Question

NewCo is a start-up company in the high-technology sector that has developed a new way of transmitting wireless Internet data at over 100 times the

NewCo is a start-up company in the high-technology sector that has developed a new way of transmitting wireless Internet data at over 100 times the current wireless transmission standards. The company has achieved the following investment milestones. On January 1, 2007, the company incorporated and issued 1,000,000 common shares (the Common Shares) at a value of $0.01 per share, split equally between its two Founders. On May 1, 2007, the company issued a $750,000 convertible debenture (the Convertible Debenture) to the Band of Angels, with a 10% annually-compounded interest rate. The debenture was convertible to next-round securities at a 30% discount to the next-round share price, or a conversion price of $0.50 per share with no further discount, whichever is lower. In the event that there are no next round securities as of the conversion date, the debenture plus any accrued interest is convertible to common shares. On March 1, 2008, the company almost ran out of working capital, but successfully negotiated a bridge loan (the Bridge Loan) with BridgeIt in the amount of $100,000 bearing a 20% annual interest rate that is re-payable in full (including all accrued interest) on March 1, 2009. As an incentive to the lender, the company issued to the lender a Purchase Warrant (number PW-1) that allows the holder to purchase common shares in the company in the amount of $100,000 at a price per share equal to 50% of the price paid per share by investors in the next round. PW-1 expires on March 1, 2009. On April 1, 2008, the company received an offer to invest from the GoBig Venture Fund according to the terms of the Term Sheet that appears at the end of this assignment. As of this date, the Convertible Debenture and the Bridge Loan were still outstanding.

