new numbers?

new numbers?

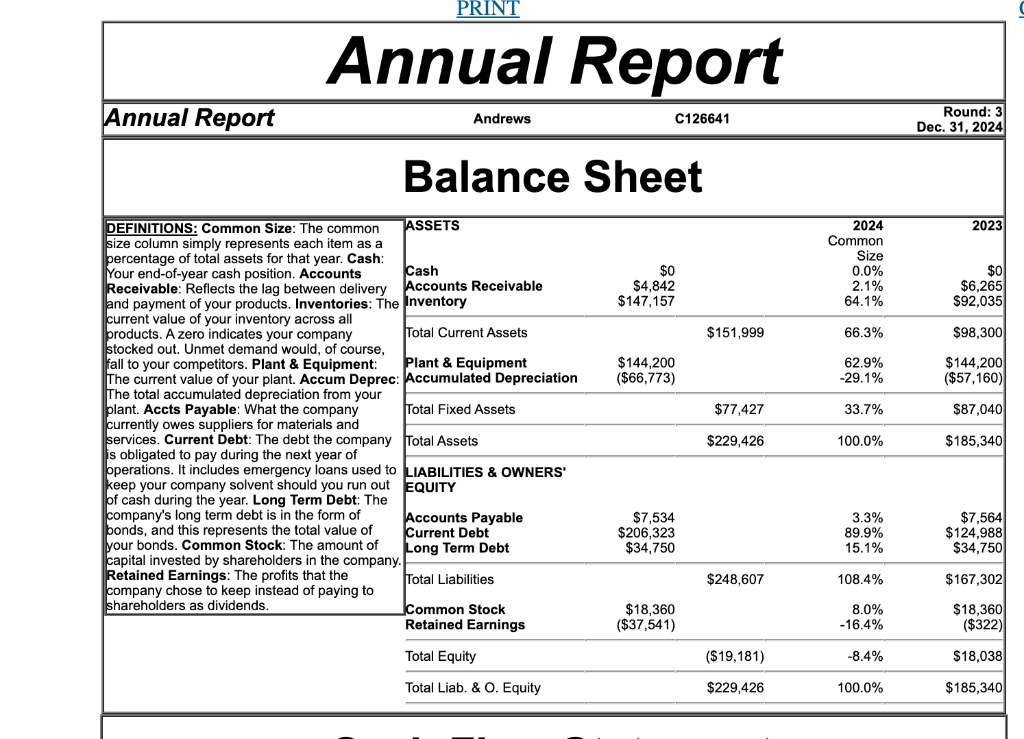

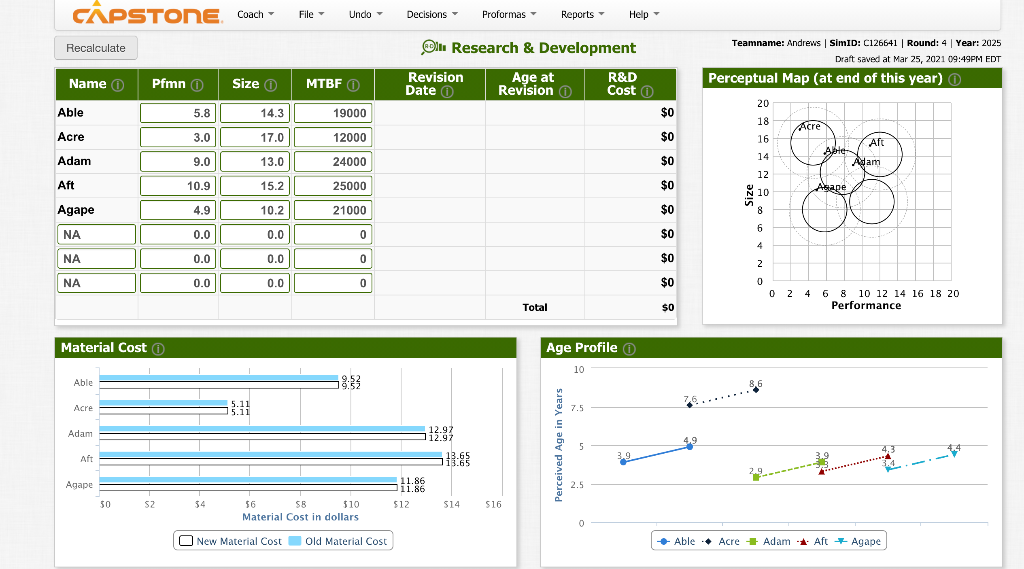

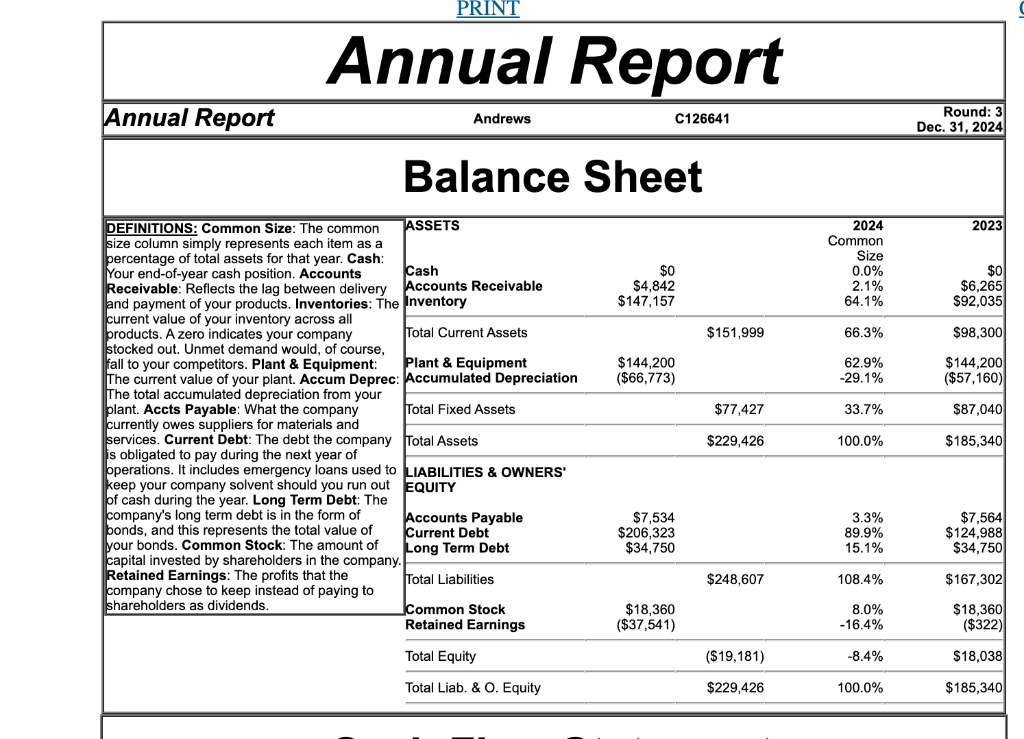

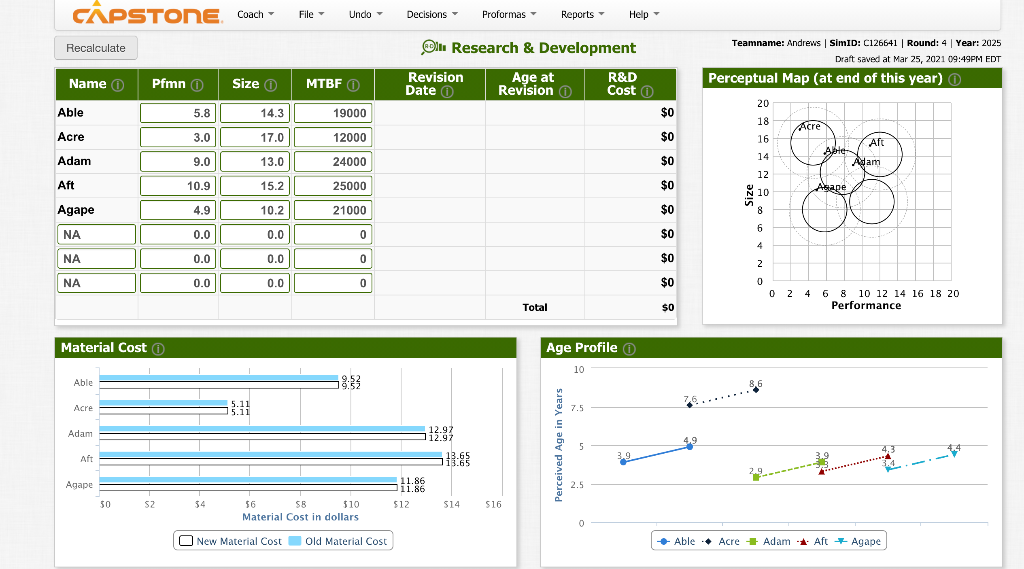

CAPSTONE Coach File Undo Decisions Proformas Reports Help Recalculate Olin Research & Development Revision Age at R&D Date 0 Revision Cost o Teamname: Andrews | SimID: C126641 | Round: 4 | Year: 2025 Draft saved at Mar 25, 2021 09:49PM EDT Perceptual Map (at end of this year) Name o Pfmn Size MTBF 20 5.8 14.3 19000 $0 Able Acre Adam 18 16 3.0 17.0 12000 $0 Acre Aft Ade- Adam 14 9.0 13.0 24000 $0 12 Aft 10.9 15.2 25000 $0 Astape 10 Agape 4.9 10.2 21000 $0 8 6 NA 0.0 0.0 0 $0 4 NA 0.0 0.0 0 $0 2 NA 0.0 0.0 0 $0 0 0 2 4 6 8 10 12 14 16 18 20 Performance Total so Material Cost Age Profile 10 Able Acre 5.11 5.11 7.5 Adam 12.97 12.97 Perceived Age in Years 43 Aft 11.69 39 Agape 2.5 11.86 11.86 $12 50 S2 34 $14 516 56 58 $10 Material Cost in dollars 0 New Material Cost Old Material Cost + Able Acre Adam Aft + Agape PRINT Annual Report Annual Report Andrews C126641 Round: 3 Dec. 31, 2024 Balance Sheet 2023 2024 Common Size 0.0% 2.1% 64.1% $0 $4,842 $147,157 $0 $6,265 $92,035 $151,999 66.3% $98,300 $144,200 ($66,773) 62.9% -29.1% $144,200 ($57,160) $77,427 33.7% $87,0401 DEFINITIONS: Common Size: The common ASSETS size column simply represents each item as a percentage of total assets for that year. Cash: Your end-of-year cash position. Accounts Cash Receivable: Reflects the lag between delivery Accounts Receivable and payment of your products. Inventories: The Inventory current value of your inventory across all products. A zero indicates your company Total Current Assets stocked out. Unmet demand would, of course, fall to your competitors. Plant & Equipment: Plant & Equipment The current value of your plant. Accum Deprec: Accumulated Depreciation The total accumulated