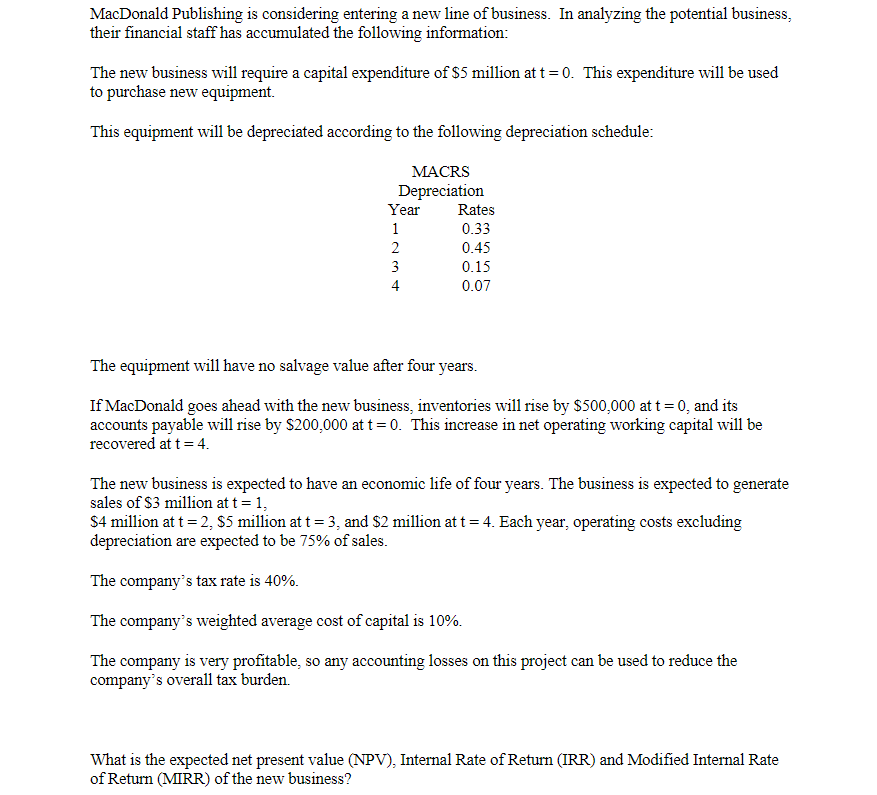

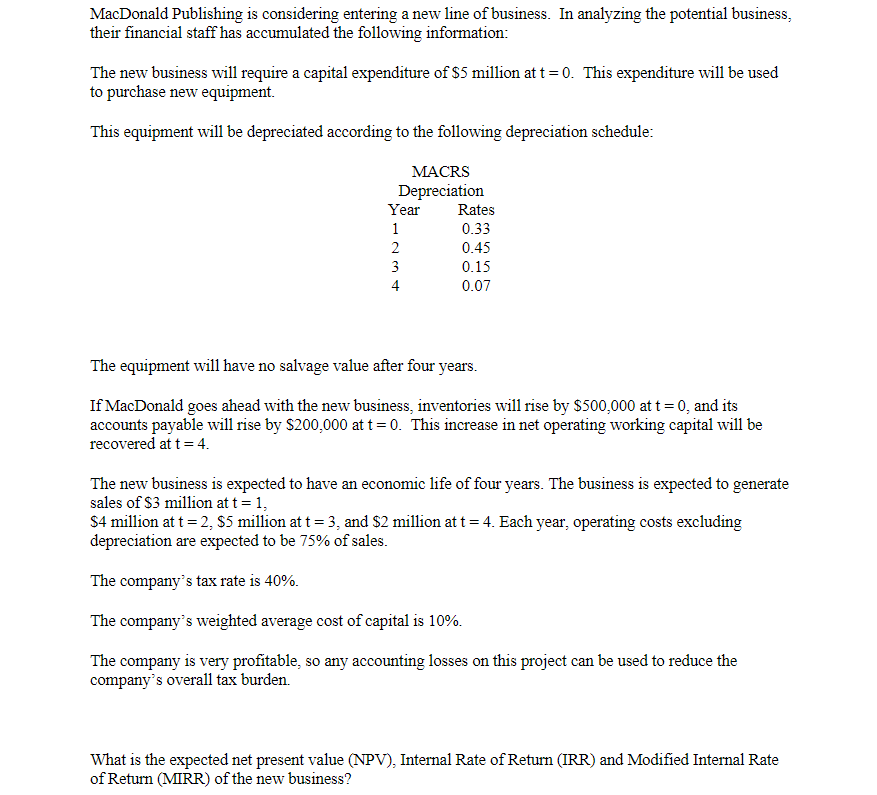

New project NPV You are to do the problem at the end of these directions as an Excel spreadsheet. Your work is to be individual. 1. Create and use a clearly labeled and easily located data input section containing ALL the variables used to compute any part of the answer. Preferably in the upper left section of your spreadsheet. 2. Refer to input variable cells in setting up the working part of the spreadsheet so that it will update automatically when variable values are changed. Every computed value must update when new input values are used! 3. Your equations and functions should NOT include any hardcoded variable values; just cell references. Make sure your entire spreadsheet, including names of items and any notes, will update itself using the data in the input section before you turn in your assignment! 4. Use Excel functions to compute output answers. 5. You must also have a clearly labeled and easily located output area to make it easy for other users to see the results. Preferably in the upper right section of your spreadsheet. 6. Format all the cells to a number of decimal places that makes sense for that item and use percent or currency formats where appropriate. 7. Name the worksheet on the bottom tab with a title that describes what the worksheet does so anyone can see at a glance the purpose of the sheet. Then REMOVE any unused sheets. Turn your assignments in using Canvas. MacDonald Publishing is considering entering a new line of business. In analyzing the potential business, their financial staff has accumulated the following information: The new business will require a capital expenditure of $5 million at t= 0. This expenditure will be used to purchase new equipment. This equipment will be depreciated according to the following depreciation schedule: MACRS Depreciation Year Rates 1 0.33 2 0.45 3 0.15 4 0.07 The equipment will have no salvage value after four years. If MacDonald goes ahead with the new business, inventories will rise by $500,000 at t = 0, and its accounts payable will rise by $200,000 at t= 0. This increase in net operating working capital will be recovered at t= 4. The new business is expected to have an economic life of four years. The business is expected to generate sales of $3 million at t=1, $4 million at t=2, $5 million at t = 3, and $2 million at t = 4. Each year, operating costs excluding depreciation are expected to be 75% of sales. The company's tax rate is 40%. The company's weighted average cost of capital is 10%. The company is very profitable, so any accounting losses on this project can be used to reduce the company's overall tax burden. What is the expected net present value (NPV), Internal Rate of Return (IRR) and Modified Internal Rate of Return (MIRR) of the new business