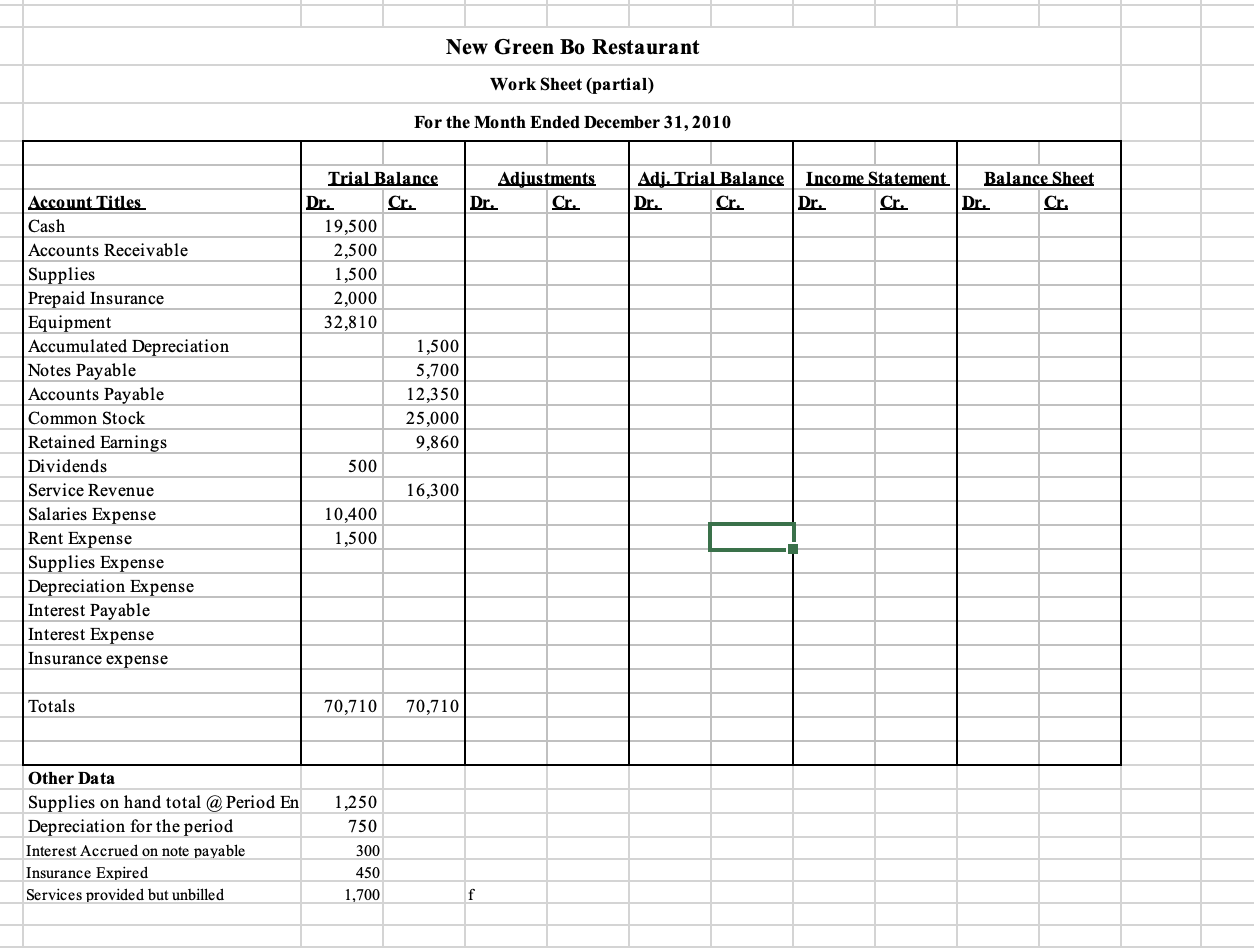

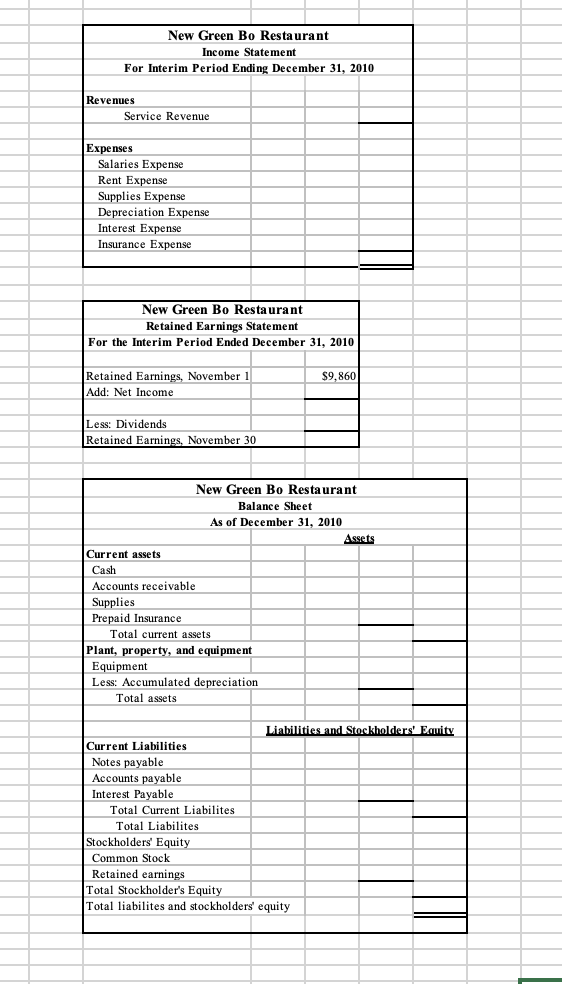

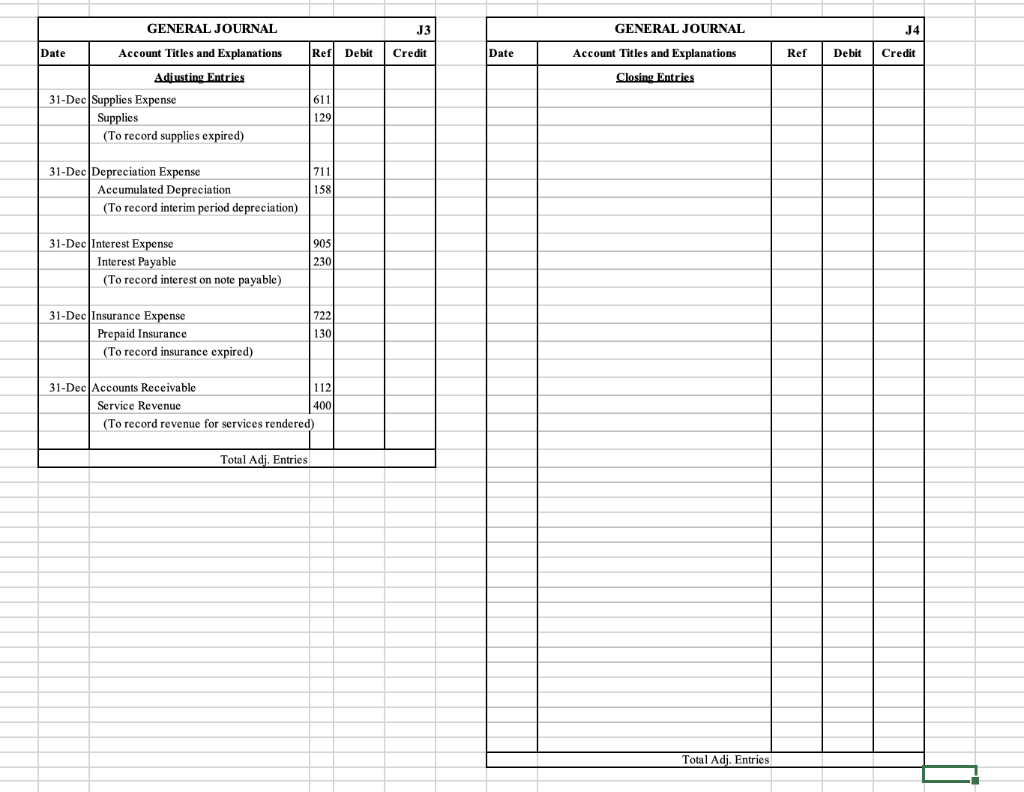

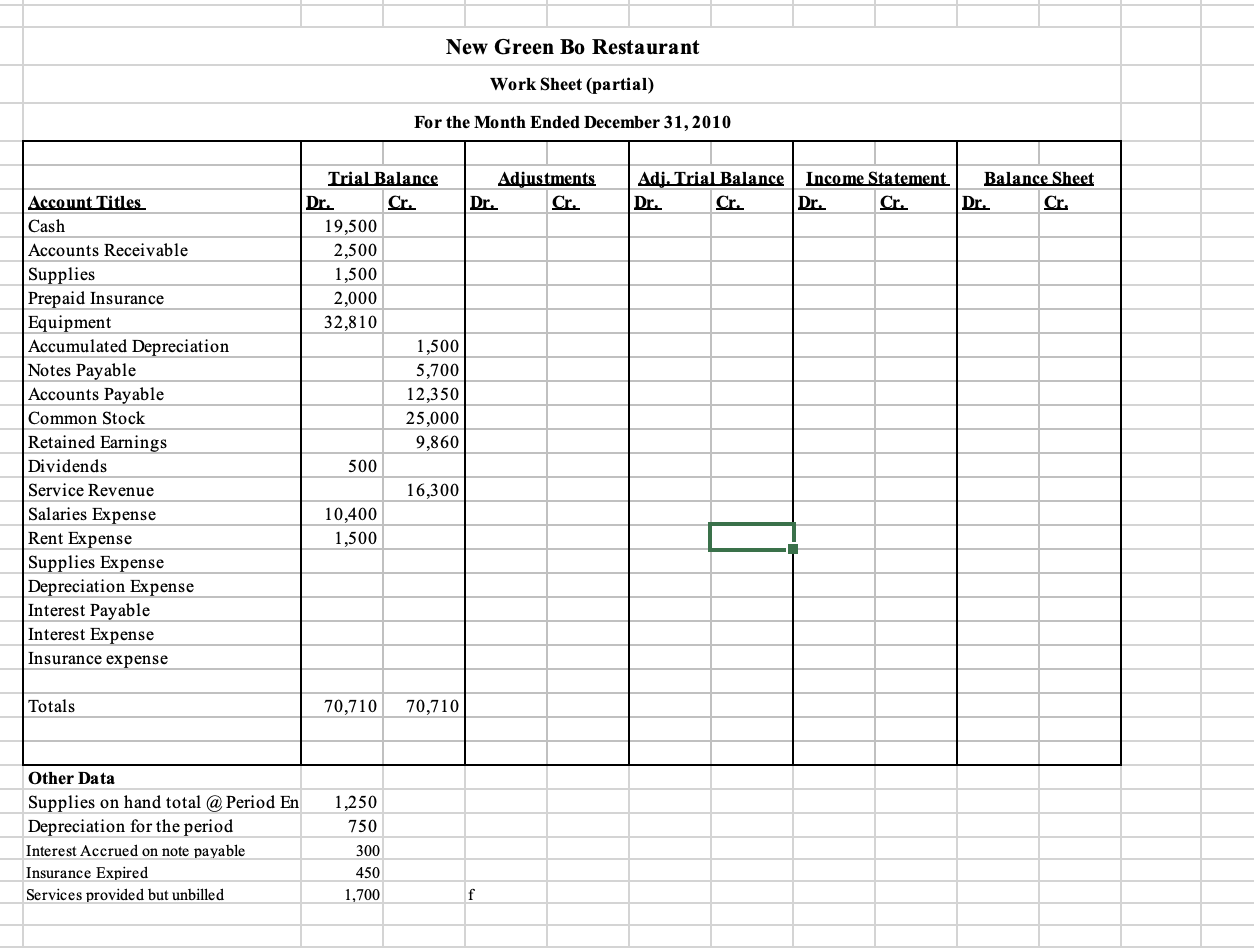

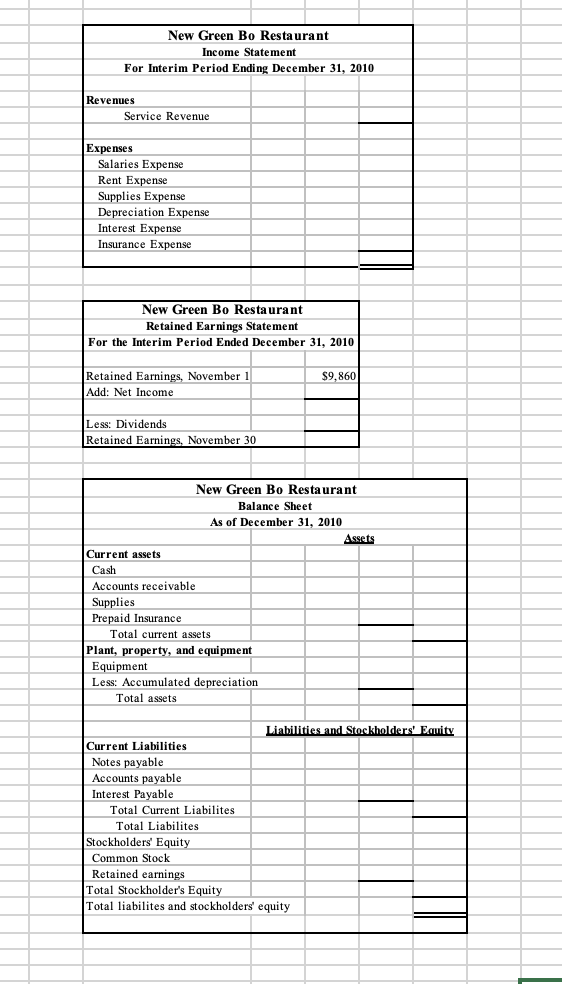

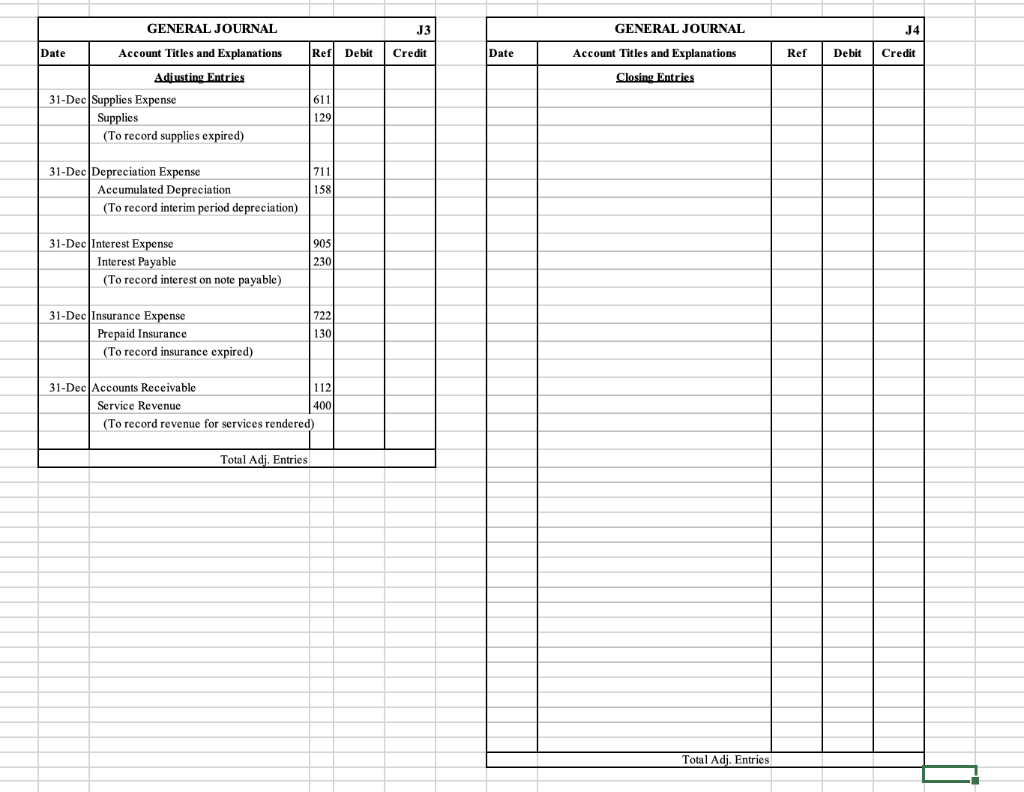

New Green Bo Restaurant Work Sheet (partial) For the Month Ended December 31, 2010 Adi. Trial Balance Dr. Cr. Income Statement Dr. Cr. Balance Sheet Dr. Cr. Account Titles. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Notes Payable Accounts Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Rent Expense Supplies Expense Depreciation Expense Interest Payable Interest Expense Insurance expense Trial Balance Adjustments Dr. Cr. Dr. Cr. 19,500 2,500 1,500 2,000 32,810 1,500 5,700 12,350 25,000 9,860 500 16,300 10,400 1,500 Totals 70,710 70,710 1,250 750 Other Data Supplies on hand total @ Period En Depreciation for the period Interest Accrued on note payable Insurance Expired Services provided