depreciation from your plant. Accts Payable: What the company Total Fixed Assets currently owes suppliers for materials and services. Current Debt: The debt the company Total Assets s obligated to pay during the next year of operations. It includes emergency loans used to LIABILITIES & OWNERS' keep your company solvent should you run out EQUITY of cash during the year. Long Term Debt: The company's long term debt is in the form of Accounts Payable bonds, and this represents the total value of Current Debt your bonds. Common Stock: The amount of Long Term Debt capital invested by shareholders in the company. Retained Earnings: The profits that the Total Liabilities company chose to keep instead of paying to shareholders as dividends. Common Stock Retained Earnings $229,426 100.0% $185,340 $7,534 $206,323 $34,750 3.3% 89.9% 15.1% $7,5641 $124,988 $34,7501 $248,607 108.4% $167,302 $18,360 ($37,541) 8.0% -16.4% $18,360 ($322) Total Equity ($19,181) -8.4% $18,038 Total Liab. & O. Equity $229,426 100.0% $185,340 CAPSTONE Coach File Undo Decisions Proformas Reports Help Recalculate Olin Research & Development Revision Age at R&D Date 0 Revision Cost o Teamname: Andrews | SimID: C126641 | Round: 4 | Year: 2025 Draft saved at Mar 25, 2021 09:49PM EDT Perceptual Map (at end of this year) Name o Pfmn Size MTBF 20 5.8 14.3 19000 $0 Able Acre Adam 18 16 3.0 17.0 12000 $0 Acre Aft Ade- Adam 14 9.0 13.0 24000 $0 12 Aft 10.9 15.2 25000 $0 Astape 10 Agape 4.9 10.2 21000 $0 8 6 NA 0.0 0.0 0 $0 4 NA 0.0 0.0 0 $0 2 NA 0.0 0.0 0 $0 0 0 2 4 6 8 10 12 14 16 18 20 Performance Total so Material Cost Age Profile 10 Able Acre 5.11 5.11 7.5 Adam 12.97 12.97 Perceived Age in Years 43 Aft 11.69 39 Agape 2.5 11.86 11.86 $12 50 S2 34 $14 516 56 58 $10 Material Cost in dollars 0 New Material Cost Old Material Cost + Able Acre Adam Aft + Agape PRINT Annual Report Annual Report