Answered step by step

Verified Expert Solution

Question

1 Approved Answer

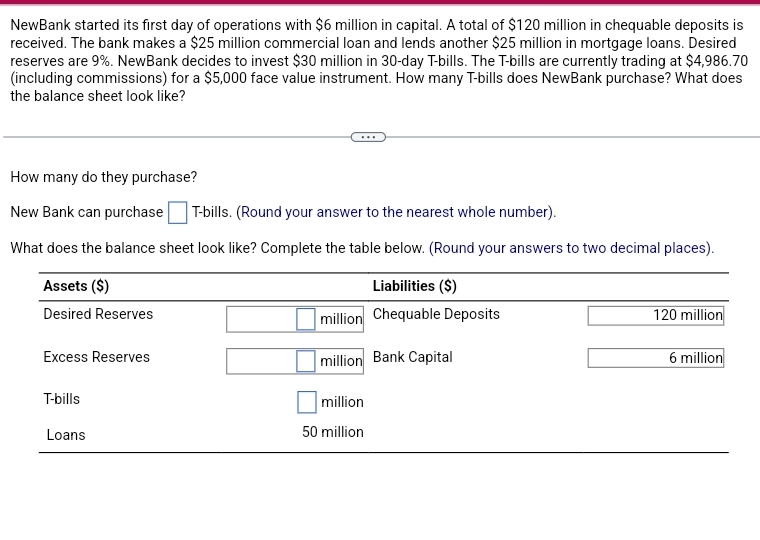

NewBank started its first day of operations with $ 6 million in capital. A total of $ 1 2 0 million in chequable deposits is

NewBank started its first day of operations with $ million in capital. A total of $ million in chequable deposits is received. The bank makes a $ million commercial loan and lends another $ million in mortgage loans. Desired reserves are NewBank decides to invest $ million in day Tbills. The Tbills are currently trading at $including commissions for a $ face value instrument. How many Tbills does NewBank purchase? What does the balance sheet look like?

How many do they purchase?

New Bank can purchase Tbills. Round your answer to the nearest whole number

What does the balance sheet look like? Complete the table below. Round your answers to two decimal places

tableAssets $Liabilities $Desired Reserves,million,Chequable DepositsExcess Reserves,million,Bank CapitalTbills,million,Loans million,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started