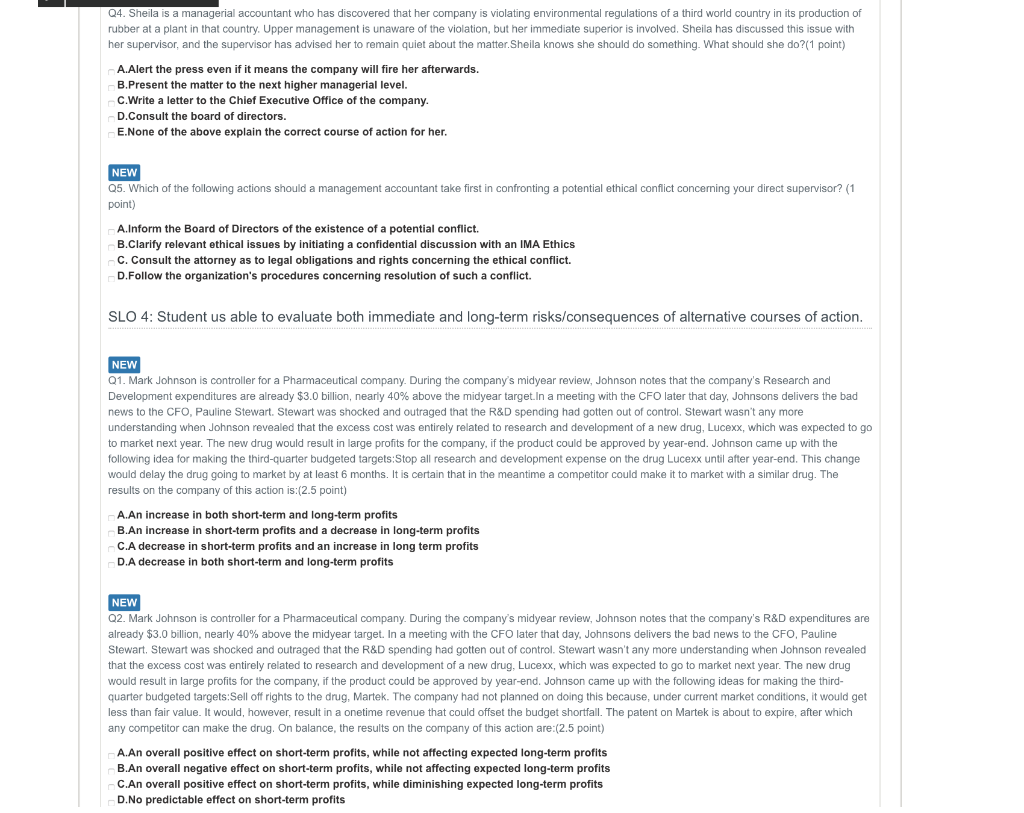

NEW Q1. Sheila is a managerial accountant who has discovered that her company is violating environmental regulations of a third world country in its production of rubber at a plant in that country. Upper management is unaware of the violation, but her immediate superior is involved. Sheila has discussed this issue with her supervisor, and the supervisor has advised her to remain quiet about the matter. Sheila reasons that she should do nothing because her supervisor is her immediate authority and has more information. Is Sheila correct in her reasoning?(1 point) A. Yes B. No NEW Q2. You are a managerial accountant who has become privy to information about a takeover bid by your employing firm to acquire a rival company. A family friend is considering selling shares in this rival company and has asked you, an expert in the industry, for advice on this matter. You comply with your friend's request. Which of the following is true?(1 point) A.You are satisfying IMA Ethical Standards because you are "providing decision support information and recommendations that are accurate, clear, concise and timely." B.You are satisfying IMA Ethical Standards by "keeping information confidential except when disclosure is authorized or legally required. C.You are violating IMA Ethical Standards by not "mitigating actual conflicts of interest." D.You are violating IMA Ethical Standards by not "maintaining an appropriate level of professional expertise by continually developing knowledge and skills." E.None of the above are true statements NEW Q3. Ethical challenges for management accountants include:1 point) A.Whether to accept gifts from suppliers, knowing it is an effort to indirectly influence decisions. .whether to report unfavorable department information that may result in unfavorable consequences for a friend. C.Whether to file a tax return for this year D.Both A and B are correct. NEW Q4. Mark Johns is the new division controller of the Frozen-Foods Division of Lindel Foods. Lindel Foods has reported a minimum 15% growth in annual earnings for each of the past 5 years. The Frozen-Foods Division has reported annual earnings growth of more than 20% each year in this same period. During the current year, the economy went into recession. The corporate controller estimates a 10% annual earnings growth rate for Lindel Foods this year. One month before the December 31 fiscal year-end of the current year, Johns estimates the Frozen-Foods Division will report an annual earnings growth of only 8%. Linda Kay, the Frozen-foods Division president, is not happy, but she notes that the "end-of-year actions" still need to be taken-Johns makes some inquiries and is able to compile a list of end-of-year actions that were more or less accepted by the previous division controller. Which one of the following proposed actions would clearly present an ethical dilemma to the company and violate the IMA Standards of Ethical Conduct?(1 point) A.Deferring December's routine monthly maintenance on packaging equipment by an independent contractor until January of next year B.Extending the close of the current fiscal year beyond December 31 so that some sales of next year are included. C.Giving salespeople a double bonus to exceed December sales targets. D.Deferring the current period's advertising by reducing the number of television spots run in December and running more than planned in January of next year NEW Q5. Mark Johns is the new division controller of the Frozen-Foods Division of Lindel Foods. Lindel Foods has reported a minimum 15% growth in annual earnings for each of the past 5 years. The Frozen-Foods Division has reported annual earnings growth of more than 20% each year in this same period. During the current year, the economy went into recession. The corporate controller estimates a 10% annual earnings growth rate for Lindel Foods this year. One month before the December 31 fiscal year-end of the current year, Johns estimates the Frozen-Foods Division will report an annual earnings growth of only 8%. Linda Kay, the frozen-foods division president, is not happy, but she notes that the "end-of-year actions" still need to be taken. Johns makes some inquiries and is able to compile a list of end-of-year actions that were more or less accepted by the previous division controller. Which one of the following proposed actions would clearly not present an ethical dilemma to the company and violate the IMA Standards of Ethical Conduct?