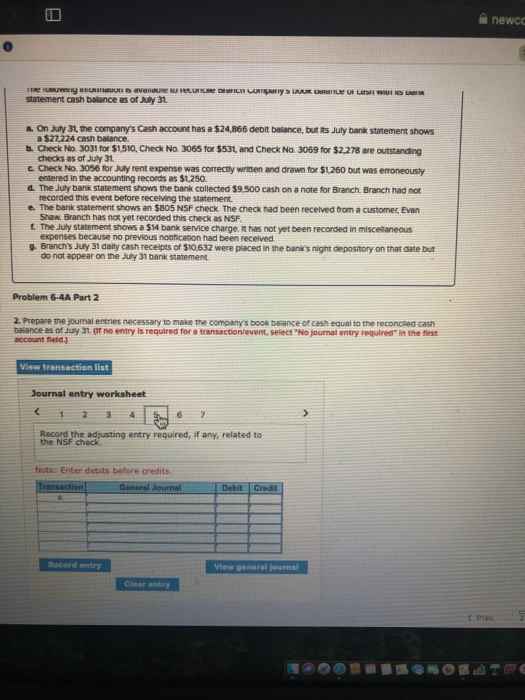

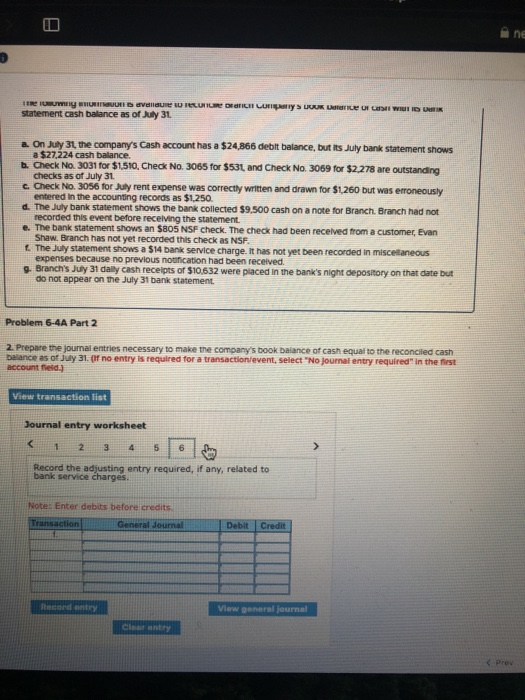

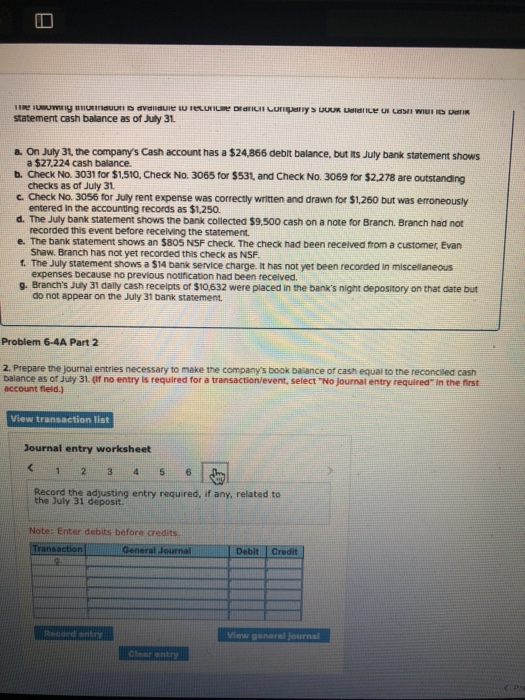

newc FLUTUR DI LUAR UR TIRULIW TR TU RIURI statement cash balance as of July 31 On July 31, the company's Cash account has a $24,866 debit balance, but its Julybank statement shows a $27.224 cash balance. Check No 3031 for SUSI, Check No. 3065 for $53t and Check No 3059 for $2.278 are outstanding checks as of July 31 Check No. 3056 for rent expense was correctly written and drawn for $1260 but was erroneously entered in the accounting records as $1.250. The July bank statement shows the bank collected $9.500 cash on a note for Branch Branch had not recorded this event before receiving the statement The bank statement shows an $805 NSF check the check had been received from a customer Evan Shaw Branch has not yet recorded this check as NSF. The jury statement shows a bank service charge. It has not yet been recorded in miscelaneous expenses because no previous notification had been received Q. Branch uy 31 any cash receipts of $10,632 were placed in the bank's night depository on that date but do not appear on the 31 bank statement Problem 6-4A Part 2 2. Prepare the journal entries necessary to make the company's book balance of cash equal to the reconciled cash balance as of July 31. Of no entry is required for a transaction/event, select "No journal entry required in the first account red.) View transaction list Journal entry worksheet Record the adjusting entry required, if any, related to the NSF check Note: Enter debits before credits Recorder View general Journal Clear andry ELURI DI II LUI SUURUUMI WIDUR TERE IN UNIV statement cash balance as of July 31 & On July 31, the company's Cash account has a $24,866 debit balance, but its July bank statement shows a $27.224 cash balance b. Check No. 3031 for $1.510, Check No. 3065 for $531, and Check No. 3069 for $2.278 are outstanding checks as of July 31 c. Check No. 3056 for July rent expense was correctly written and drawn for $1.260 but was erroneously entered in the accounting records as $1.250 d. The July bank statement shows the bank collected $9.500 cash on a note for Branch Branch had not recorded this event before receiving the statement The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. The July statement shows a $14 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received 9. Branch's July 31 daily cash receipts of $10,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement Problem 6-4A Part 2 2. Prepare the journal entries necessary to make the company's book balance of cash equal to the reconciled cash balance as of July 31. (if no entry is required for a transaction/event, select "No journal entry required in the first account feld) View transaction list Journal entry worksheet 2 3 4 56 | Record the adjusting entry required, if any, related to bank service charges. Note: Enter debits before credits Jouma Debit Credit View general journal U UUR LIUR WII U TIRI TUWUWWE RIDUUR Value U TELUTIR DEILI LU statement cash balance as of July 31 a. On July 31 the company's Cash account has a $24,866 debit balance, but its July bank statement shows a $27.224 cash balance. b. Check No. 3031 for $1,510, Check No. 3065 for $531, and Check No. 3069 for $2.278 are outstanding checks as of July 31 e. Check No. 3056 for July rent expense was correctly written and drawn for $1.260 but was erroneously entered in the accounting records as $1.250 d. The July bank statement shows the bank collected $9,500 cash on a note for Branch Branch had not recorded this event before receiving the statement e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF . The July statement shows a $14 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received g. Branch's July 31 daily cash receipts of $10,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement Problem 6-4A Part 2 2. Prepare the journal entries necessary to make the company's book balance of cash equal to the reconciled cash balance as of July 31 ( no entry is required for a transaction/event, select "No journal entry required in the first account feld) View transaction list Journal entry worksheet