Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Newly formed S&J Iron Corporation has 62,000 shares of $4 par common stock authorized. On March 1, Year 1, S&J Iron issued 10,000 shares

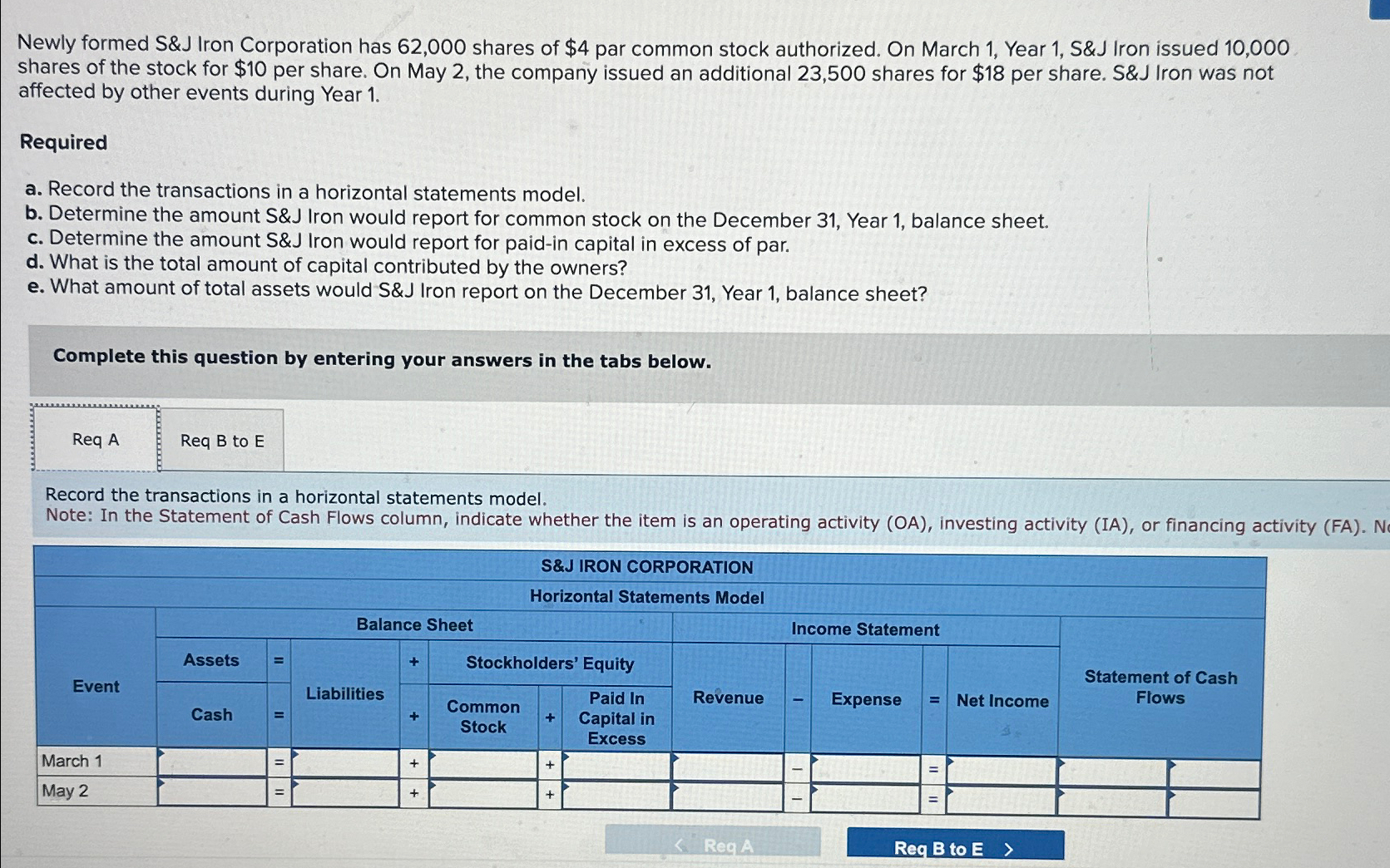

Newly formed S&J Iron Corporation has 62,000 shares of $4 par common stock authorized. On March 1, Year 1, S&J Iron issued 10,000 shares of the stock for $10 per share. On May 2, the company issued an additional 23,500 shares for $18 per share. S&J Iron was not affected by other events during Year 1. Required a. Record the transactions in a horizontal statements model. b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount S&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S&J Iron report on the December 31, Year 1, balance sheet? Complete this question by entering your answers in the tabs below. Req A Req B to E Record the transactions in a horizontal statements model. Note: In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). No S&J IRON CORPORATION Horizontal Statements Model Balance Sheet Income Statement Assets + Stockholders' Equity Statement of Cash Event Liabilities Cash + Common Stock + Paid In Capital in Excess Revenue Expense = Net Income Flows March 1 May 2 ++ + + < Req A Req B to E>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Req A Record the transactions in a horizontal statements model SJIRON CORPORATION Horizontal Stateme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started