(1 point) A.Altering dates of shipping documents of next January's sales to record them as sales in December of the current year B.Deferring the current period's reported advertising costs by having Lindel Foods's outside advertising agency delay billing December advertisements until January of next year or by having the agency alter invoices to conceal the December date C.Persuading carriers to accept merchandise for shipment in December of the current year even though they normally would not have done so SLO 2: Student can identify stakeholders in an ethical dilemma/issue and can demonstrate awareness of differing perspectives of those stakeholders NEW Q1. Reginald Logistics, a U.S. shipping company, has just begun distributing goods across the Atlantic to Norway. The company began operations in 2011 transporting goods to South America in a very competitive industry. The company's earnings are currently trailing behind its competitors and Reginald's investors are becoming anxious. Some of the company's largest investors are even talking of selling their interest in the shipping newcomer. Reginald's CEO Bryce Wayne, calls an emergency meeting with his executive team. Wayne needs a plan before his upcoming conference call with uneasy investors Reginald's executive staff suggest pressuring current customers to take early delivery of goods before the end of the year so that more revenue can be reported on this year's financial statements.Which stakeholders of Reginald will be least affected by this practice?(1 point) Investors in Reginald stock. Customers of Reginald services Management personnel at Reginald NEW Q2. Wintz Publishing House produces consumer magazines. The House and Home Division, which sells home-improvement and home-decorating magazines, has seen a 20% reduction in operating income over the past 9 months, primarily due to an economic recession and a depressed consumer housing market. The division's controller, Happy Franklin, has felt pressure from the CFO to improve her division's operating results by the end of the year. Franklin is considering the following options for improving the division's performance by year-end: (a.) Cancelling two of the division's least profitable magazines, resulting in the layoff of 25 employees. (b.) Selling the new printing equipment that was purchased in January and replacing it with discarded equipment from one of the company's other divisions. The previously discarded equipment no longer meets current safety standards. (c.) Recognizing unearned subscription revenue (cash received in advance for magazines that will be delivered in the future) as revenue when cash is received in the current month (just before fiscal year-end) instead of showing it as a liability. (d.) Recognizing advertising revenues that relate to January in December. Which of the forgoing "year-end" actions are clearly in conflict with the IMA Statement of Ethical Standards and should be viewed as unacceptable because of their potential harm to investors? (2 point) Options a and c Options a and d Options c and d Options b and d NEW Q3. Wintz Publishing House produces consumer magazines. The House and Home Division, which sells home-improvement and home-decorating magazines has seen a 20% reduction in operating income over the past 9 months, primarily due to an economic recession and a depressed consumer housing market. The division's controller, Happy Franklin, has felt pressure from the CFO to improve her division's operating results by the end of the year. Franklin is considering the following options for improving the division's performance by year-end:a.Cancelling two of the division's least profitable magazines, resulting in the layoff of 25 employees.b.Selling the new printing equipment that was purchased in January and replacing it with discarded equipment from one of the company's other divisions. The previously discarded equipment no longer meets current safety standards.c.Recognizing unearned subscription revenue (cash received in advance for magazines that will be delivered in the future) as revenue when cash is received in the current month (just before fiscal year-end) instead of showing it as a liability. d.Reducing the division's Allowance for Bad Debt Expense. This transaction alone would increase operating income by 5%.e. Recognizing advertising revenues that relate to January in December, which of the forgoing "year-end" actions should be viewed as unacceptable because of their potential harm to employee?