Question

New Era Cleaning Service, Inc. opened for business on July 1, 2010. During the month of July, the following transactions occurred: July 1: Issued $18,000

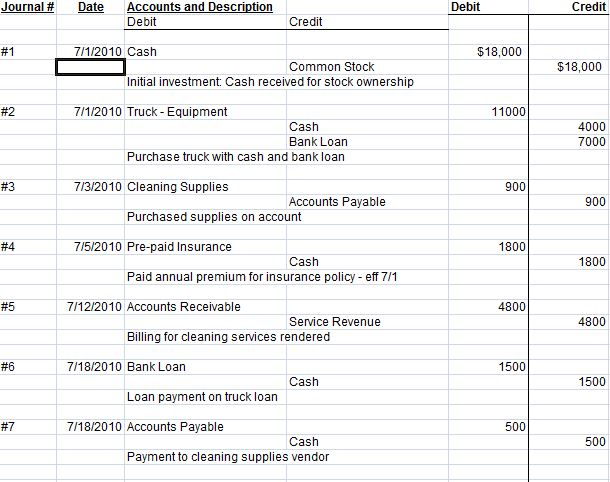

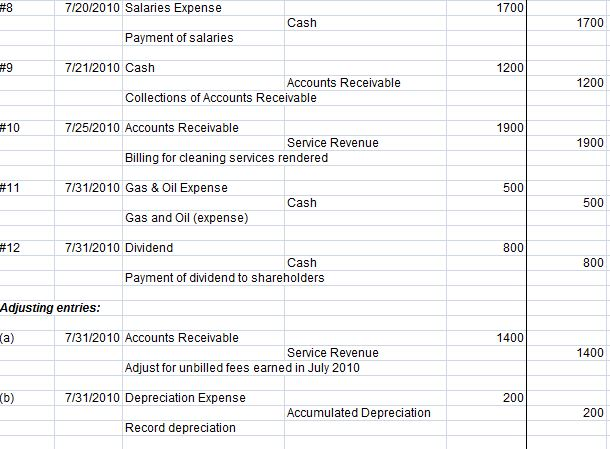

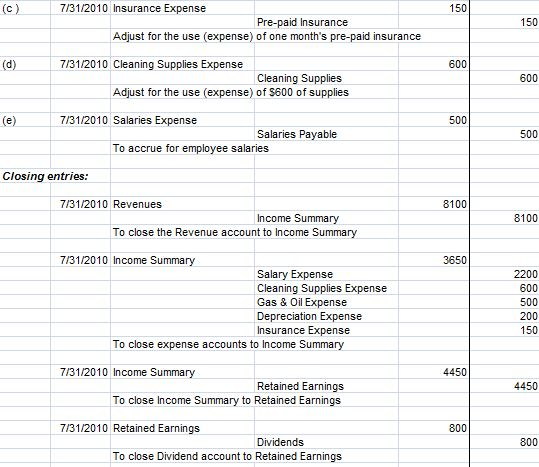

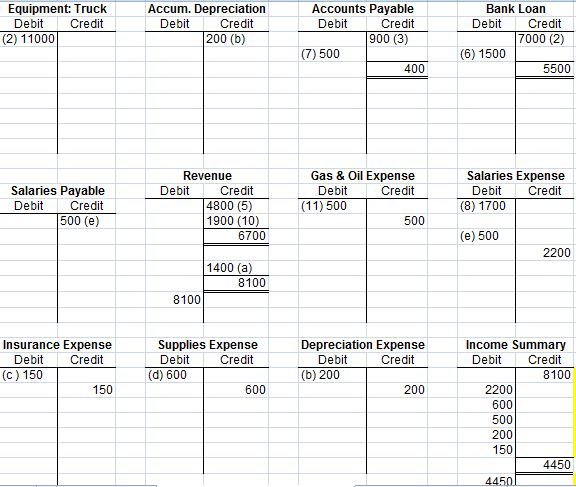

New Era Cleaning Service, Inc. opened for business on July 1, 2010. During the month of July, the following transactions occurred: July 1: Issued $18,000 of common stock for $18,000 cash. July 1: Purchased a truck for $11,000. Paid $4,000 in cash and borrowed the remainder (long term) from the bank. July 3: Purchased cleaning supplies for $900 on account. July 5: Paid $1,800 on a one-year insurance policy, effective July 1. July 12: Billed customers $4,800 for cleaning services. July 18: Paid $1,500 of the amount owed on the truck. July 18: Paid $500 of the amount owed on cleaning services. July 20: Paid $1,700 for employee salaries. July 21: Collected $1,200 from customers billed on July 12. July 25: Billed customers $1,900 for cleaning services. July 31: Paid gas and oil for the month on the truck, $500. July 31: Paid a $800 dividend. ABOVE IS THE ORIGINAL QUESTION, BELOW IS LAST WEEKS ASSIGNMENT. BELOW IS THEANSWER

|

|

|

|

|

|

|

|

|

|

|

| Journal Entries |

|

|

|

|

|

| |

| Date | Accounting titles & Explanations | Debit | Credit |

|

| |||

|

|

|

|

|

|

|

|

|

|

| 1-Jul | Cash |

|

|

| 18,000 |

|

|

|

|

| Common stock |

|

|

| 18,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1-Jul | Truck |

|

|

| 11,000 |

|

|

|

|

| Cash |

|

|

|

| 4,000 |

|

|

|

| long term loan |

|

|

| 7,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3-Jul | Supplies |

|

|

| 900 |

|

|

|

|

| Accounts payable |

|

|

| 900 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5-Jul | prepaid insurance |