but unbilled 300 450 1,700 f New Green Bo Restaurant Income Statement For Interim Period Ending December 31, 2010 Revenues Service Revenue Expenses Salaries Expense Rent Expense Supplies Expense Depreciation Expense Interest Expense Insurance Expense New Green Bo Restaurant Retained Earnings Statement For the Interim Period Ended December 31, 2010 $9,860 Retained Earnings, November 1 Add: Net Income Less: Dividends Retained Earnings, November 30 New Green Bo Restaurant Balance Sheet As of December 31, 2010 Assets Current assets Cash Accounts receivable Supplies Prepaid Insurance Total current assets Plant, property, and equipment Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current Liabilities Notes payable Accounts payable Interest Payable Total Current Liabilites Total Liabilites Stockholders' Equity Common Stock Retained earnings Total Stockholder's Equity Total liabilites and stockholders' equity GENERAL JOURNAL J3 GENERAL JOURNAL J4 Date Account Titles and Explanations Ref Debit Credit Date Account Titles and Explanations Ref Debit Credit Closing Entries Adiusting Entries 31-Dec Supplies Expense Supplies (To record supplies expired) 611 129 31-Dec Depreciation Expense Accumulated Depreciation (To record interim period depreciation) 711 158 905 31-Dec Interest Expense Interest Payable (To record interest on note payable) 230 722 31-Dec Insurance Expense Prepaid Insurance (To record insurance expired) 130 31-Dec Accounts Receivable 112 Service Revenue 400 (To record revenue for services rendered) Total Adj. Entries Total Adj. Entries New Green Bo Restaurant Work Sheet (partial) For the Month Ended December 31, 2010 Adi. Trial Balance Dr. Cr. Income Statement Dr. Cr. Balance Sheet Dr. Cr. Account Titles. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Notes Payable Accounts Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Rent Expense Supplies Expense Depreciation Expense