Question

Next, prepare a report that evaluates two factors that have contributed to Bed, Bath & Beyond's recent problems. In doing so, relate these issues back

Next, prepare a report that evaluates two factors that have contributed to Bed, Bath & Beyond's recent problems. In doing so, relate these issues back to topics we have discussed in this course. Use specific details from articles to support your answer. Then, list and explain one topic we discussed in the course that might help Bed, Bath & Beyond to become competitive in the near future. Please note that you are free to use other articles or resources to support your answer. Just make sure to properly cite them in your submission. Notes on submission: This should be no more than three (3) double-spaced pages (excluding the reference page), 12 point font and 1" margins. Your analysis should incorporate full-sentences/paragraphs (i.e., no bulleted lists) and should be free of spelling and grammatical errors. Make sure to include an introductory and concluding paragraph.

Refrence Case:

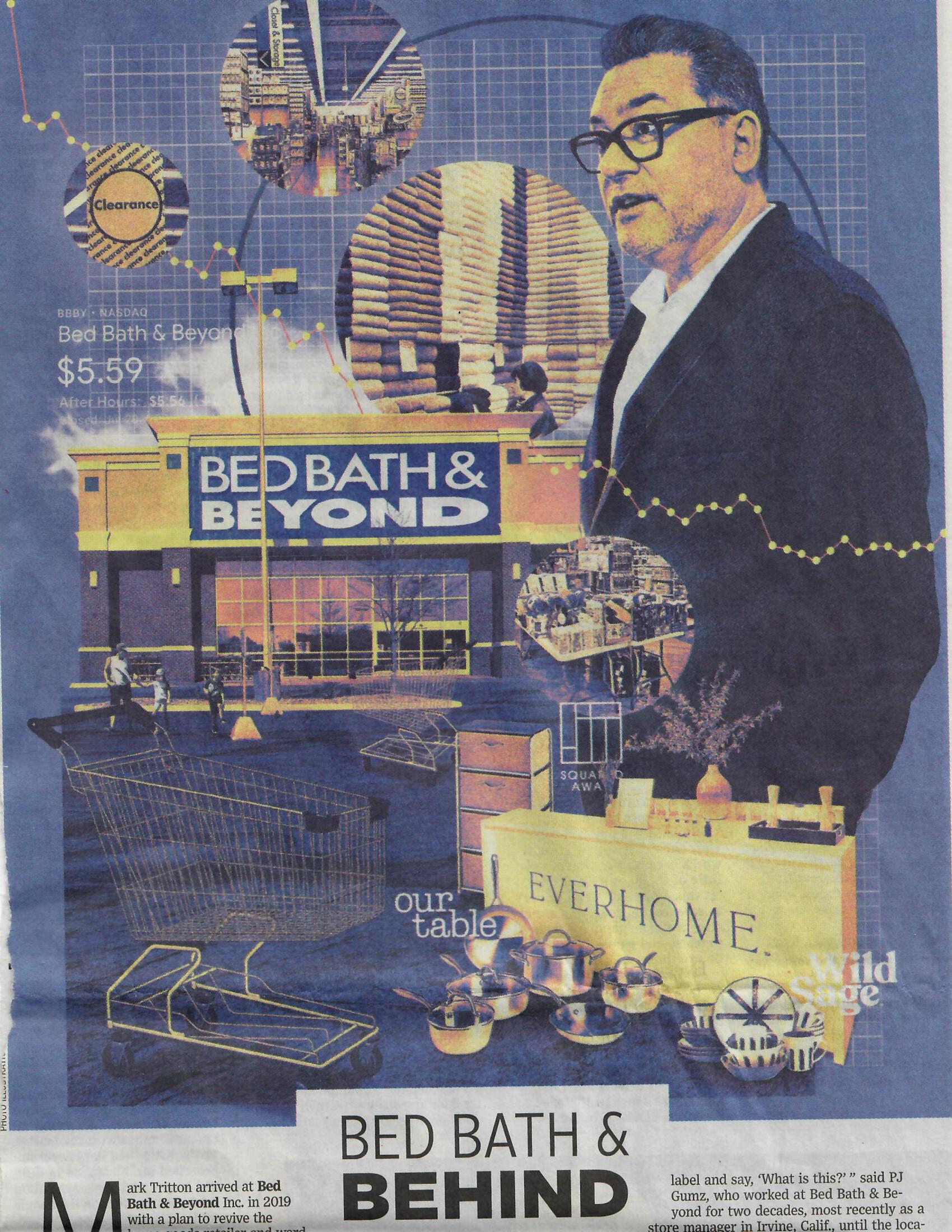

Bed Bath &Beyond Inc., which this week ousted its chief executive and revealed deep losses, faces not just a strategic crisis but a financial one. The retailer ended May with roughly $100 million in cash, after burning through more than $300 million of its reserves and borrowing $200 million from its credit line. It has already sold off real estate to raise funds. Now, it is working with advisers on cash management and trying to find a buyer for its Buybuy Baby business. "The company appears to be in a bit of a free fall operationally," said David Silverman, a senior director at Fitch Ratings. "The liquidity concerns are quite real and will likely get worse over the next quarter or two." Bed Bath &Beyond is searching for a new chief executive to replace Mark Tritton. In the interim, it is being run by board member Sue Gove, a former retail executive and retail restructuring adviser. The company's net sales dropped 25% to $1.46 billion and it lost $358 million in the latest quarter. Bed Bath &Beyond's senior unsecured notes due 2024 dropped 21 points to trade at a new low of 38 cents on Thursday, according to Finra's Trade Reporting and Compliance Engine, or Trace. The selloff reflects doubts among debt investors about whether the notes can be repaid or refinanced when they come due. The bonds were trading near par as recently as March. The company's shares are down 85% over the past year. Finance Chief Gustavo Arnal told analysts on Wednesday that the retailer had sufficient liquidity. The company also said it hired Berkeley Research Group, a consulting firm, to help with its cash, inventory and balance sheet management. Berkeley has worked with a number of troubled retailers, including Modell's, Shopko and Gymboree, which later filed for bankruptcy protection. Bed Bath &Beyond was troubled well