Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nevermind just dont do Task 2 (L2, L3) PharmaOne, a pharmaceutical company, is specialised in discovering, developing, producing and marketing effective drugs for use as

Nevermind just dont do

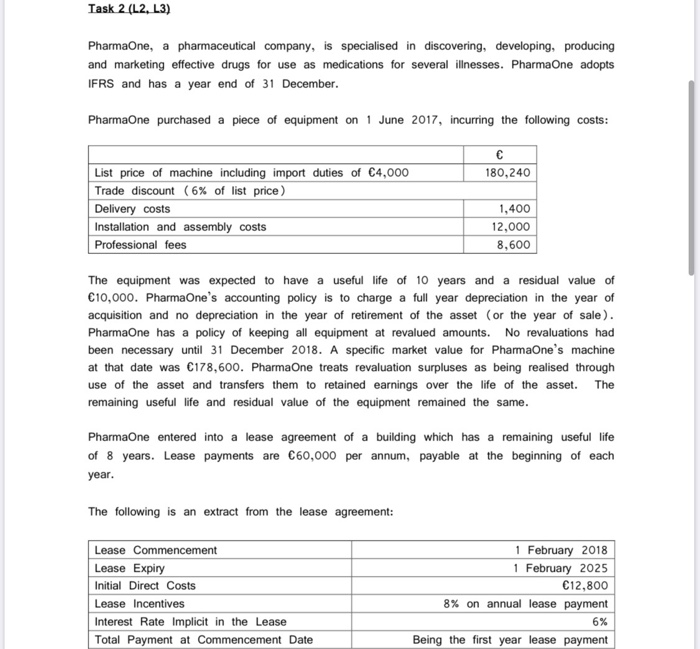

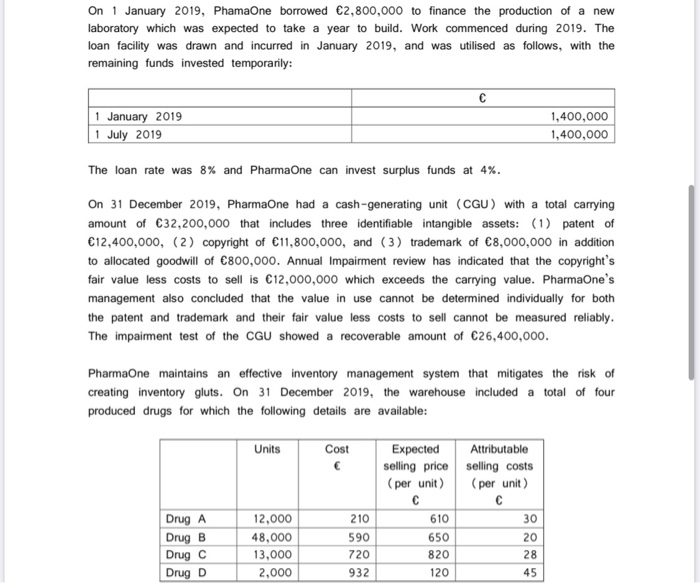

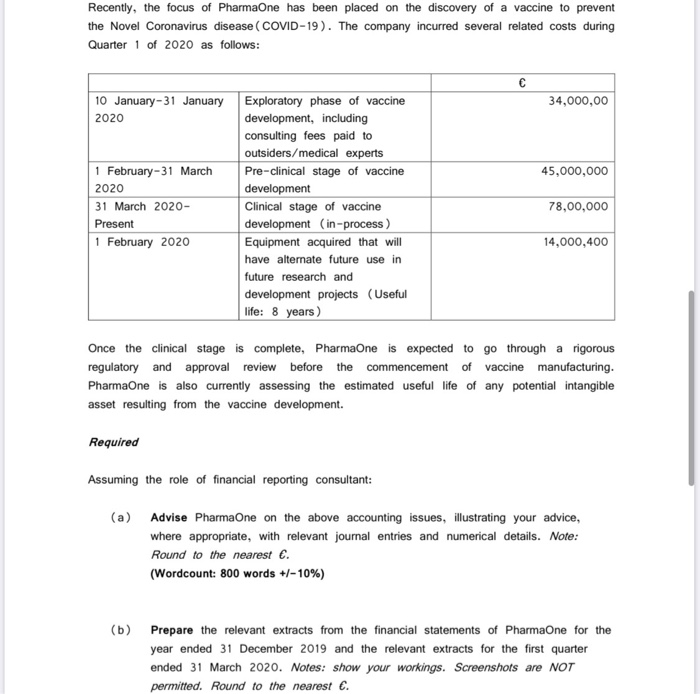

Task 2 (L2, L3) PharmaOne, a pharmaceutical company, is specialised in discovering, developing, producing and marketing effective drugs for use as medications for several illnesses. PharmaOne adopts IFRS and has a year end of 31 December. PharmaOne purchased a piece of equipment on 1 June 2017, incurring the following costs: 180, 240 List price of machine including import duties of 4,000 Trade discount (6% of list price) Delivery costs Installation and assembly costs Professional fees 1,400 12,000 8,600 The equipment was expected to have a useful life of 10 years and a residual value of 10,000. PharmaOne's accounting policy is to charge a full year depreciation in the year of acquisition and no depreciation in the year of retirement of the asset (or the year of sale). PharmaOne has a policy of keeping all equipment at revalued amounts. No revaluations had been necessary until 31 December 2018. A specific market value for PharmaOne's machine at that date was 178,600. PharmaOne treats revaluation surpluses as being realised through use of the asset and transfers them to retained earnings over the life of the asset. The remaining useful life and residual value of the equipment remained the same. PharmaOne entered into a lease agreement of a building which has a remaining useful life of 8 years. Lease payments are 60,000 per annum, payable at the beginning of each year. The following is an extract from the lease agreement: Lease Commencement Lease Expiry Initial Direct Costs Lease Incentives Interest Rate Implicit in the Lease Total Payment at Commencement Date 1 February 2018 1 February 2025 12,800 8% on annual lease payment 6% Being the first year lease payment On 1 January 2019, PhamaOne borrowed 2,800,000 to finance the production of a new laboratory which was expected to take a year to build. Work commenced during 2019. The loan facility was drawn and incurred in January 2019, and was utilised as follows, with the remaining funds invested temporarily: 1 January 2019 1 July 2019 1,400,000 1,400,000 The loan rate was 8% and PharmaOne can invest surplus funds at 4%. On 31 December 2019, PharmaOne had a cash-generating unit (CGU) with a total carrying amount of 32,200,000 that includes three identifiable intangible assets: (1) patent of 12,400,000, (2) copyright of 11,800,000, and (3) trademark of 8,000,000 in addition to allocated goodwill of 800,000. Annual Impairment review has indicated that the copyright's fair value less costs to sell is 12,000,000 which exceeds the carrying value. PharmaOne's management also concluded that the value in use cannot be determined individually for both the patent and trademark and their fair value less costs to sell cannot be measured reliably. The impairment test of the CGU showed a recoverable amount of 26,400,000. PharmaOne maintains an effective inventory management system that mitigates the risk of creating inventory gluts. On 