(2 point) Option b Option c option d option e SLO 3: Student is able to identify alternative courses of action/solutions regarding an ethical dilemma NEW Q1. According to the IMA Standards of Ethical Conduct, if there is an ethical conflict concerning your direct supervisor, you may contact (1 point) local media IMA Ethics Counselor an attorney board of directors NEW Q2. If there is an ethical conflict concerning your direct supervisor, when is it appropriate to contact authorities or individuals not employed by the organization? (1 point) when there is when your supervisor is about to be promoted when there is a clear violation of the law when you face injustice from your supervisor a personal conflict NEW Q3. If a managerial accountant suspected his or her immediate superior of unethical behavior, who happens to be a chief executive officer or equivalent, the managerial accountant should request an immediate meeting with the executive committee or the audit committee. (1 point) TRUE FALSE NEW Q4. Sheila is a managerial accountant who has discovered that her company is violating environmental regulations of a third world country in its production of Q4. Sheila is a managerial accountant who has discovered that her company is violating environmental regulations of a third world country in its production of rubber at a plant in that country. Upper management is unaware of the violation, but her immediate superior is involved. Sheila has discussed this issue with her supervisor, and the supervisor has advised her to remain quiet about the matter.Sheila knows she should do something. What should she do? (1 point) A.Alert the press even if it means the company will fire her afterwards. B.Present the matter to the next higher managerial level. .write a letter to the Chief Executive Office of the company. D.Consult the board of directors. E.None of the above explain the correct course of action for her NEW Q5. Which of the following actions should a management accountant take first in confronting a potential ethical conflict concerming your direct supervisor? (1 point) A.Inform the Board of Directors of the existence of a potential conflict. B.Clarify relevant ethical issues by initiating a confidential discussion with an IMA Ethics C. Consult the attorney as to legal obligations and rights concerning the ethical conflict. D.Follow the organization's procedures concerning resolution of such a conflict. SLO 4: Student us able to evaluate both immediate and long-term risks/consequences of alternative courses of action NEW Q1. Mark Johnson is controller for a Phamaceutical company. During the company's midyear review, Johnson notes that the company's Research and Development expenditures are already $3.0 billion, nearly 40% above the midyear target-In a meeting with the CFO later that day, Johnsons delivers the bad news to the CFO, Pauline Stewart. Stewart was shocked and outraged that the R&D spending had gotten out of control. Stewart wasn't any more understanding when Johnson revealed that the excess cost was entirely related to research and development of a new drug, Lucexx, which was expected to go to market next year. The new drug would result in large profits for the company, if the product could be approved by year-end. Johnson came up with the following idea for making the third-quarter budgeted targets:Stop all research and development expense on the drug Lucexx until after year-end. This change would delay the drug going to market by at least 6 months. It is certain that in the meantime a competitor could make it to market with a similar drug. The results on the company of this action is: (2.5 point) A.An increase in both short-term and long-term profits B.An increase in short-term profits and a decrease in long-term profits C.A decrease in short-term profits and an increase in long term profits D.A decrease in both short-term and long-term profits NEW Q2. Mark Johnson is controller for a Phamaceutical company. During the company's midyear review, Johnson notes that the company's R&D expenditures are already $3.0 billion, nearly 40% above the midyear target. In a meeting with the CFO later that day, Johnsons delivers the bad news to the CFO, Pauline Stewart. Stewart was shocked and outraged that the R&D spending had gotten out of control. Stewart wasn't any more understanding when Johnson revealed that the excess cost was entirely related to research and development of a new drug, Lucexx, which was expected to go to market next year. The new drug would result in large profits for the company, if the product could be approved by year-end. Johnson came up with the following ideas for making the third- quarter budgeted targets:Sell off rights to the drug, Martek. The company had not planned on doing this because, under current market conditions, it would get less than fair value. It would, however, result in a onetime revenue that could offset the budget shortfall. The patent on Martek is about to expire, after which any competitor can make the drug. On balance, the results on the company of this action are:(2.5 point) A.An overall positive effect on short-term profits, while not affecting expected long-term profits B.An overall negative effect on short-term profits, while not affecting expected long-term profits C.An overall positive effect on short-term profits, while diminishing expected long-term profits D.No predictable effect on short-term profits