before it wooed Mr. Tritton away from Target Corp., where he was the chief merchant, to join the home goods retailer in 2019. Activists had already unseated the company's top officials and reconfigured the board after a string of weak financial results. Mr. Tritton quickly struck a deal to sell roughly half the company's real estate, including its Union, N.J. headquarters, for more than $250 million in proceeds. He also jettisoned noncore businesses, including the Christmas Tree Shops and Cost Plus World Market chains. Executives used the proceeds to fund a transformation of the business, which included overhauling stores to make them less cluttered, scaling back discounts and replacing national brands with new, private-label goods. The board also authorized in November 2019 spending $1 billion on a three-year share-repurchase plan, which the company completed a year ahead of plan. Bed Bath &Beyond spent about $600 million on buybacks last fiscal year and another $43 million in the most recent quarter when its losses ballooned. "It's unusual for a company in the middle of a turnaround that isn't going well to buy back stock that aggressively," said Anthony Chukumba, senior research analyst at investment bank Loop Capital Markets. "We have already taken actions on many fronts to improve our results among other strategic areas," a spokesman said, noting that the company has reduced capital expenditures by $100 million. In March, the company attracted another activist investor, Ryan Cohen, the billionaire founder of the pet retailer PDF GENERATED BY PROQUEST.COM Page 1 of 4

Chewy Inc. In a settlement with Mr. Cohen, Bed Bath &Beyond said it would add three new directors and explore strategic options for its Buybuy Baby chain. Mr. Tritton's plans to reinvigorate the company were derailed in part by supply chain snarls that have hit retailers, including factory bottlenecks, shipping and port delays that kept seasonal items out of stores during key times like the holiday season.When those goods finally arrived, consumers had shifted their spending away from home items. Some of Mr. Tritton's changes also fell flat with shoppers, including his push into private-label merchandise. The company said Wednesday that it would scale back those offerings and bring back more national brands. The mismatch between supply and demand left the company with bloated inventory that it will have to mark down to clear out. --- Jodi Xu Klein contributed to this article. Enlarge this image. Credit: By Suzanne Kapner DETAILS

label and say, 'vonat is urus! sau re Gumz, who worked at Bed Bath \& Beyond for two decades, most recently as a store manager in Irvine, Calif., until the loca- label and say, 'vonat is urus! sau re Gumz, who worked at Bed Bath \& Beyond for two decades, most recently as a store manager in Irvine, Calif., until the loca

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started