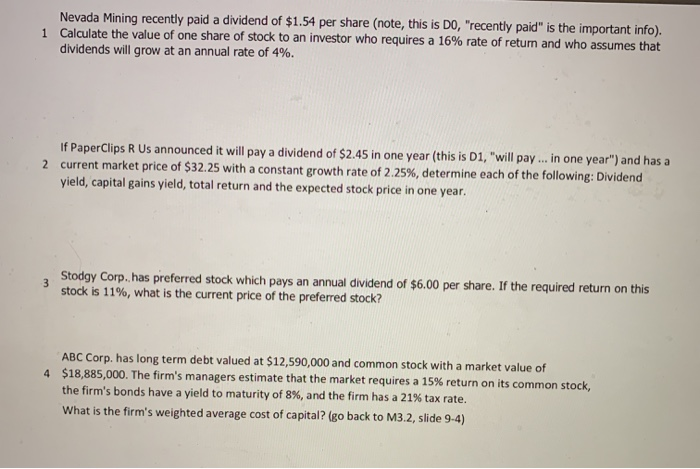

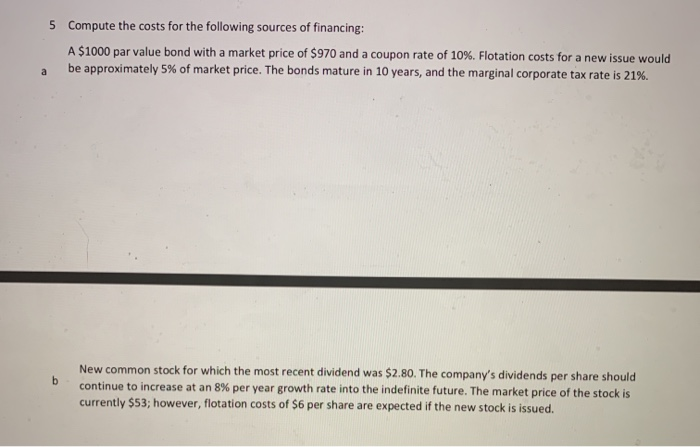

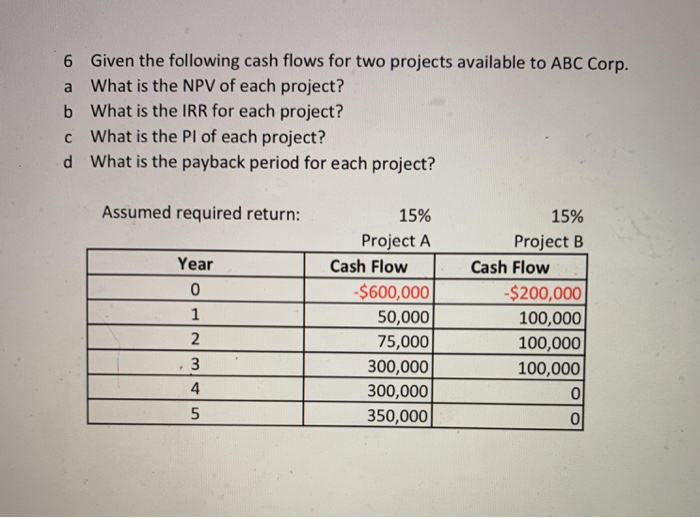

Nevada Mining recently paid a dividend of $1.54 per share (note, this is DO, "recently paid" is the important info). 1 Calculate the value of one share of stock to an investor who requires a 16% rate of return and who assumes that dividends will grow at an annual rate of 4%. If PaperClips R Us announced it will pay a dividend of $2.45 in one year (this is D1, "will pay ... in one year") and has a 2 current market price of $32.25 with a constant growth rate of 2.25%, determine each of the following: Dividend yield, capital gains yield, total return and the expected stock price in one year. Stodgy Corp., has preferred stock which pays an annual dividend of $6.00 per share. If the required return on this stock is 11%, what is the current price of the preferred stock? ABC Corp, has long term debt valued at $12,590,000 and common stock with a market value of 4 $18.885,000. The firm's managers estimate that the market requires a 15% return on its common stock. the firm's bonds have a yield to maturity of 8%, and the firm has a 21% tax rate. What is the firm's weighted average cost of capital? (go back to M3.2, slide 9-4) 5 Compute the costs for the following sources of financing: A $1000 par value bond with a market price of $970 and a coupon rate of 10%. Flotation costs for a new issue would a be approximately 5% of market price. The bonds mature in 10 years, and the marginal corporate tax rate is 21%. New common stock for which the most recent dividend was $2.80. The company's dividends per share should continue to increase at an 8% per year growth rate into the indefinite future. The market price of the stock is currently $53; however, flotation costs of $6 per share are expected if the new stock is issued. 6 Given the following cash flows for two projects available to ABC Corp. a What is the NPV of each project? b What is the IRR for each project? c What is the PI of each project? d What is the payback period for each project? Assumed required return: Year 0 1 2 .3 . 4 15 15% Project A Cash Flow -$600,000 50,000 75,000 300,000 300,000 350,000 15% Project B Cash Flow : -$200,000 100,000 100,000 100,000