Answered step by step

Verified Expert Solution

Question

1 Approved Answer

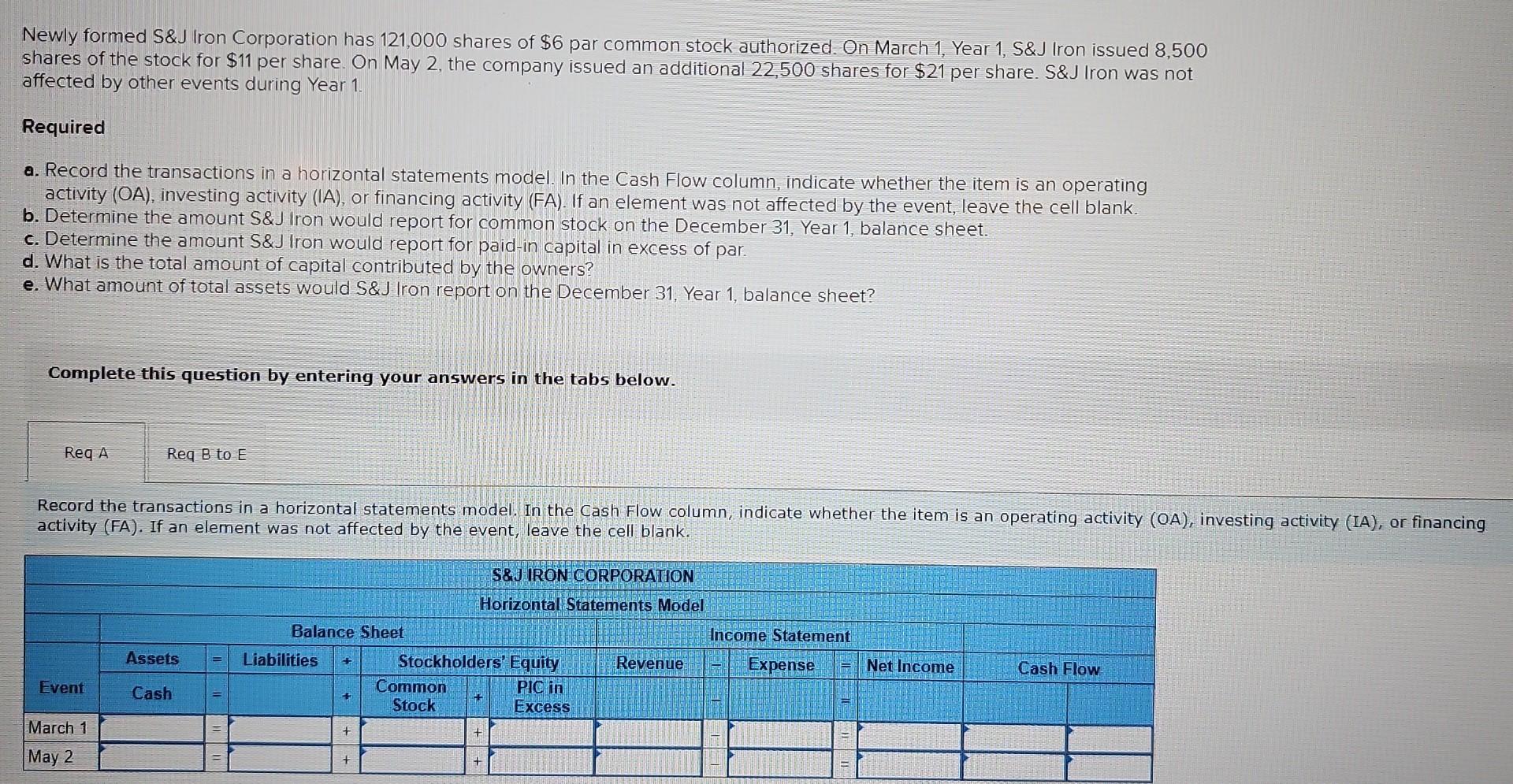

Newly formed S&J Iron Corporation has 121,000 shares of $6 par common stock authorized. On March 1, Year 1, S&J Iron issued 8,500 shares of