Andrews C126641 Round: 3 Dec. 31, 2024 Balance Sheet 2023 2024 Common Size 0.0% 2.1% 64.1% $0 $4,842 $147,157 $0 $6,265 $92,035 $151,999 66.3% $98,300 $144,200 ($66,773) 62.9% -29.1% $144,200 ($57,160) $77,427 33.7% $87,0401 DEFINITIONS: Common Size: The common ASSETS size column simply represents each item as a percentage of total assets for that year. Cash: Your end-of-year cash position. Accounts Cash Receivable: Reflects the lag between delivery Accounts Receivable and payment of your products. Inventories: The Inventory current value of your inventory across all products. A zero indicates your company Total Current Assets stocked out. Unmet demand would, of course, fall to your competitors. Plant & Equipment: Plant & Equipment The current value of your plant. Accum Deprec: Accumulated Depreciation The total accumulated depreciation from your plant. Accts Payable: What the company Total Fixed Assets currently owes suppliers for materials and services. Current Debt: The debt the company Total Assets s obligated to pay during the next year of operations. It includes emergency loans used to LIABILITIES & OWNERS' keep your company solvent should you run out EQUITY of cash during the year. Long Term Debt: The company's long term debt is in the form of Accounts Payable bonds, and this represents the total value of Current Debt your bonds. Common Stock: The amount of Long Term Debt capital invested by shareholders in the company. Retained Earnings: The profits that the Total Liabilities company chose to keep instead of paying to shareholders as dividends. Common Stock Retained Earnings $229,426 100.0% $185,340 $7,534 $206,323 $34,750 3.3% 89.9% 15.1% $7,5641 $124,988 $34,7501 $248,607 108.4% $167,302 $18,360 ($37,541) 8.0% -16.4% $18,360 ($322) Total Equity ($19,181) -8.4% $18,038 Total Liab. & O. Equity $229,426 100.0% $185,340

new numbers?

new numbers?