Answered step by step

Verified Expert Solution

Question

1 Approved Answer

New Orleans Living Magazine (NOLM) is a monthly, subscription- based magazine that has content related to local businesses, residences and neighborhoods, and cultural events. The

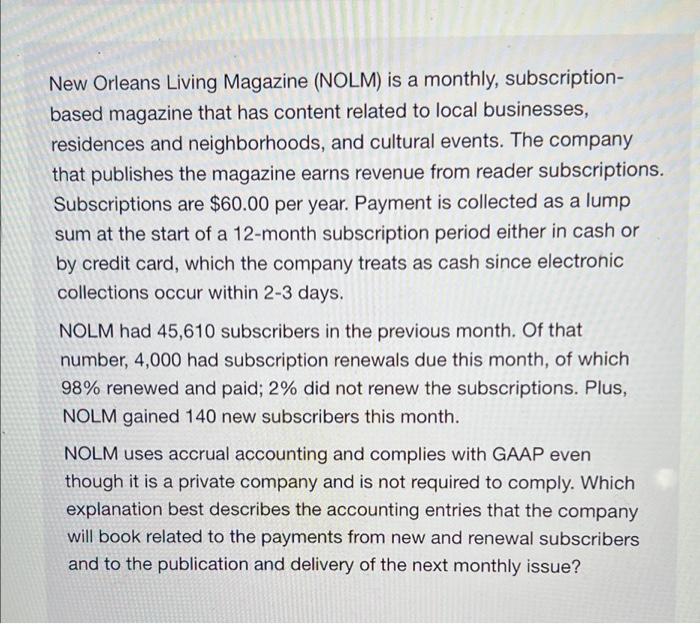

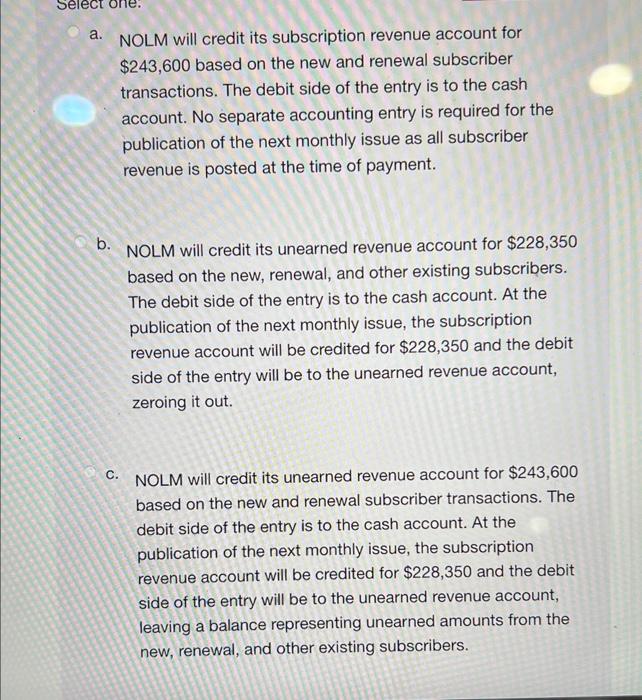

New Orleans Living Magazine (NOLM) is a monthly, subscription- based magazine that has content related to local businesses, residences and neighborhoods, and cultural events. The company that publishes the magazine earns revenue from reader subscriptions. Subscriptions are $60.00 per year. Payment is collected as a lump sum at the start of a 12-month subscription period either in cash or by credit card, which the company treats as cash since electronic collections occur within 2-3 days. NOLM had 45,610 subscribers in the previous month. Of that number, 4,000 had subscription renewals due this month, of which 98% renewed and paid; 2% did not renew the subscriptions. Plus, NOLM gained 140 new subscribers this month. NOLM uses accrual accounting and complies with GAAP even though it is a private company and is not required to comply. Which explanation best describes the accounting entries that the company will book related to the payments from new and renewal subscribers and to the publication and delivery of the next monthly issue?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started