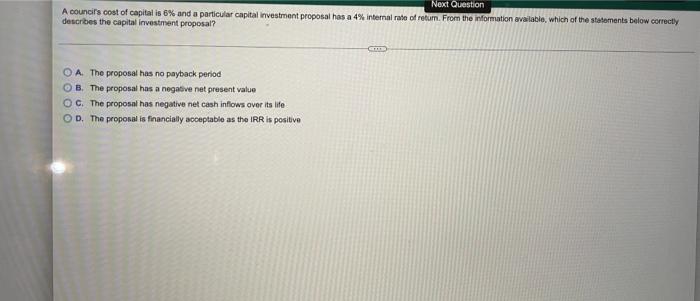

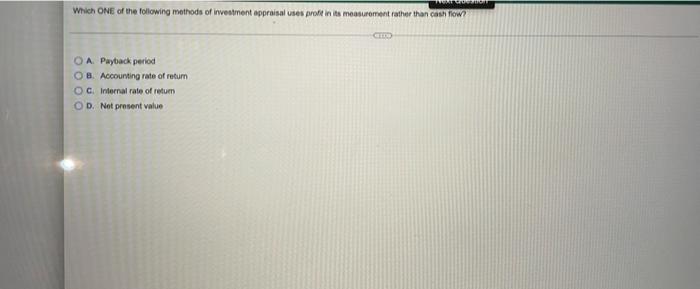

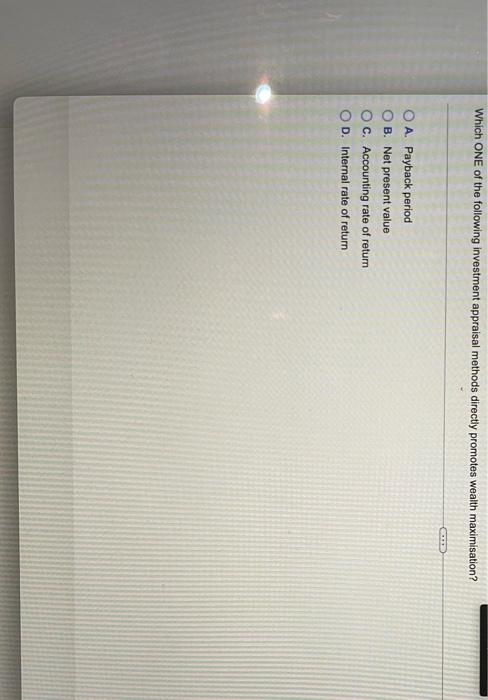

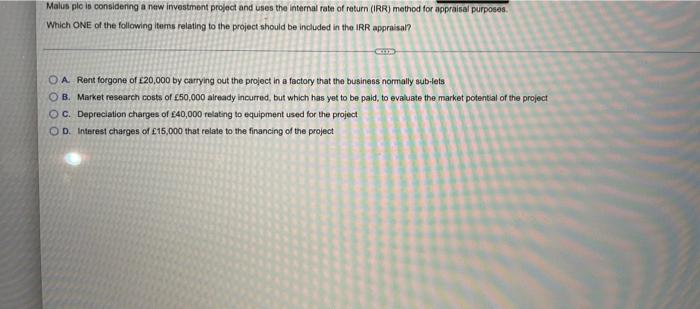

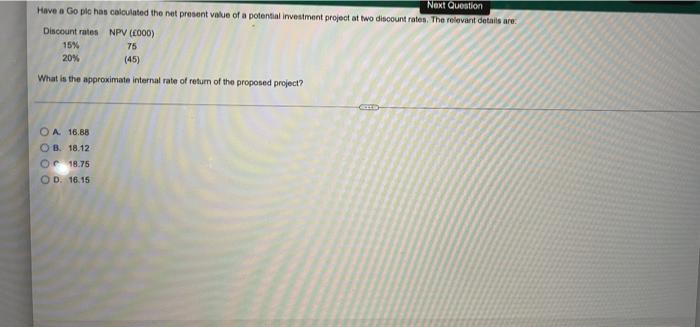

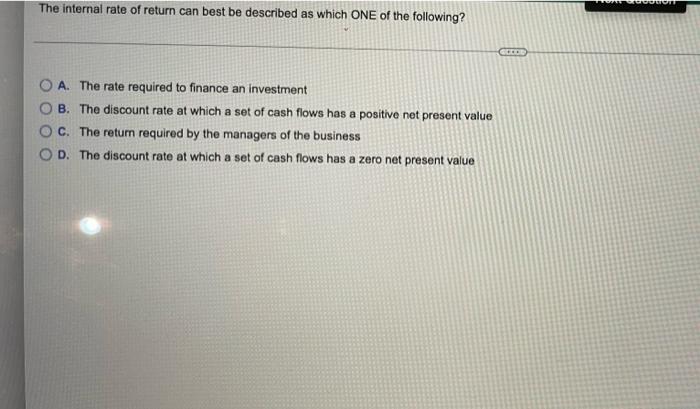

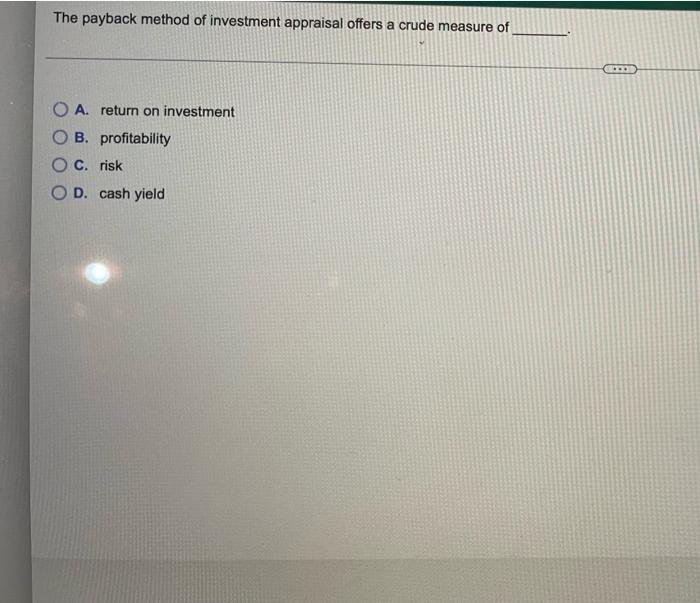

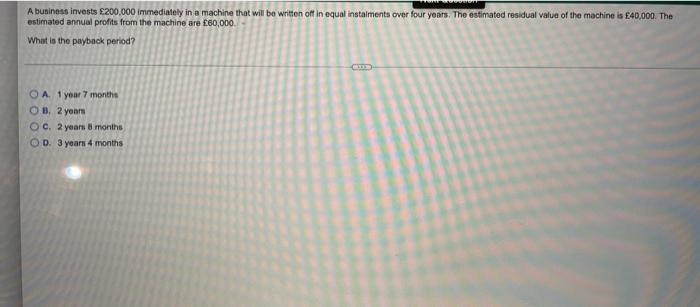

Next Question A councils cost of capital is 6% and a particular capital investment proposal has a 4% internal rate of retum. From the information available, which of the statements below correctly describes the capital investment proposal? CHE O A. The proposal has no payback period OB. The proposal has a negative net present value OC. The proposal has negative net cash inflows over its life OD. The proposal is financially acceptable as the IRR is positive Which ONE of the following methods of investment appraisal ses protein is measurement rather than cash flow? CH OA Payback period OB Accounting rate of retum OG Internal rate of retum OD. Not present value Which ONE of the following investment appraisal methods directly promotes wealth maximisation? A. Payback period B. Net present value c. Accounting rate of retum D. Internal rate of return Malus plo is considering a new investment project and uses the internal rate of return (IRR) method for appraisal purposes Which ONE of the following terms relating to the project should be included in the IRR appraisal? OA Rent forgone of 20,000 by carrying out the project in a factory that the business normally sub-lets O B. Market research costs of 50,000 already incurred, but which has yet to be paid to evaluate the market potential of the project OC. Depreciation charges of 40,000 relating to equipment used for the project OD. Interest charges of 15,000 that relate to the financing of the project Next Question Have a Go plc has calculated the net present value of a potential investment project at two discount rates. The relevant details are Discount rates NPV (2000) 15% 75 20% (45) What is the approximate internal rate of return of the proposed project? O A 16.88 OB 18.12 Or 18.75 OD. 16.15 UNG The internal rate of return can best be described as which ONE of the following? A. The rate required to finance an investment B. The discount rate at which a set of cash flows has a positive net present value C. The return required by the managers of the business D. The discount rate at which a set of cash flows has a zero net present value The payback method of investment appraisal offers a crude measure of A. return on investment B. profitability O C. risk D. cash yield A business invests 200,000 immediately in a machine that will be written of in equal instalments over four years. The estimated residual value of the machine is 40,000. The What is the payback period? estimated annual profits from the machine are 60,000 OA. 1 year 7 months OB. 2 years Oc. 2 years 8 months OD 3 years 4 months