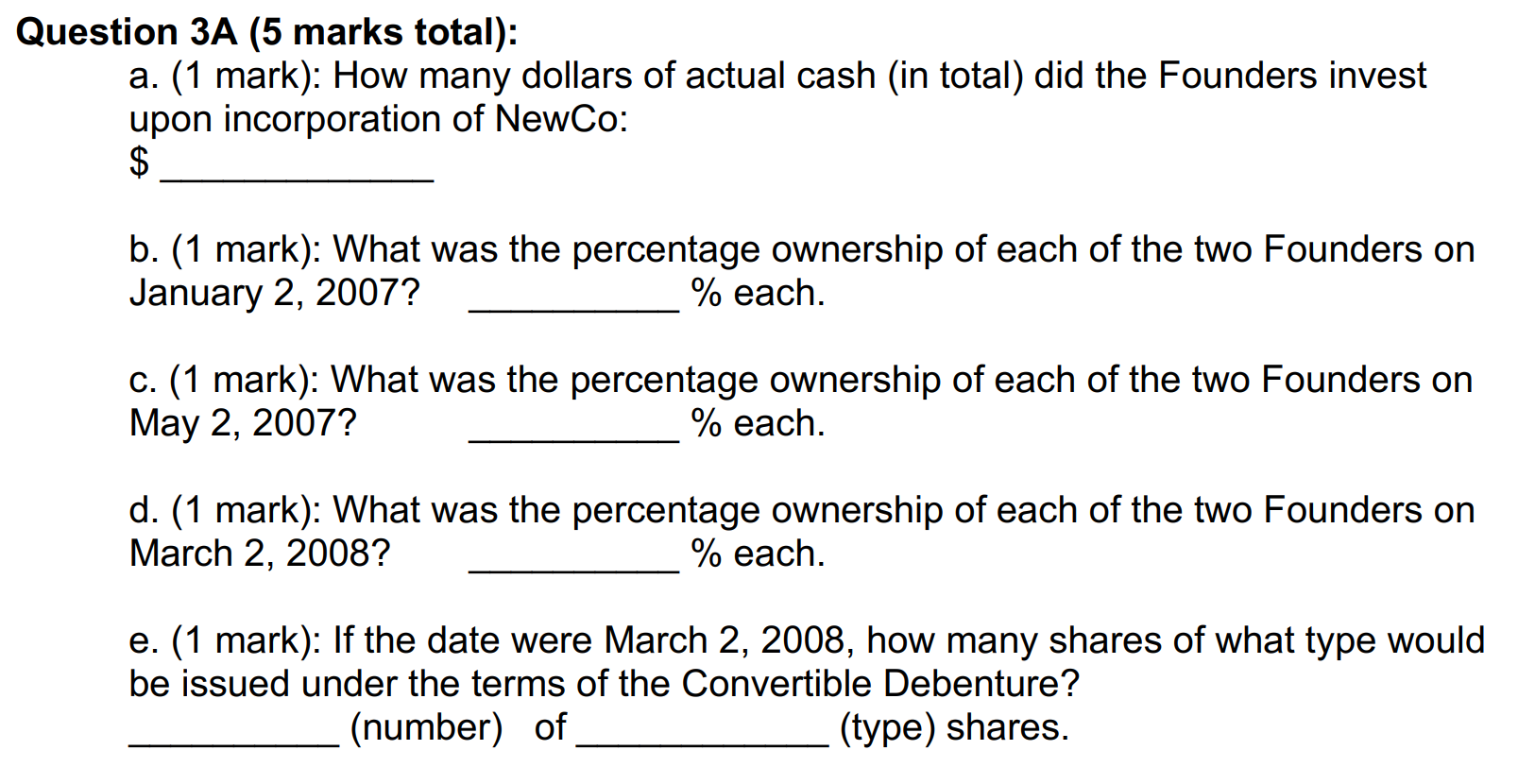

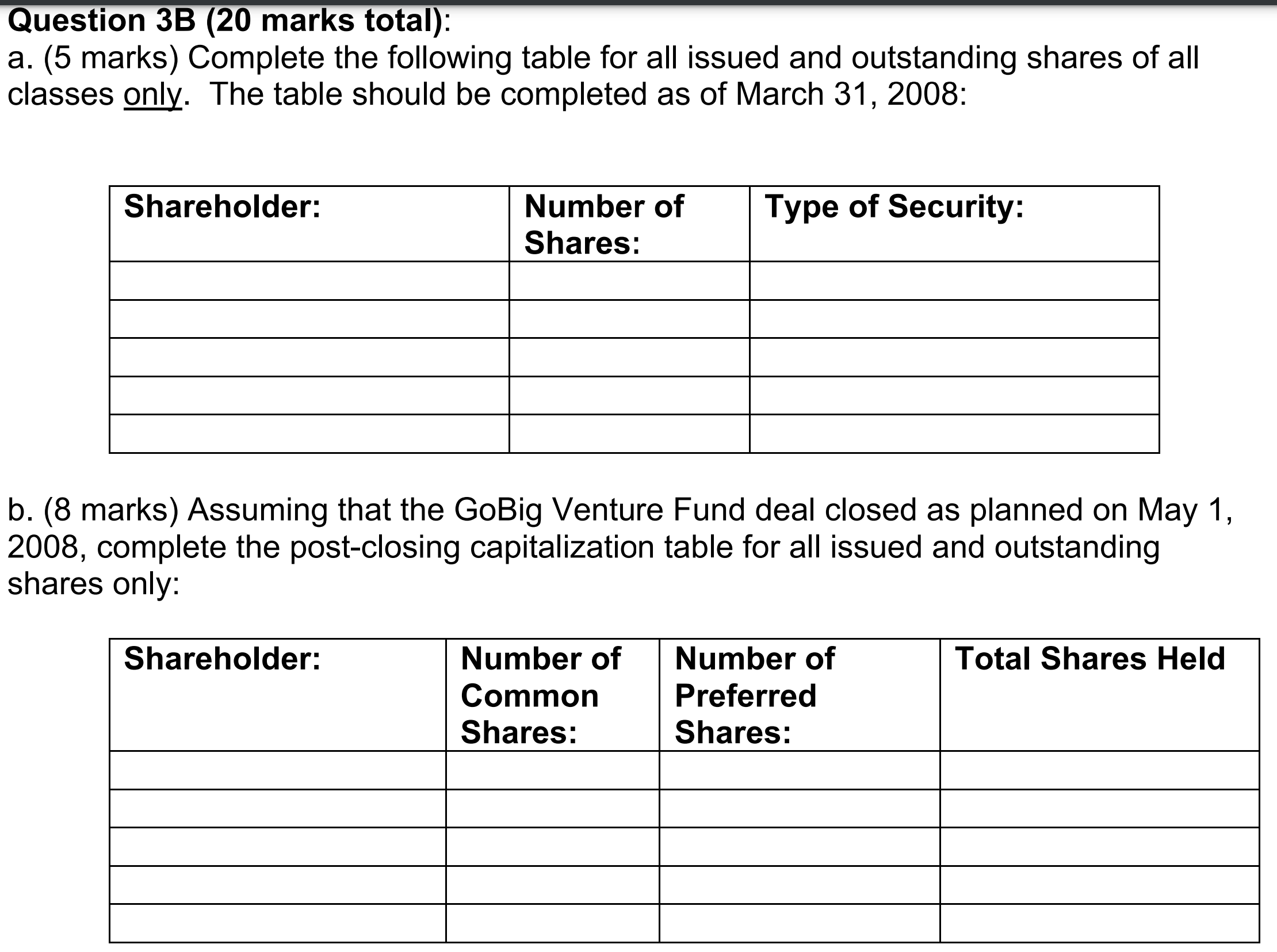

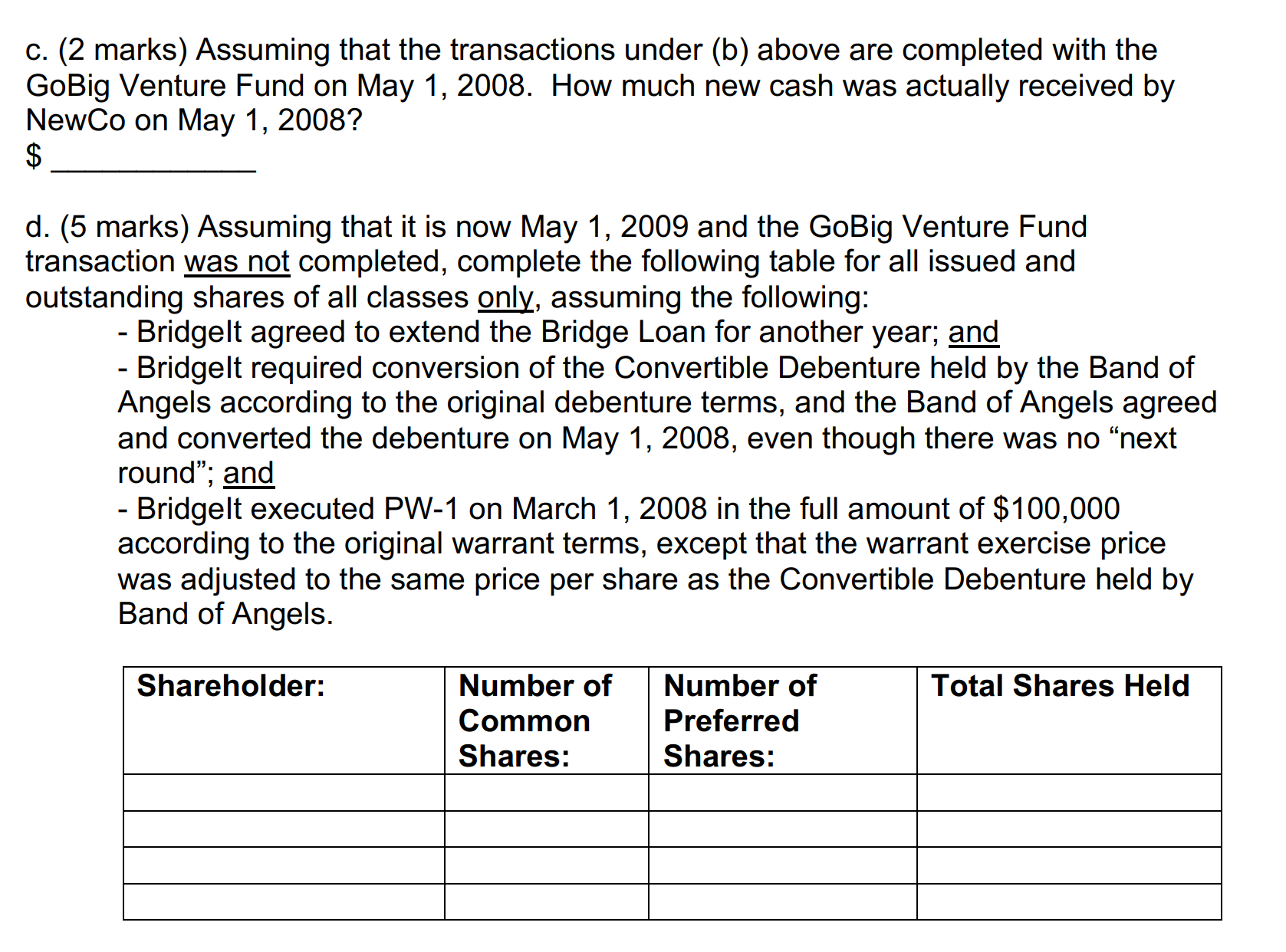

estion 3A (5 marks total): a. (1 mark): How many dollars of actual cash (in total) did the Founders invest upon incorporation of NewCo: \\( \\$ \\) b. (1 mark): What was the percentage ownership of each of the two Founders on January 2, 2007? \ each. c. (1 mark): What was the percentage ownership of each of the two Founders on May 2, 2007? \ each. d. (1 mark): What was the percentage ownership of each of the two Founders on March 2, 2008? \ each. e. (1 mark): If the date were March 2, 2008, how many shares of what type would be issued under the terms of the Convertible Debenture? (number) of (type) shares. c. (2 marks) Assuming that the transactions under (b) above are completed with the GoBig Venture Fund on May 1, 2008. How much new cash was actually received by NewCo on May 1, 2008? \\( \\$ \\) d. (5 marks) Assuming that it is now May 1, 2009 and the GoBig Venture Fund transaction was not completed, complete the following table for all issued and outstanding shares of all classes only, assuming the following: - Bridgelt agreed to extend the Bridge Loan for another year; and - Bridgelt required conversion of the Convertible Debenture held by the Band of Angels according to the original debenture terms, and the Band of