Answered step by step

Verified Expert Solution

Question

1 Approved Answer

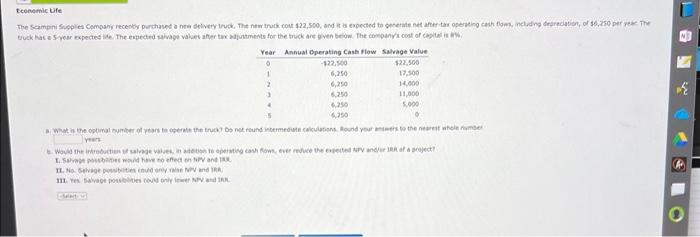

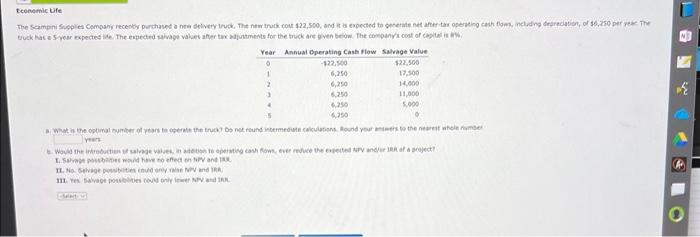

New truck costs 22500 xash flow of 6250 per year 5 year expected life coat of capital 8 % salvage values for years 0-5 (22500,

New truck costs 22500

xash flow of 6250 per year

5 year expected life

coat of capital 8 %

salvage values for years 0-5 (22500, 17500, 14000, 11,000, 5000, 0)

what is optimal number of years to operate truck? do not round intermediate calculations, round answer to nearest whole number.

Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?

i) salvage possibilities would have no effect on npv and irr

ii) No. dalvage possibilities could only raise npv and irr

iii) Yes. Salavge possibilities could only lower npv and irr

Pick one

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started