Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newly married, recently purchased their first home, and now

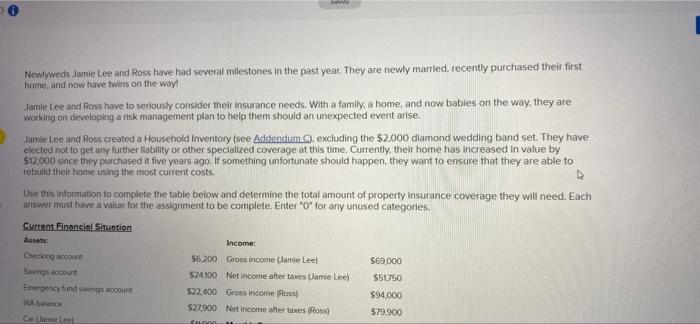

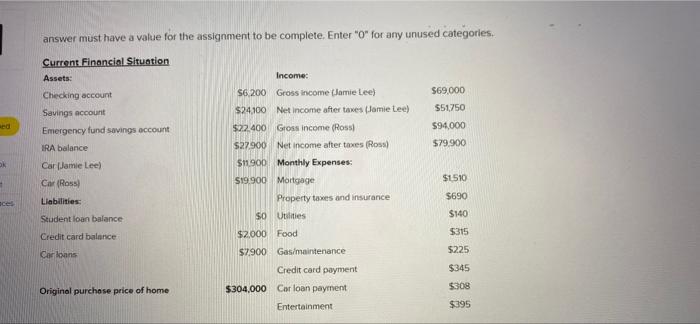

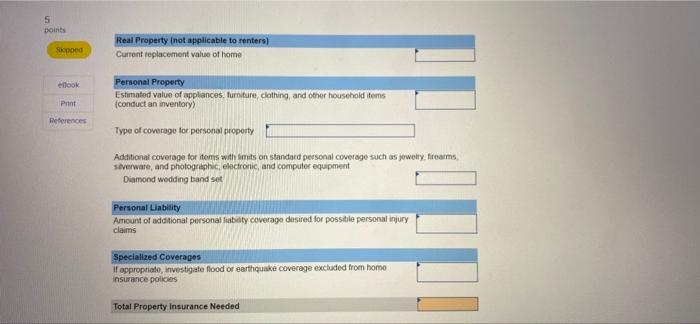

Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newly married, recently purchased their first home, and now have twins on the way! Jamie Lee and Ross have to seriously consider their insurance needs. With a family, a home, and now babies on the way, they are working on developing a risk management plan to help them should an unexpected event arise. Jamie Lee and Ross created a Household Inventory (see Addendum C), excluding the $2.000 diamond wedding band set. They have elected not to get any further liability or other specialized coverage at this time. Currently, their home has increased in value by $12,000 since they purchased it five years ago. If something unfortunate should happen, they want to ensure that they are able to rebuild their home using the most current costs. Use this information to complete the table below and determine the total amount of property insurance coverage they will need. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories. Current Financial Situation Assets: Checking account Savings account Income: $6,200 Gross income (Jamie Lee) $69,000 Emergency fund savings account $24,100 Net income after taxes (Jamie Lee) $22,400 Gross income (Ross) $51,750 $94,000 RA balance Car Lane Leel $27,900 Net income after taxes (Ross) S1000 $79,900 ed aces answer must have a value for the assignment to be complete. Enter "0" for any unused categories. Current Financial Situation Assets: Checking account Income: $6,200 Gross income (Jamie Lee) $69,000 Savings account $24,100 Net income after taxes (Jamie Lee) $51,750 Emergency fund savings account $22.400 Gross income (Ross) $94,000 IRA balance Car Jamie Lee) Car (Ross) Liabilities: Student loan balance Credit card balance Car loans $27.900 Net income after taxes (Ross) $79,900 $11.900 Monthly Expenses: $19.900 Mortgage $1510 Property taxes and insurance $690 SO Utilities $140 $2,000 Food $315 $7.900 Gas/maintenance $225 Credit card payment $345 Original purchase price of home $304,000 Car loan payment $308 Entertainment $395 5 points Sipped Real Property (not applicable to renters) Current replacement value of home Estimated value of appliances, furniture, clothing, and other household items (conduct an inventory) ellook Personal Property Pant References Type of coverage for personal property Additional coverage for items with limits on standard personal coverage such as jewelry, firearms severware, and photographic, electronic, and computer equipment Diamond wedding band set Personal Liability Amount of additional personal liability coverage desired for possible personal injury claims Specialized Coverages If appropriate, investigate flood or earthquake coverage excluded from home insurance policies Total Property Insurance Needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the total amount of property insurance coverage Jamie Lee and Ross will need well go stepbystep using the given details and assumptions S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started