31 December 2019, the warehouse included a total of four produced drugs for which the following details are available: Units Cost Drug A Drug B Drug C Drug D 210 Expected Attributable selling price selling costs (per unit) (per unit) 610 30 650 20 820 28 120 45 12,000 48,000 13,000 2,000 590 720 932 Recently, the focus of PharmaOne has been placed on the discovery of a vaccine to prevent the Novel Coronavirus disease ( COVID-19). The company incurred several related costs during Quarter 1 of 2020 as follows: 34,000,00 10 January-31 January 2020 45,000,000 1 February-31 March 2020 31 March 2020- Present 1 February 2020 Exploratory phase of vaccine development, including consulting fees paid to outsiders/medical experts Pre-clinical stage of vaccine development Clinical stage of vaccine development (in-process) Equipment acquired that will have alternate future use in future research and development projects (Useful life: 8 years) 78,00,000 14,000,400 Once the clinical stage is complete, PharmaOne is expected to go through a rigorous regulatory and approval review before the commencement of vaccine manufacturing. PharmaOne is also currently assessing the estimated useful life of any potential intangible asset resulting from the vaccine development. Required Assuming the role of financial reporting consultant: (a) Advise PharmaOne on the above accounting issues, illustrating your advice, where appropriate, with relevant journal entries and numerical details. Note: Round to the nearest . (Wordcount: 800 words +/-10%) (b) Prepare the relevant extracts from the financial statements of PharmaOne for the year ended 31 December 2019 and the relevant extracts for the first quarter ended 31 March 2020. Notes: show your workings. Screenshots are NOT permitted. Round to the nearest . Task 2 (L2, L3) PharmaOne, a pharmaceutical company, is specialised in discovering, developing, producing and marketing effective drugs for use as medications for several illnesses. PharmaOne adopts IFRS and has a year end of 31 December. PharmaOne purchased a piece of equipment on 1 June 2017, incurring the following costs: 180, 240 List price of machine including import duties of 4,000 Trade discount (6% of list price) Delivery costs Installation and assembly costs Professional fees 1,400 12,000 8,600 The equipment was expected to have a useful life of 10 years and a residual value of 10,000. PharmaOne's accounting policy is to charge a full year depreciation in the year of acquisition and no depreciation in the year of retirement of the asset (or the year of sale). PharmaOne has a policy of keeping all equipment at revalued amounts. No revaluations had been necessary until 31 December 2018. A specific market value for PharmaOne's machine at that date was 178,600. PharmaOne treats revaluation surpluses as being realised through use of the asset and transfers them to retained earnings over the life of the asset. The remaining useful life and residual value of the equipment remained the same. PharmaOne entered into a lease agreement of a building which has a remaining useful life of 8 years. Lease payments are 60,000 per annum, payable at the beginning of each year. The following is an extract from the lease agreement: Lease Commencement Lease Expiry Initial Direct