Answered step by step

Verified Expert Solution

Question

1 Approved Answer

New Zealand Taxation. Question 3 Goods and Services Tax (GST) (10 marks) Part A Wendy Wong, a shareholder employee owns all the shares in Wendy

New Zealand Taxation.

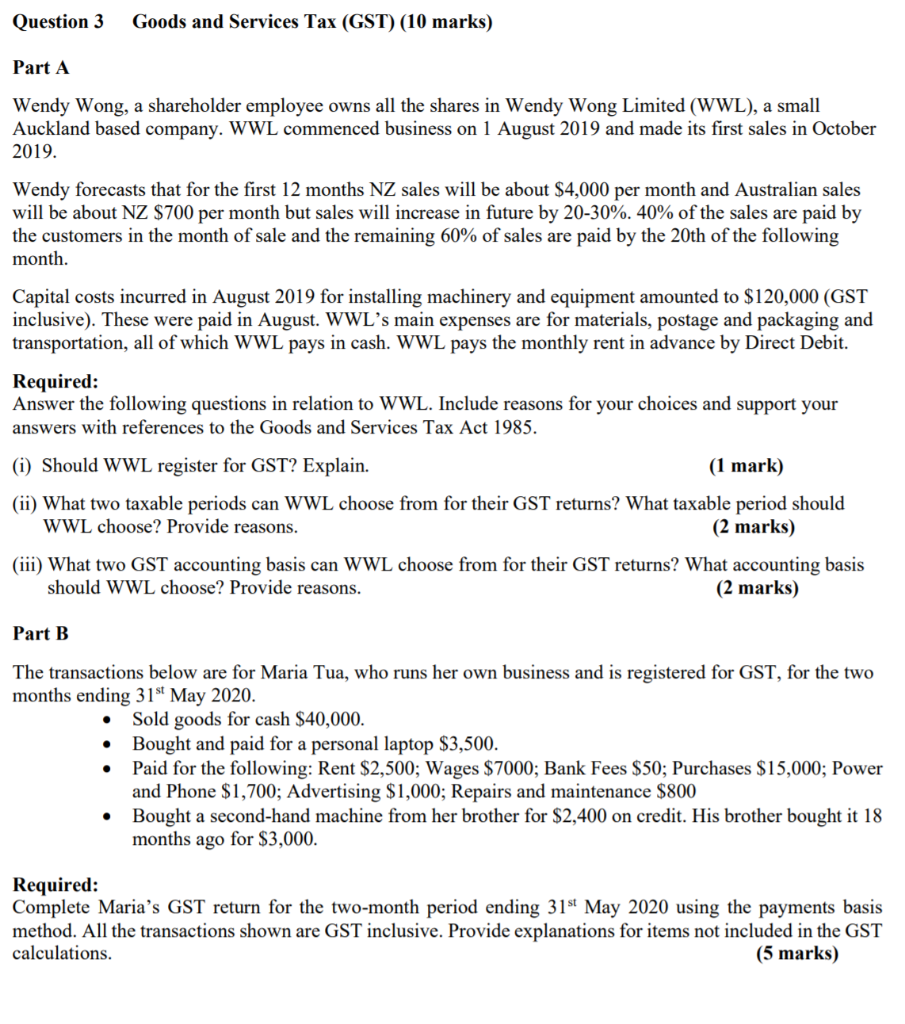

Question 3 Goods and Services Tax (GST) (10 marks) Part A Wendy Wong, a shareholder employee owns all the shares in Wendy Wong Limited (WWL), a small Auckland based company. WWL commenced business on 1 August 2019 and made its first sales in October 2019. Wendy forecasts that for the first 12 months NZ sales will be about $4,000 per month and Australian sales will be about NZ $700 per month but sales will increase in future by 20-30%. 40% of the sales are paid by the customers in the month of sale and the remaining 60% of sales are paid by the 20th of the following month. Capital costs incurred in August 2019 for installing machinery and equipment amounted to $120,000 (GST inclusive). These were paid in August. WWL's main expenses are for materials, postage and packaging and transportation, all of which WWL pays in cash. WWL pays the monthly rent in advance by Direct Debit. Required: Answer the following questions in relation to WWL. Include reasons for your choices and support your answers with references to the Goods and Services Tax Act 1985. (i) Should WWL register for GST? Explain. (1 mark) (ii) What two taxable periods can WWL choose from for their GST returns? What taxable period should WWL choose? Provide reasons. (2 marks) (iii) What two GST accounting basis can WWL choose from for their GST returns? What accounting basis should WWL choose? Provide reasons. (2 marks) Part B The transactions below are for Maria Tua, who runs her own business and is registered for GST, for the two months ending 315 May 2020. Sold goods for cash $40,000. Bought and paid for a personal laptop $3,500. Paid for the following: Rent $2,500; Wages $7000; Bank Fees $50; Purchases $15,000; Power and Phone $1,700; Advertising $1,000; Repairs and maintenance $800 Bought a second-hand machine from her brother for $2,400 on credit. His brother bought it 18 months ago for $3,000. . Required: Complete Maria's GST return for the two-month period ending 31st May 2020 using the payments basis method. All the transactions shown are GST inclusive. Provide explanations for items not included in the GST calculations. (5 marks) Question 3 Goods and Services Tax (GST) (10 marks) Part A Wendy Wong, a shareholder employee owns all the shares in Wendy Wong Limited (WWL), a small Auckland based company. WWL commenced business on 1 August 2019 and made its first sales in October 2019. Wendy forecasts that for the first 12 months NZ sales will be about $4,000 per month and Australian sales will be about NZ $700 per month but sales will increase in future by 20-30%. 40% of the sales are paid by the customers in the month of sale and the remaining 60% of sales are paid by the 20th of the following month. Capital costs incurred in August 2019 for installing machinery and equipment amounted to $120,000 (GST inclusive). These were paid in August. WWL's main expenses are for materials, postage and packaging and transportation, all of which WWL pays in cash. WWL pays the monthly rent in advance by Direct Debit. Required: Answer the following questions in relation to WWL. Include reasons for your choices and support your answers with references to the Goods and Services Tax Act 1985. (i) Should WWL register for GST? Explain. (1 mark) (ii) What two taxable periods can WWL choose from for their GST returns? What taxable period should WWL choose? Provide reasons. (2 marks) (iii) What two GST accounting basis can WWL choose from for their GST returns? What accounting basis should WWL choose? Provide reasons. (2 marks) Part B The transactions below are for Maria Tua, who runs her own business and is registered for GST, for the two months ending 315 May 2020. Sold goods for cash $40,000. Bought and paid for a personal laptop $3,500. Paid for the following: Rent $2,500; Wages $7000; Bank Fees $50; Purchases $15,000; Power and Phone $1,700; Advertising $1,000; Repairs and maintenance $800 Bought a second-hand machine from her brother for $2,400 on credit. His brother bought it 18 months ago for $3,000. . Required: Complete Maria's GST return for the two-month period ending 31st May 2020 using the payments basis method. All the transactions shown are GST inclusive. Provide explanations for items not included in the GST calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started