Angels agreed and converted the debenture on May 1, 2008, even though there was no \"next round\"; and - Bridgelt executed PW-1 on March 1, 2008 in the full amount of \\( \\$ 100,000 \\) according to the original warrant terms, except that the warrant exercise price was adjusted to the same price per share as the Convertible Debenture held by Band of Angels. Question 3B (20 marks total): . (5 marks) Complete the following table for all issued and outstanding shares of all lasses only. The table should be completed as of March 31, 2008: . (8 marks) Assuming that the GoBig Venture Fund deal closed as planned on May 1, 008 , complete the post-closing capitalization table for all issued and outstanding hares only

estion 3A (5 marks total): a. (1 mark): How many dollars of actual cash (in total) did the Founders invest upon incorporation of NewCo: \\( \\$ \\) b. (1 mark): What was the percentage ownership of each of the two Founders on January 2, 2007? \ each. c. (1 mark): What was the percentage ownership of each of the two Founders on May 2, 2007? \ each. d. (1 mark): What was the percentage ownership of each of the two Founders on March 2, 2008? \ each. e. (1 mark): If the date were March 2, 2008, how many shares of what type would be issued under the terms of the Convertible Debenture? (number) of (type) shares. c. (2 marks) Assuming that the transactions under (b) above are completed with the GoBig Venture Fund on May 1, 2008. How much new cash was actually received by NewCo on May 1, 2008? \\( \\$ \\) d. (5 marks) Assuming that it is now May 1, 2009 and the GoBig Venture Fund transaction was not completed, complete the following table for all issued and outstanding shares of all classes only, assuming the following: - Bridgelt agreed to extend the Bridge Loan for another year; and - Bridgelt required conversion of the Convertible Debenture held by the Band of Angels according to the original debenture terms, and the Band of Angels agreed and converted the debenture on May 1, 2008, even though there was no \"next round\"; and - Bridgelt executed PW-1 on March 1, 2008 in the full amount of \\( \\$ 100,000 \\) according to the original warrant terms, except that the warrant exercise price was adjusted to the same price per share as the Convertible Debenture held by Band of Angels. Question 3B (20 marks total): . (5 marks) Complete the following table for all issued and outstanding shares of all lasses only. The table should be completed as of March 31, 2008: . (8 marks) Assuming that the GoBig Venture Fund deal closed as planned on May 1, 008 , complete the post-closing capitalization table for all issued and outstanding hares only Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started