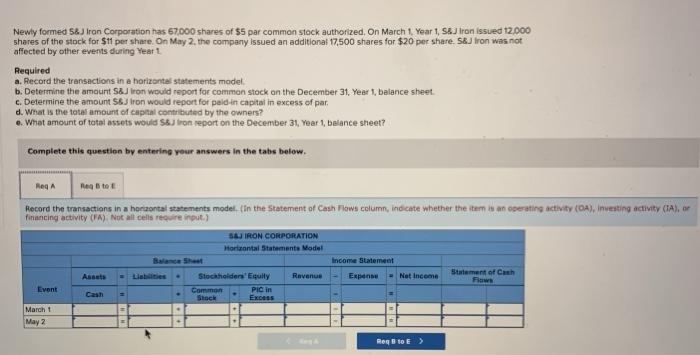

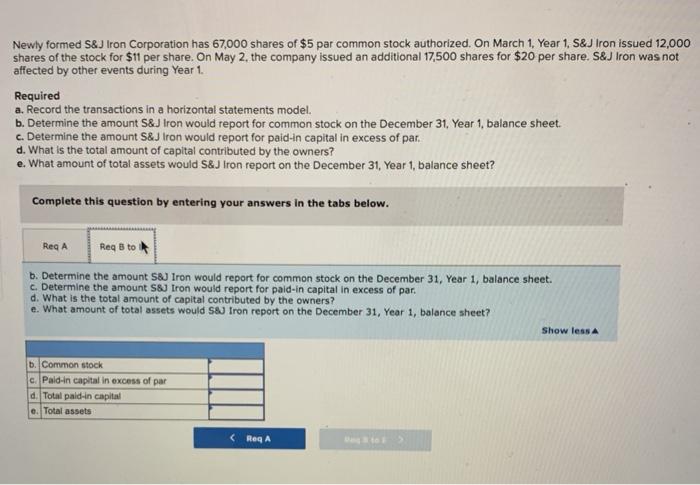

Newly formed S&J Iron Corporation has 67,000 shares of $5 par common stock authorized on March 1 Year 1, S&J Iron issued 12.000 shares of the stock for $11 per share On May 2, the company issued an additional 17,500 shares for $20 per share. S&J Iron was not affected by other events during Year 1 Required a. Record the transactions in a horizontal statements madel b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount S&J Iron would report for pald.in capital in excess of par d. What is the total amount of capital contributed by the owners? o. What amount of total assets would S&Jtron report on the December 31, Year 1, balance sheet? Complete this question by entering your answers in the tabs below. ReqA Reto Record the transactions in a horizontal statements modet. (In the Statement of Cash Flow column, indicate whether the item in an operating activity (04), Investing activity (IA), financing activity (FA). Not all cells require input.) SARON CORPORATION Horizontal Statement Model Income Statement Ravenue Expen Net Income Statement of Cash Fawn Event Stockholders' Equity Common PIC in Stock Excess March 1 May 2 Reqto E) Newly formed S&J Iron Corporation has 67,000 shares of $5 par common stock authorized. On March 1, Year 1, S&J Iron issued 12,000 shares of the stock for $11 per share. On May 2, the company issued an additional 17,500 shares for $20 per share. S&J Iron was not affected by other events during Year 1. Required a. Record the transactions in a horizontal statements model. b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet c. Determine the amount S&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S&J Iron report on the December 31, Year 1, balance sheet? Complete this question by entering your answers in the tabs below. Reg A Reg B to b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount S&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would say Iron report on the December 31, Year 1, balance sheet? Show less b. Common stock c. Pald-in capital in excess of par d. Total paid-in capital e. Total assets