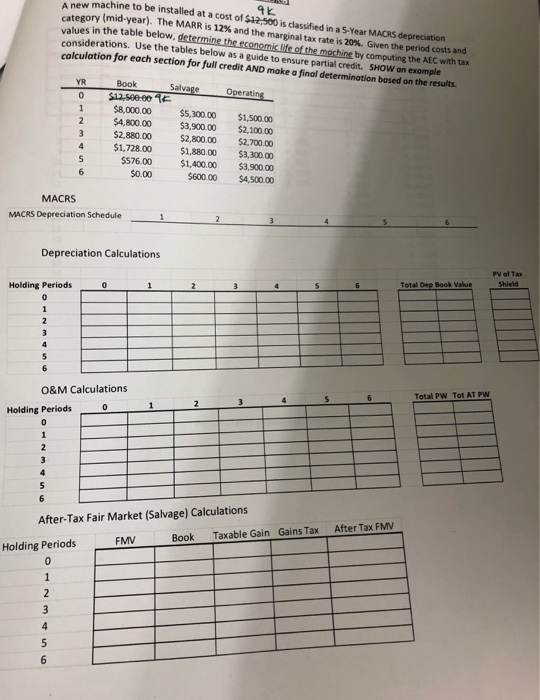

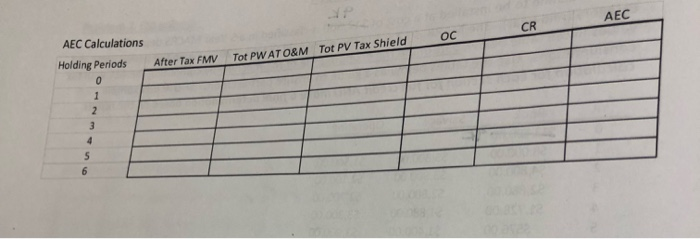

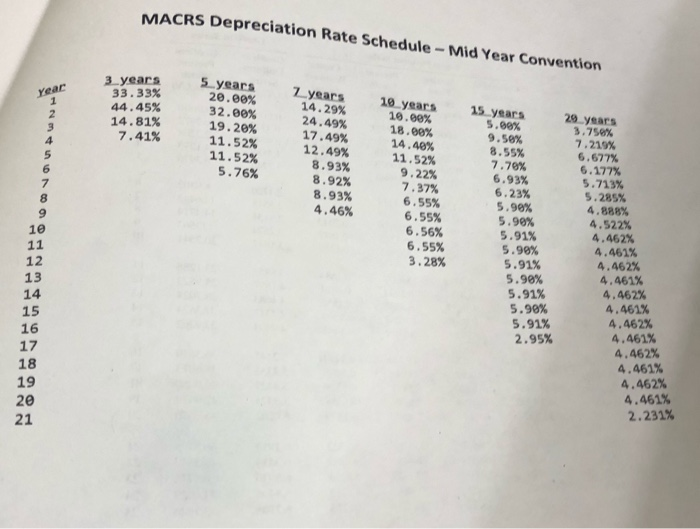

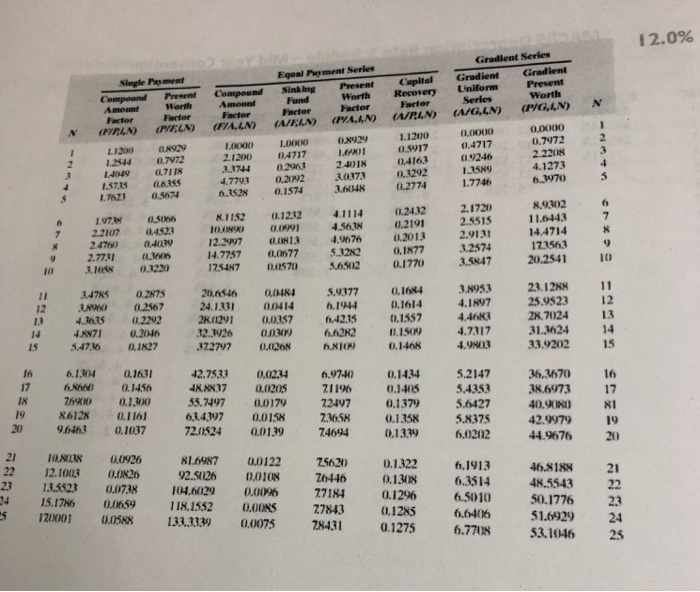

new machine to be installed at a cost of $12,500 is classified in a 5-Year MACRS depreciation category (mid-year). The MARR is 12% and the marginal tax rate is 20%. Given the period costs and values in the table below, determine the economic life of the machine by computing the AEC with tax considerations. Use the tables below as a guide to ensure partial credit. SHOW an example calculation for each section for full credit AND make a final determination based on the results. Operating Book $12,500. $8,000.00 $4,800.00 $2,880.00 $1,728.00 $576.00 Salvare $5,300.00 $3,900.00 $2,800.00 $1,880 00 $1,400.00 $600.00 $1,500.00 $2,100.00 $2.700 m $3,300.00 $3,900.00 $4,500.00 $0.00 MACRS MACRS Depreciation Schedule Depreciation Calculations Holding Periods 0 1 2 4 T O&M Calculations Holding Periods 0 1 5 2 3 4 After-Tax Fair Market (Salvage) Calculations FMV Book Taxable Gain Gains Tax Holding Periods After Tax FMV wN T OC Tot PV Tax Shield AEC Calculations Holding Periods Tot PWAT O&M After Tax FMV After Tax FM MACRS Depreciation Rate Schedule - Mid Year Convention 3 years 33.33% 44.45% 14.81% 7.41% 15 years 29 years 5 years 20.00% 32.00% 19. 20% 11.52% 11.52% 5.76% 2 years 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% 10 years 19.80% 18.80% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.56% 6.55% 3.28% 5.89% 9.50% 8.55% 7.70% 6.93% 6.23% 5.99% 5.90% 5.91% 5.99% 5.91% 5.90% 5.91% 5.90% 5.91% 2.95% 3.750% 7.219% 6.677% 6.177% 5.713% 5.285% 4.888% 4.522% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 2.231% 12.0% Simple Page Compound Worth Factor Factor (F/P.IN (VELN Worth Equal Moment Series Sinking Present Fund Factor (A/ELN (PA.AN) Compound Amount Factor (FYA.LN Factor Capital Recovery Factor (1/PIN) 1.1200 0.5917 0.4163 0.1292 0.2774 Gradient Series Gradient Gradient Uniform Present Series Worth (A/GLN) (PVGN) 0.0000 0.0000 0.4717 0.7972 01.9246 2.2208 1.1589 4.1273 1.7746 6.3970) LI 1.2544 LU 1.37.85 1.7621 0.7472 0.7118 08.155 0.5674 LONDO 2.1.2 13744 4.7793 6.1528 0.929 LOT 2.4018 3.0373 3.6048 LOOO 0.4717 0.2963 0.2092 0.1574 1.97. 