Question

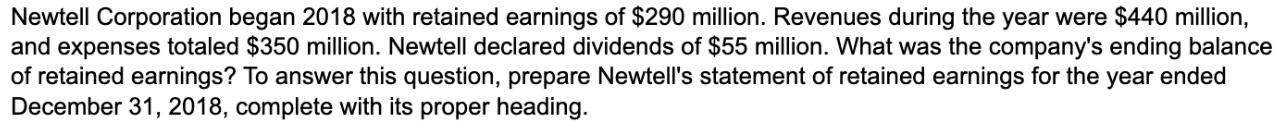

Newtell Corporation began 2018 with retained earnings of $290 million. Revenues during the year were $440 million, and expenses totaled $350 million. Newtell declared

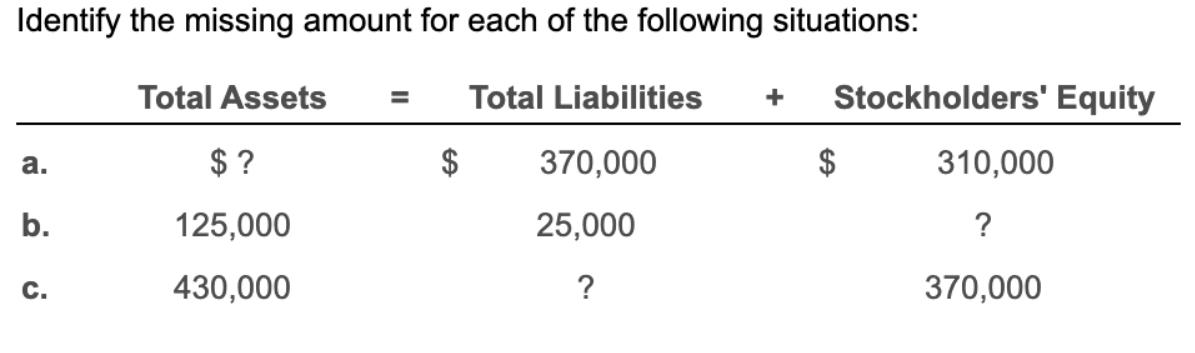

Newtell Corporation began 2018 with retained earnings of $290 million. Revenues during the year were $440 million, and expenses totaled $350 million. Newtell declared dividends of $55 million. What was the company's ending balance of retained earnings? To answer this question, prepare Newtell's statement of retained earnings for the year ended December 31, 2018, complete with its proper heading. Identify the missing amount for each of the following situations: a. b. C. Total Assets $? 125,000 430,000 Total Liabilities + Stockholders' Equity 370,000 25,000 ? $ 310,000 ? 370,000

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

net profit revenue expenses net profit 440 million 350 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

12th edition

134725980, 9780134726656 , 978-0134725987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App