Interest Payable Interest Expense Insurance expense Trial Balance Adjustments Dr. Cr. Dr. Cr. 19,500 2,500 1,500 2,000 32,810 1,500 5,700 12,350 25,000 9,860 500 16,300 10,400 1,500 Totals 70,710 70,710 1,250 750 Other Data Supplies on hand total @ Period En Depreciation for the period Interest Accrued on note payable Insurance Expired Services provided but unbilled 300 450 1,700 f New Green Bo Restaurant Income Statement For Interim Period Ending December 31, 2010 Revenues Service Revenue Expenses Salaries Expense Rent Expense Supplies Expense Depreciation Expense Interest Expense Insurance Expense New Green Bo Restaurant Retained Earnings Statement For the Interim Period Ended December 31, 2010 $9,860 Retained Earnings, November 1 Add: Net Income Less: Dividends Retained Earnings, November 30 New Green Bo Restaurant Balance Sheet As of December 31, 2010 Assets Current assets Cash Accounts receivable Supplies Prepaid Insurance Total current assets Plant, property, and equipment Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current Liabilities Notes payable Accounts payable Interest Payable Total Current Liabilites Total Liabilites Stockholders' Equity Common Stock Retained earnings Total Stockholder's Equity Total liabilites and stockholders' equity GENERAL JOURNAL J3 GENERAL JOURNAL J4 Date Account Titles and Explanations Ref Debit Credit Date Account Titles and Explanations Ref Debit Credit Closing Entries Adiusting Entries 31-Dec Supplies Expense Supplies (To record supplies expired) 611 129 31-Dec Depreciation Expense Accumulated Depreciation (To record interim period depreciation) 711 158 905 31-Dec Interest Expense Interest Payable (To record interest on note payable) 230 722 31-Dec Insurance Expense Prepaid Insurance (To record insurance expired) 130 31-Dec Accounts Receivable 112 Service Revenue 400 (To record revenue for services rendered) Total Adj. Entries Total Adj. Entries