2.2107 2.4760 2.7731 0,5066 0.4523 04019 OUW 0.3220 8.1152 10.0N90 12.2997 14.7757 12547 0.12.12 0.0091 CONT3 0.0677 DAS 70 4.1114 4.561 4.9676 5.32x2 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 2.1720 2.5515 2.9131 3.2574 3.5847 8.9302 11.0443 14.4714 173563 20.2541 3.8953 5.9377 6.1944 375 39 4.11.15 4.8871 5.-1736 0.2175 0.2567 0.2292 0.2016 0.1827 20.05.16 24.1331 28.(1291 32.3026 0.0184 0.0414 0,0357 0.0309 0.01208 0.1684 0.1614 0.1557 0.1509 0.1468 4.1897 4,4683 42.15 23.128 25.9523 28.7024 31.3624 33.9202 4.7317 6.6262 6.8109 15 32297 4.9803 6,9740 6.1.304 0.1631 6.8610 0.1456 7660 0.1300 8.6128 0.1161 961630.1037 42.7533 48.8837 55.7497 6,34397 72.01524 0.0234 0.0205 0.0179 0.0158 0.01.39 21196 22497 7.3658 7.4694 0.1434 0.1405 0.1379 0.1358 0.13.39 5.2147 5.4353 5.6427 5.8375 6.0202 36,3670 38.6973 40.90ND 42.9979 44.9676 21 22 10.80.18 12.1003 1.3.3523 15.1786 120001 0.0926 0.0826 0.0738 0.1659 0.0588 81.6987 92.5626 104.6029 118.1552 133.3339 0.0122 0.0108 0.0096 0.0065 0.0075 25620 76446 77184 77843 28431 0.1322 0.1308 0.12% 0.12X5 0.1275 6.1913 6.3514 6.5010 0.04036 6.7708 46.8188 48.5543 50.1776 51.6929 53.1046 new machine to be installed at a cost of $12,500 is classified in a 5-Year MACRS depreciation category (mid-year). The MARR is 12% and the marginal tax rate is 20%. Given the period costs and values in the table below, determine the economic life of the machine by computing the AEC with tax considerations. Use the tables below as a guide to ensure partial credit. SHOW an example calculation for each section for full credit AND make a final determination based on the results. Operating Book $12,500. $8,000.00 $4,800.00 $2,880.00 $1,728.00 $576.00 Salvare $5,300.00 $3,900.00 $2,800.00 $1,880 00 $1,400.00 $600.00 $1,500.00 $2,100.00 $2.700 m $3,300.00 $3,900.00 $4,500.00 $0.00 MACRS MACRS Depreciation Schedule Depreciation Calculations Holding Periods 0 1 2 4 T O&M Calculations Holding Periods 0 1 5 2 3 4 After-Tax Fair Market (Salvage) Calculations FMV Book Taxable Gain Gains Tax Holding Periods After Tax FMV wN T OC Tot PV Tax Shield AEC Calculations Holding Periods Tot PWAT O&M After Tax FMV After Tax FM MACRS Depreciation Rate Schedule - Mid Year Convention 3 years 33.33% 44.45% 14.81% 7.41% 15 years 29 years 5 years 20.00% 32.00% 19. 