Question

New Frontiers Rob Richman, president of AmeriBank , takes off his glasses, rubs his eyes in exhaustion, and squints at the clock in his study.

New Frontiers

Rob Richman, president of AmeriBank, takes off his glasses, rubs his eyes in exhaustion, and squints at the clock in his study. It reads 3 AM. For the last several hours, Rob has been poring over AmeriBanks financial statements from the last three quarters of operation. AmeriBank, a medium-sized bank with branches throughout the United States, is headed for dire economic straits. The bank, which provides transaction, savings, investment, and loan services, has been experiencing a steady decline in its net income over the past year, and trends show that the decline will continue. The bank is simply losing customers to nonbank and foreign bank competitors.

AmeriBank is not alone in its struggle to stay out of the red. From his daily industry readings, Rob knows that many American banks have been suffering significant losses because of increasing competition from nonbank and foreign bank competitors offering services typically in the domain of American banks. Because the nonbank and foreign bank competitors specialize in particular services, they are able to better capture the market for those services by offering less expensive, more efficient, more convenient services. For example, large corporations now turn to foreign banks and commercial paper offerings for loans, and affluent Americans now turn to money-market funds for investment. Banks face the daunting challenge of distinguishing themselves from nonbank and foreign bank competitors.

Rob has concluded that one strategy for distinguishing AmeriBank from its competitors is to improve services that nonbank and foreign bank competitors do not readily provide: transaction services. He has decided that a more convenient transaction method must logically succeed the automatic teller machine, and he believes that electronic banking over the Internet allows this convenient transaction method. Over the Internet, customers are able to perform transactions on their desktop computers either at home or work. The explosion of the Internet means that many potential customers understand and use the World Wide Web. He therefore feels that if AmeriBank offers Web banking (as the practice of Internet banking is commonly called), the bank will attract many new customers.

Before Rob undertakes the project to make Web banking possible, however, he needs to understand the market for Web banking and the services AmeriBank should provide over the Internet. For example, should the bank only allow customers to access account balances and historical transaction information over the Internet, or should the bank develop a strategy to allow customers to make deposits and withdrawals over the Internet? Should the bank try to recapture a portion of the investment market by continuously running stock prices and allowing customers to make stock transactions over the Internet for a minimal fee?

Because AmeriBank is not in the business of performing surveys, Rob has decided to outsource the survey project to a professional survey company. He has opened the project up for bidding by several survey companies and will award the project to the company that is willing to perform the survey for the least cost. Rob provided each survey company with a list of survey requirements to ensure that AmeriBank receives the needed information for planning the Web banking project.

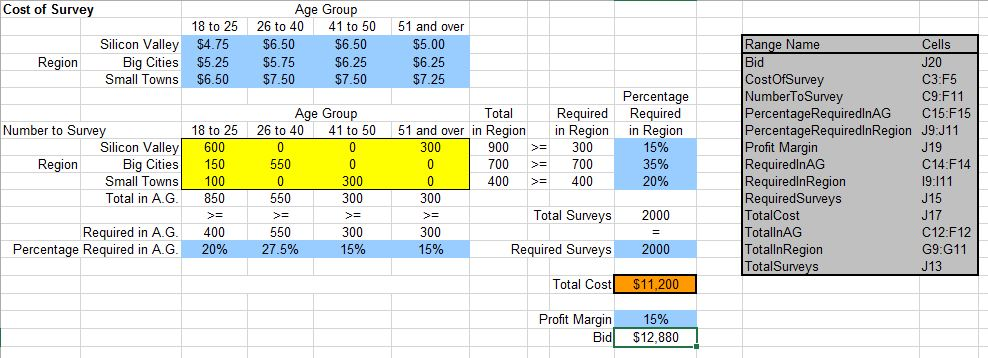

Because different age groups require different services, AmeriBank is interested in surveying four different age groups. The first group encompasses customers who are 18 to 25 years old. The bank assumes that this age group has limited yearly income and performs minimal transactions. The second group Page 161encompasses customers who are 26 to 40 years old. This age group has significant sources of income, performs many transactions, requires numerous loans for new houses and cars, and invests in various securities. The third group encompasses customers who are 41 to 50 years old. These customers typically have the same level of income and perform the same number of transactions as the second age group, but the bank assumes that these customers are less likely to use Web banking since they have not become as comfortable with the explosion of computers or the Internet. Finally, the fourth group encompasses customers who are 51 years of age and over. These customers commonly crave security and require continuous information on retirement funds. The bank believes that it is highly unlikely that customers in this age group will use Web banking, but the bank desires to learn the needs of this age group for the future. AmeriBank wants to interview 2,000 customers with at least 20 percent from the first age group, at least 27.5 percent from the second age group, at least 15 percent from the third age group, and at least 15 percent from the fourth age group.

