Answered step by step

Verified Expert Solution

Question

1 Approved Answer

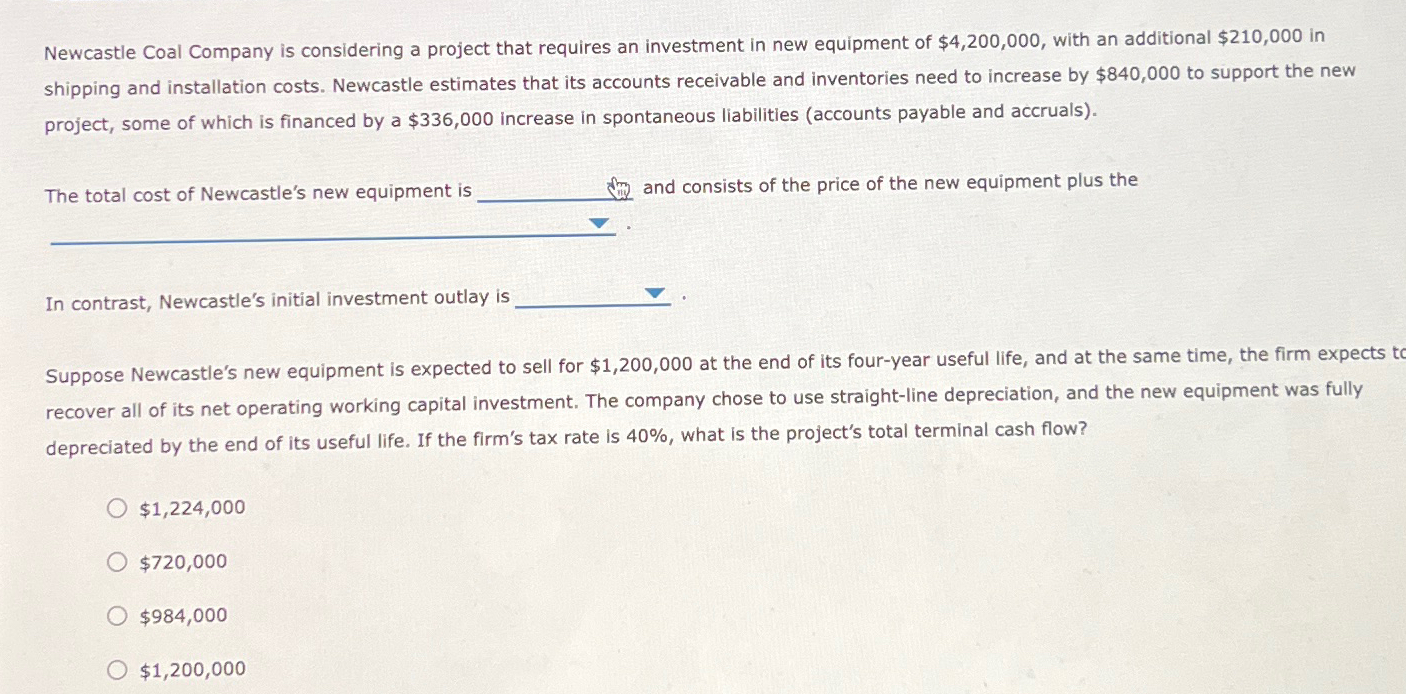

Newcastle Coal Company is considering a project that requires an investment in new equipment of $ 4 , 2 0 0 , 0 0 0

Newcastle Coal Company is considering a project that requires an investment in new equipment of $ with an additional $ in shipping and installation costs. Newcastle estimates that its accounts receivable and inventories need to increase by $ to support the new project, some of which is financed by a $ increase in spontaneous liabilities accounts payable and accruals

The total cost of Newcastle's new equipment is and consists of the price of the new equipment plus the

In contrast, Newcastle's initial investment outlay is

Suppose Newcastle's new equipment is expected to sell for $ at the end of its fouryear useful life, and at the same time, the firm expects recover all of its net operating working capital investment. The company chose to use straightline depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is what is the project's total terminal cash flow?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started