Answered step by step

Verified Expert Solution

Question

1 Approved Answer

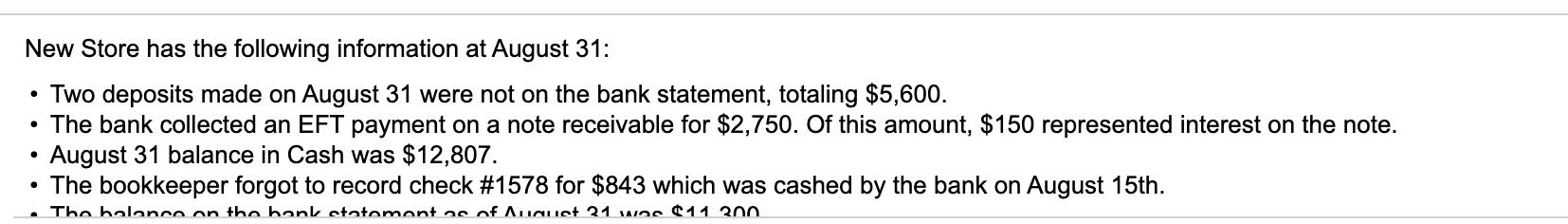

New Store has the following information at August 31: Two deposits made on August 31 were not on the bank statement, totaling $5,600. The

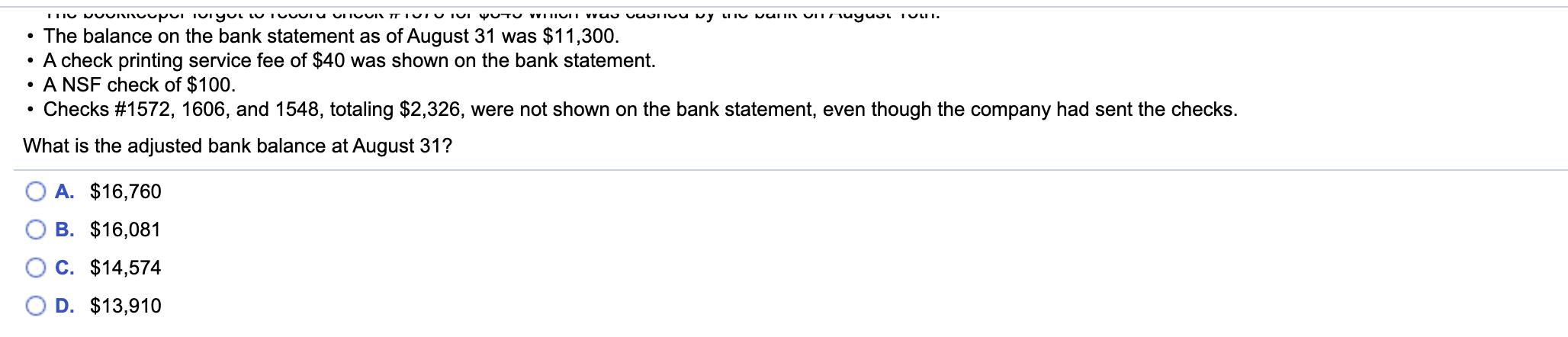

New Store has the following information at August 31: Two deposits made on August 31 were not on the bank statement, totaling $5,600. The bank collected an EFT payment on a note receivable for $2,750. Of this amount, $150 represented interest on the note. August 31 balance in Cash was $12,807. The bookkeeper forgot to record check #1578 for $843 which was cashed by the bank on August 15th. The balance on the bank statement as of August 21 was $11 300 THE DOURneuportvigui in Tovun UNOURI TOT VI PUTO WHICH was casnice by the vann Un Muyuul The balance on the bank statement as of August 31 was $11,300. A check printing service fee of $40 was shown on the bank statement. A NSF check of $100. Checks #1572, 1606, and 1548, totaling $2,326, were not shown on the bank statement, even though the company had sent the checks. What is the adjusted bank balance at August 31? TSET. A. $16,760 B. $16,081 C. $14,574 D. $13,910

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer C 14574 Bank balance as per cash book as at August 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started