20% 11.52% 11.52% 5.76% 2 years 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% 10 years 19.80% 18.80% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.56% 6.55% 3.28% 5.89% 9.50% 8.55% 7.70% 6.93% 6.23% 5.99% 5.90% 5.91% 5.99% 5.91% 5.90% 5.91% 5.90% 5.91% 2.95% 3.750% 7.219% 6.677% 6.177% 5.713% 5.285% 4.888% 4.522% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 2.231% 12.0% Simple Page Compound Worth Factor Factor (F/P.IN (VELN Worth Equal Moment Series Sinking Present Fund Factor (A/ELN (PA.AN) Compound Amount Factor (FYA.LN Factor Capital Recovery Factor (1/PIN) 1.1200 0.5917 0.4163 0.1292 0.2774 Gradient Series Gradient Gradient Uniform Present Series Worth (A/GLN) (PVGN) 0.0000 0.0000 0.4717 0.7972 01.9246 2.2208 1.1589 4.1273 1.7746 6.3970) LI 1.2544 LU 1.37.85 1.7621 0.7472 0.7118 08.155 0.5674 LONDO 2.1.2 13744 4.7793 6.1528 0.929 LOT 2.4018 3.0373 3.6048 LOOO 0.4717 0.2963 0.2092 0.1574 1.97. 2.2107 2.4760 2.7731 0,5066 0.4523 04019 OUW 0.3220 8.1152 10.0N90 12.2997 14.7757 12547 0.12.12 0.0091 CONT3 0.0677 DAS 70 4.1114 4.561 4.9676 5.32x2 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 2.1720 2.5515 2.9131 3.2574 3.5847 8.9302 11.0443 14.4714 173563 20.2541 3.8953 5.9377 6.1944 375 39 4.11.15 4.8871 5.-1736 0.2175 0.2567 0.2292 0.2016 0.1827 20.05.16 24.1331 28.(1291 32.3026 0.0184 0.0414 0,0357 0.0309 0.01208 0.1684 0.1614 0.1557 0.1509 0.1468 4.1897 4,4683 42.15 23.128 25.9523 28.7024 31.3624 33.9202 4.7317 6.6262 6.8109 15 32297 4.9803 6,9740 6.1.304 0.1631 6.8610 0.1456 7660 0.1300 8.6128 0.1161 961630.1037 42.7533 48.8837 55.7497 6,34397 72.01524 0.0234 0.0205 0.0179 0.0158 0.01.39 21196 22497 7.3658 7.4694 0.1434 0.1405 0.1379 0.1358 0.13.39 5.2147 5.4353 5.6427 5.8375 6.0202 36,3670 38.6973 40.90ND 42.9979 44.9676 21 22 10.80.18 12.1003 1.3.3523 15.1786 120001 0.0926 0.0826 0.0738 0.1659 0.0588 81.6987 92.5626 104.6029 118.1552 133.3339 0.0122 0.0108 0.0096 0.0065 0.0075 25620 76446 77184 77843 28431 0.1322 0.1308 0.12% 0.12X5 0.1275 6.1913 6.3514 6.5010 0.04036 6.7708 46.8188 48.5543 50.1776 51.6929 53.1046