Question

New Tech management reviewed the model developed to assess the best approach for the marketing/R&D problem. (See text problem 19.17 which was assigned as a

New Tech management reviewed the model developed to assess the best approach for the marketing/R&D problem. (See text problem 19.17 which was assigned as a practice problem.) They have decided that the "high" value for Choice A should be 14. They also decided that they are more risk averse than the current model shows and ask that the weighting factors on the importance scores be changed to 50%/50%. a. What are the new expected values for the PW? What are the revised risk values? b. Determine the new importance scores for the present worth and risk of each choice. Calculate the weighted score and identify the best approach.

please show all working

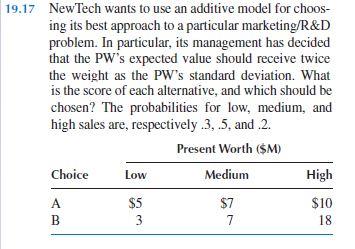

19.17 New Tech wants to use an additive model for choos- ing its best approach to a particular marketing/R&D problem. In particular, its management has decided that the PW's expected value should receive twice the weight as the PW's standard deviation. What is the score of each alternative, and which should be chosen? The probabilities for low, medium, and high sales are, respectively.3.5. and.2. Present Worth ($M) Choice Low Medium High B $5 3 $7 7 $10 18 19.17 New Tech wants to use an additive model for choos- ing its best approach to a particular marketing/R&D problem. In particular, its management has decided that the PW's expected value should receive twice the weight as the PW's standard deviation. What is the score of each alternative, and which should be chosen? The probabilities for low, medium, and high sales are, respectively.3.5. and.2. Present Worth ($M) Choice Low Medium High B $5 3 $7 7 $10 18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started