Rob understands that some customers are uncomfortable with using the Internet. He therefore wants to ensure that the survey includes a mix of customers who know the Internet well and those that have less exposure to the Internet. To ensure that AmeriBank obtains the correct mix, he wants to interview at least 15 percent of customers from the Silicon Valley where Internet use is high, at least 35 percent of customers from big cities where Internet use is medium, and at least 20 percent of customers from small towns where Internet use is low.

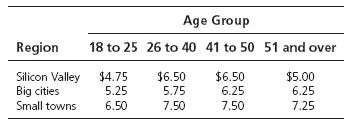

Sophisticated Surveys is one of three survey companies competing for the project. It has performed an initial analysis of these survey requirements to determine the cost of surveying different populations. The costs per person surveyed are listed in the following table.

Sophisticated Surveys explores the following options cumulatively.

a. Formulate a linear programming model to minimize costs while meeting all survey constraints imposed by AmeriBank. If the profit margin for Sophisticated Surveys is 15 percent of cost, what bid will it submit?

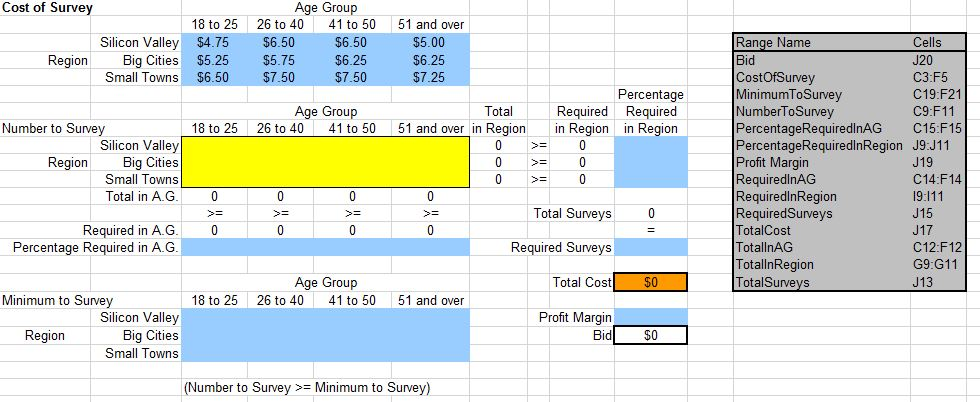

c. After submitting its bid, Sophisticated Surveys is informed that it has the lowest cost but that AmeriBank does not like the solution. Specifically, Rob feels that the selected survey population is not representative enough of the banking customer population. Rob wants at least 50 people of each age group surveyed in each region. What is the new bid made by Sophisticated Surveys?

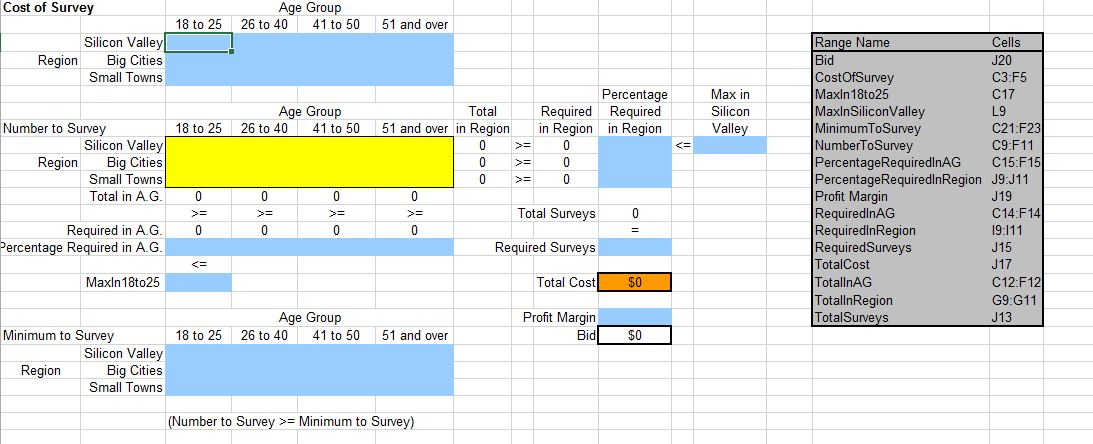

d. Rob feels that Sophisticated Surveys oversampled the 18-to-25-year-old population and the Silicon Valley population. He imposes a new constraint that no more than 600 individuals can be surveyed from the 18-to-25-year-old population and no more than 650 individuals can be surveyed from the Silicon Valley population. What is the new bid?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started