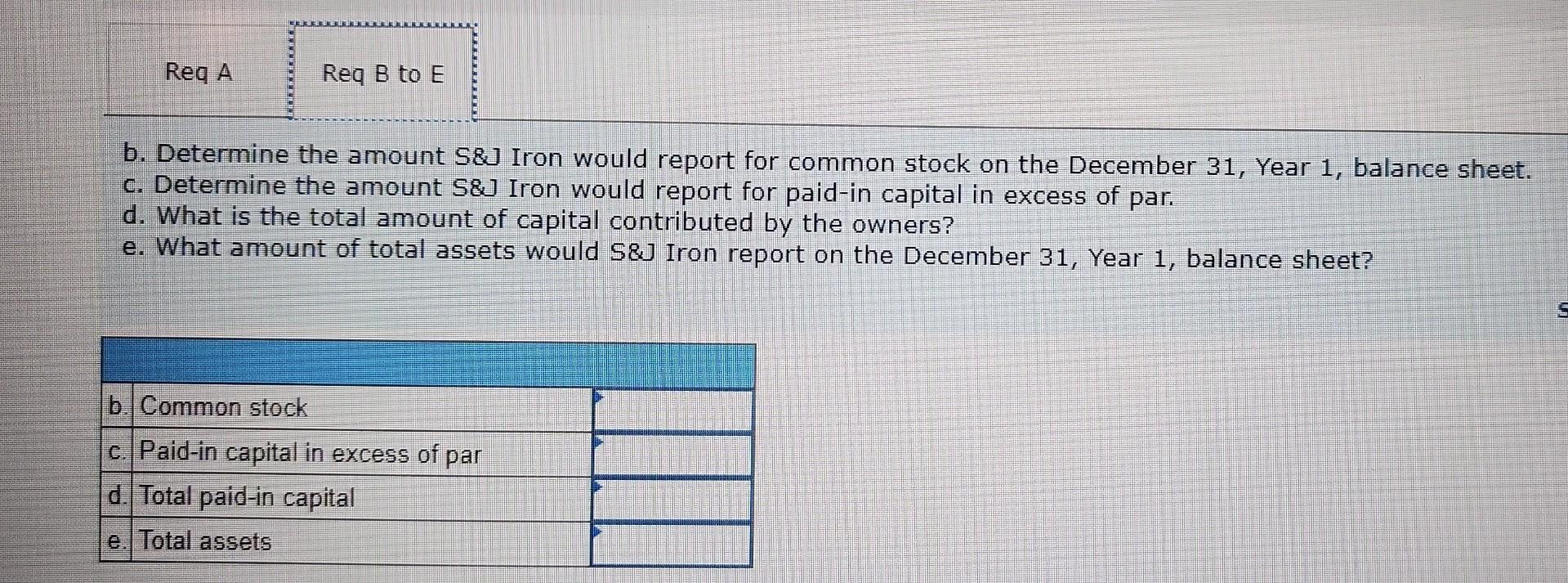

Newly formed S\&J Iron Corporation has 121,000 shares of $6 par common stock authorized. On March 1, Year 1, S\&J Iron issued 8,500 shares of the stock for $11 per share. On May 2 , the company issued an additional 22,500 shares for $21 per share. S\&J Iron was not affected by other events during Year 1 . Required a. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount S&J Iron would report for common stock on the December 31 , Year 1 , balance sheet. c. Determine the amount S\&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S\& I Iron report on the December 31, Year 1 , balance sheet? Complete this question by entering your answers in the tabs below. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount S\&J Iron would report for common stock on the December 31 , Year 1 , balance sheet. c. Determine the amount S\&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S&J Iron report on the December 31 , Year 1 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started