|

| 1,800 |

|

|

| |

|

| cash |

|

|

|

| 1,800 |

|

|

|

|

|

|

|

|

|

|

|

|

| 12-Jul | Accounts receivable |

|

| 4,800 |

|

|

| |

|

| Service revenue |

|

|

| 4,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

| 18-Jul | long term loan |

|

| 1,500 |

|

|

| |

|

| Cash |

|

|

|

| 1,500 |

|

|

|

|

|

|

|

|

|

|

|

|

| julu 18 | Accounts payable |

|

| 500 |

|

|

| |

|

| Cash |

|

|

|

| 500 |

|

|

|

|

|

|

|

|

|

|

|

|

| 20-Jul | Salaries & wages expense |

| 1,700 | 1,700 |

|

| ||

|

| Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 21-Jul | Cash |

|

|

| 1,200 |

|

|

|

|

| Account receivable |

|

|

| 1,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

| 25-Jul | Accounts receivable |

|

| 1,900 |

|

|

| |

|

| Service revenue |

|

|

| 1,900 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 31-Jul | Utilitiy expense |

|

| 500 |

|

|

| |

|

| cash |

|

|

|

| 500 |

|

|

|

|

|

|

|

|

|

|

|

|

| 31-Jul | Dividend |

|

|

| 800 |

|

|

|

|

| cash |

|

|

|

| 800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash |

|

|

|

| Common stock |

|

| |

| 1-Jul | 18,000 | 1-Jul | 4,000 |

|

|

| 1 Jul | 18,000 |

| 21-Jul | 1,200 | 5-Jul | 1,800 |

|

|

| end bal | 18,000 |

|

|

| 18-Jul | 1,500 |

|

|

|

|

|

|

|

| 18-Jul | 500 |

| Truck |

|

|

|

|

|

| 20-Jul | 1,700 |

| 1-Jul | 11,000 |

|

|

|

|

| 31-Jul | 500 |

| end bal | 11,000 |

|

|

|

|

| 31-Jul | 800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| End bal | 8400 |

|

|

| long term loan |

|

| |

|

|

|

|

|

| 18-Jul | 1,500 | 1-Jul | 7,000 |

|

|

|

|

|

|

|

| end bal | 5500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplies |

|

|

|

| Accounts payable |

|

| |

| 3-Jul | 900 |

|

|

| 18-Jul | 500 | 3-Jul | 900 |

| End bal | 900 |

|

|

|

|

| end bal | 400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| prepaid insurance |

|

|

| Accounts receivable |

|

| ||

| 5-Jul | 1,800 |

|

|

| 12-Jul | 4,800 | 21-Jul | 1,200 |

| end bal | 1,800 |

|

|

| 25-Jul | 1,900 |

|

|

|

|

|

|

|

| End bal | 5500 |

|

|

|

|

|

|

|

|

|

|

|

|

| Service revenue |

|

|

| Salaries & wages expense |

| |||

|

|

| 12-Jul | 4,800 |

| 20-Jul | 1,700 |

|

|

|

|

| 25-Jul | 1,900 |

| end bal | 1,700 |

|

|

|

|

| end bal | 6,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Utility expense |

|

|

| Dividend |

|

|

| |

| 31-Jul | 500 |

|

|

| 31-Jul | 800 |

|

|

| end bal | 500 |

|

|

| end bal | 800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From the results of last week's assignment, Prepare an unadjusted trial balance; Post the following adjustments: (a) Earned but unbilled fees at July 31 were $1,400 (b) Depreciation for the month was $200 (c ) One-twelfth of the insurance expired (d) An inventory count showed $300 of cleaning supplies remaining on July 31 (e) Accrued but unpaid employee salaries were $500 Prepare an adjusted trial balance.

Anonymous answered this

Was this answer helpful?

0

0

2,352 answers

Similar to last week, there is an excel spreadsheet template attached to this unit's module. Please feel free to use it for your response to this week's assignment.

Unit 3 Assignment:

From the results of last week's assignment,

Post closing entries;

Prepare a classified balance sheet and an income statement as of July 31, 201

Journal Date Accounts and Description Debit Credit #1 7/1/2010 Cash Common Stock Initial investment Cash received for stock ownership #2 7/1/2010 Truck- Equipment Cash Bank Loan Purchase truck with cash and bank loan #3 7/3/2010 Cleaning Supplies Accounts Payable Purchased supplies on account #4 7/5/2010 Pre-paid Insurance Cash Paid annual premium for insurance policy-eff 7/1 712/2010 Accounts Receivable #5 Service Revenue Billing for cleaning services rendered #6 7/18/2010 Bank Loan Cash Loan payment on truck loan PT 7/18/2010 Accounts Payable Cash Payment to cleaning supplies vendor Debit $18.000 11000 900 1800 4800 1500 500 Credit $18,000 4000 7000 900 1800 4800 1500 500 Journal Date Accounts and Description Debit Credit #1 7/1/2010 Cash Common Stock Initial investment Cash received for stock ownership #2 7/1/2010 Truck- Equipment Cash Bank Loan Purchase truck with cash and bank loan #3 7/3/2010 Cleaning Supplies Accounts Payable Purchased supplies on account #4 7/5/2010 Pre-paid Insurance Cash Paid annual premium for insurance policy-eff 7/1 712/2010 Accounts Receivable #5 Service Revenue Billing for cleaning services rendered #6 7/18/2010 Bank Loan Cash Loan payment on truck loan PT 7/18/2010 Accounts Payable Cash Payment to cleaning supplies vendor Debit $18.000 11000 900 1800 4800 1500 500 Credit $18,000 4000 7000 900 1800 4800 1500 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started