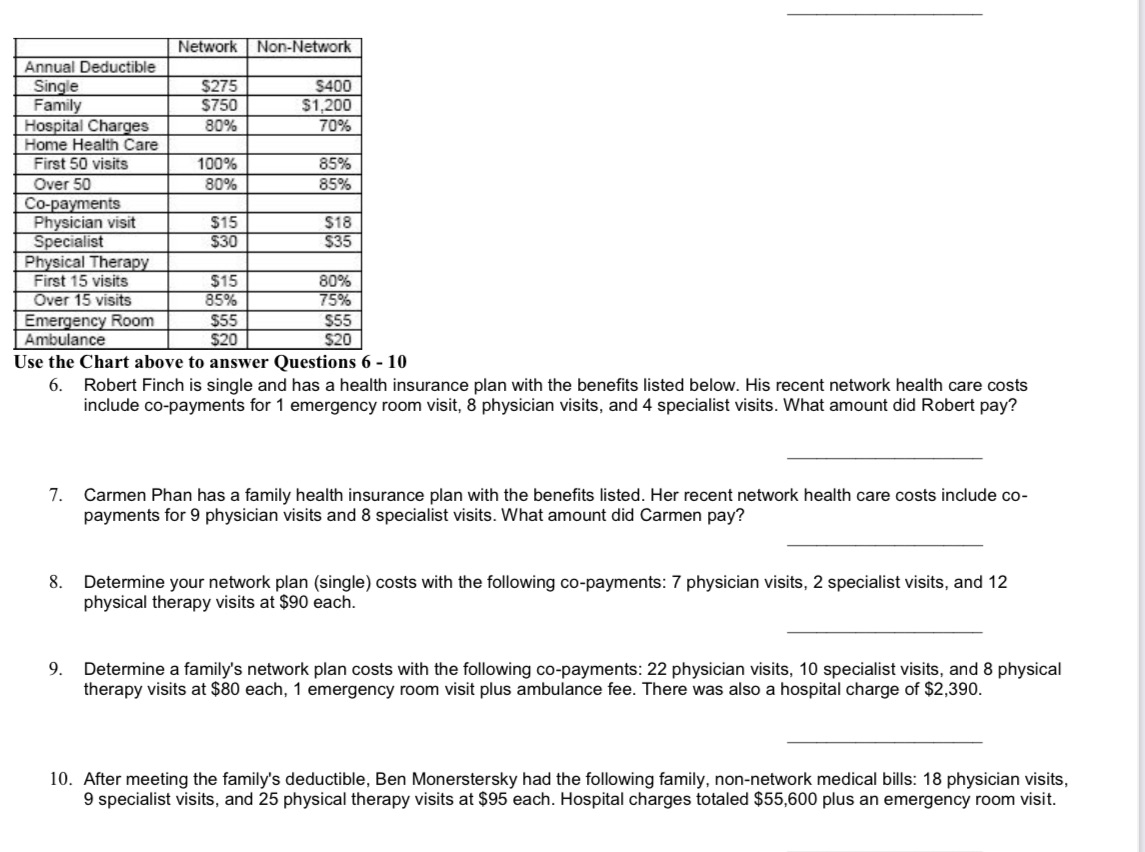

Network Non-Network Annual Deductible Single $275 $400 Family $750 $1,200 Hospital Charges 80% 70% Home Health Care First 50 visits 100% 85% Over 50

Network Non-Network Annual Deductible Single $275 $400 Family $750 $1,200 Hospital Charges 80% 70% Home Health Care First 50 visits 100% 85% Over 50 80% 85% Co-payments Physician visit $15 $18 Specialist $30 $35 Physical Therapy First 15 visits $15 80% Over 15 visits 85% 75% Emergency Room Ambulance $55 $20 $55 $20 Use the Chart above to answer Questions 6-10 6. Robert Finch is single and has a health insurance plan with the benefits listed below. His recent network health care costs include co-payments for 1 emergency room visit, 8 physician visits, and 4 specialist visits. What amount did Robert pay? 7. Carmen Phan has a family health insurance plan with the benefits listed. Her recent network health care costs include co- payments for 9 physician visits and 8 specialist visits. What amount did Carmen pay? 8. Determine your network plan (single) costs with the following co-payments: 7 physician visits, 2 specialist visits, and 12 physical therapy visits at $90 each. 9. Determine a family's network plan costs with the following co-payments: 22 physician visits, 10 specialist visits, and 8 physical therapy visits at $80 each, 1 emergency room visit plus ambulance fee. There was also a hospital charge of $2,390. 10. After meeting the family's deductible, Ben Monerstersky had the following family, non-network medical bills: 18 physician visits, 9 specialist visits, and 25 physical therapy visits at $95 each. Hospital charges totaled $55,600 plus an emergency room visit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started