Costs Lease Incentives Interest Rate Implicit in the Lease Total Payment at Commencement Date 1 February 2018 1 February 2025 12,800 8% on annual lease payment 6% Being the first year lease payment On 1 January 2019, PhamaOne borrowed 2,800,000 to finance the production of a new laboratory which was expected to take a year to build. Work commenced during 2019. The loan facility was drawn and incurred in January 2019, and was utilised as follows, with the remaining funds invested temporarily: 1 January 2019 1 July 2019 1,400,000 1,400,000 The loan rate was 8% and PharmaOne can invest surplus funds at 4%. On 31 December 2019, PharmaOne had a cash-generating unit (CGU) with a total carrying amount of 32,200,000 that includes three identifiable intangible assets: (1) patent of 12,400,000, (2) copyright of 11,800,000, and (3) trademark of 8,000,000 in addition to allocated goodwill of 800,000. Annual Impairment review has indicated that the copyright's fair value less costs to sell is 12,000,000 which exceeds the carrying value. PharmaOne's management also concluded that the value in use cannot be determined individually for both the patent and trademark and their fair value less costs to sell cannot be measured reliably. The impairment test of the CGU showed a recoverable amount of 26,400,000. PharmaOne maintains an effective inventory management system that mitigates the risk of creating inventory gluts. On 31 December 2019, the warehouse included a total of four produced drugs for which the following details are available: Units Cost Drug A Drug B Drug C Drug D 210 Expected Attributable selling price selling costs (per unit) (per unit) 610 30 650 20 820 28 120 45 12,000 48,000 13,000 2,000 590 720 932 Recently, the focus of PharmaOne has been placed on the discovery of a vaccine to prevent the Novel Coronavirus disease ( COVID-19). The company incurred several related costs during Quarter 1 of 2020 as follows: 34,000,00 10 January-31 January 2020 45,000,000 1 February-31 March 2020 31 March 2020- Present 1 February 2020 Exploratory phase of vaccine development, including consulting fees paid to outsiders/medical experts Pre-clinical stage of vaccine development Clinical stage of vaccine development (in-process) Equipment acquired that will have alternate future use in future research and development projects (Useful life: 8 years) 78,00,000 14,000,400 Once the clinical stage is complete, PharmaOne is expected to go through a rigorous regulatory and approval review before the commencement of vaccine manufacturing. PharmaOne is also currently assessing the estimated useful life of any potential intangible asset resulting from the vaccine development. Required Assuming the role of financial reporting consultant: (a) Advise PharmaOne on the above accounting issues, illustrating your advice, where appropriate, with relevant journal entries and numerical details. Note: Round to the nearest . (Wordcount: 800 words +/-10%) (b) Prepare the relevant extracts from the financial statements of PharmaOne for the year ended 31 December 2019 and the relevant extracts for the first quarter ended 31 March 2020. Notes: show your workings. Screenshots are NOT permitted. Round to the nearestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started