Answered step by step

Verified Expert Solution

Question

1 Approved Answer

New england communications has the following dtickholders equity: New England Communications has the following stockholders' equity on December 31, 2024: (Click on the icon to

New england communications has the following dtickholders equity:

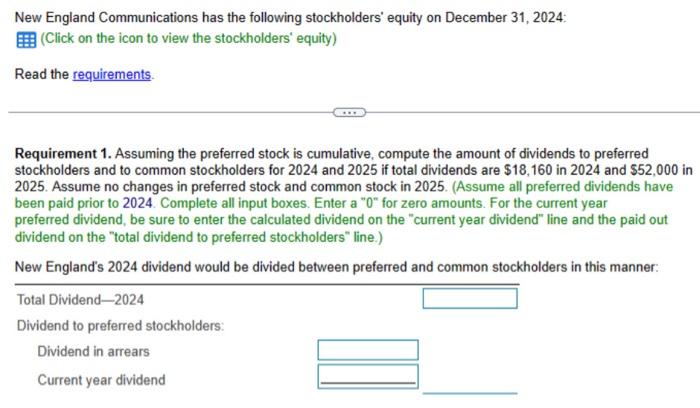

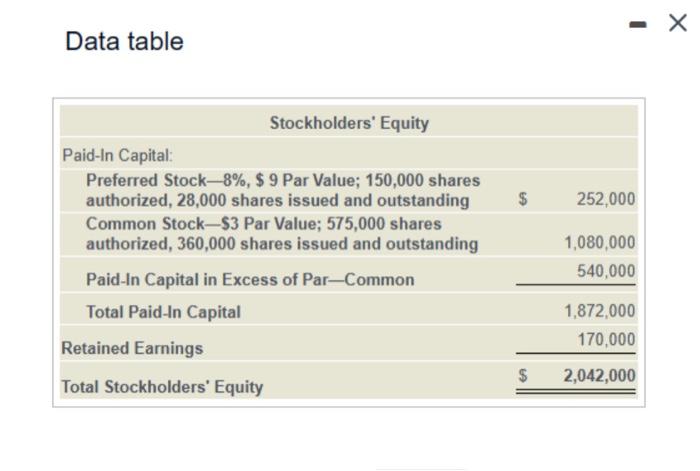

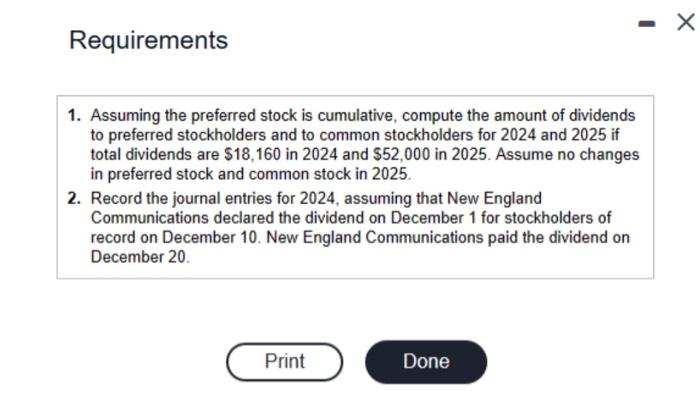

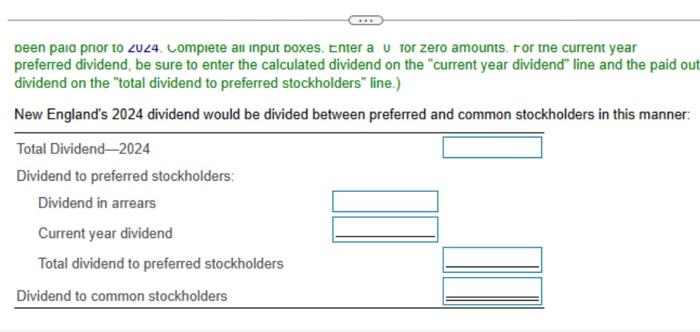

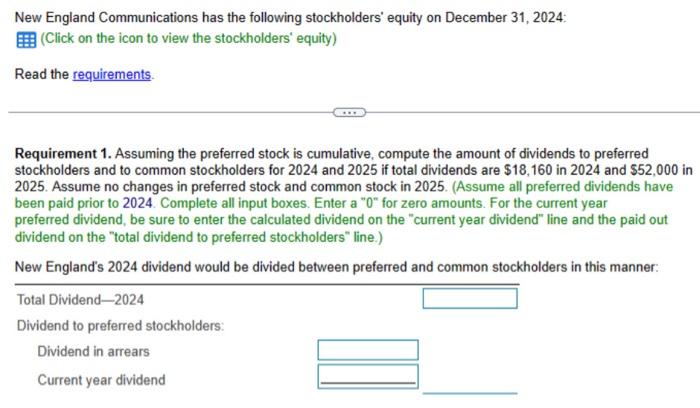

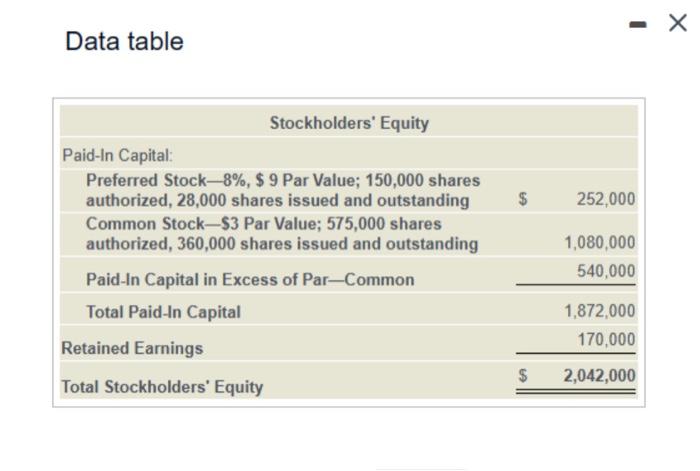

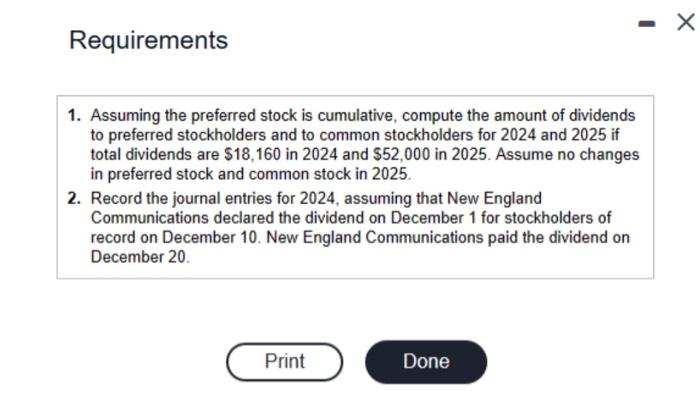

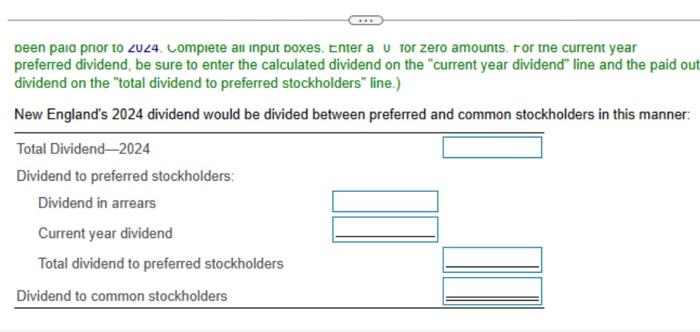

New England Communications has the following stockholders' equity on December 31, 2024: (Click on the icon to view the stockholders' equity) Read the requirements. Requirement 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common stockholders for 2024 and 2025 if total dividends are $18,160 in 2024 and $52,000 in 2025. Assume no changes in preferred stock and common stock in 2025. (Assume all preferred dividends have been paid prior to 2024. Complete all input boxes. Enter a "0" for zero amounts. For the current year preferred dividend, be sure to enter the calculated dividend on the "current year dividend" line and the paid out dividend on the "total dividend to preferred stockholders" line.) New England's 2024 dividend would be divided between preferred and common stockholders in this manner: Data table Requirements 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common stockholders for 2024 and 2025 if total dividends are $18,160 in 2024 and $52,000 in 2025 . Assume no changes in preferred stock and common stock in 2025. 2. Record the journal entries for 2024 , assuming that New England Communications declared the dividend on December 1 for stockholders of record on December 10. New England Communications paid the dividend on December 20. Deen paia pror to U4. ompiete all input boxes. Enter a U tor zero amounts. ror the current year preferred dividend, be sure to enter the calculated dividend on the "current year dividend" line and the paid out dividend on the "total dividend to preferred stockholders" line.) New England's 2024 dividend would be divided between preferred and common stockholders in this manner

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started