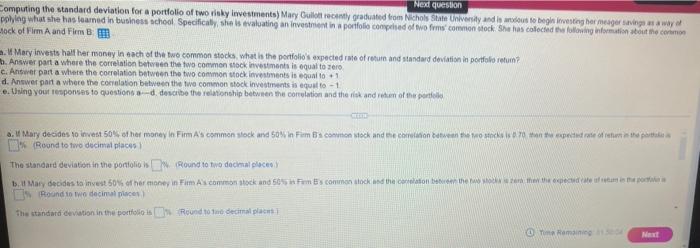

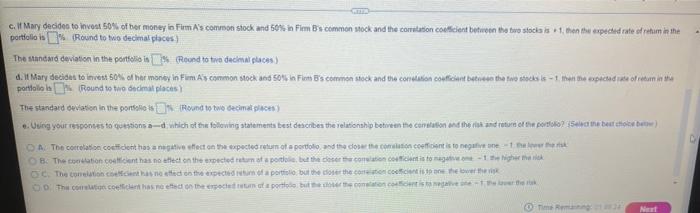

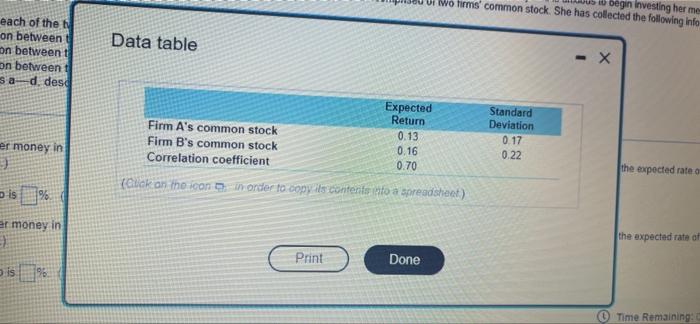

Next question Computing the standard deviation for a portfolio of two risky investments Mary Bullott recently graduated from Nichols State University and is us to begin investing her meager sig at a way polylag what she has learned in business school Specifically, this evaluating an investment in a portfolio comprised of twofoms common stock. She has collected the following information about the common lock of FirmA and Firm Mary invests halt her money in each of the two common trocks what is the portfolio's expected into of return and standard deviation in portfoloratum Answer part a where the correlation between the two common stock investments is equal to zero c. Answer part a where the correlation between the two common stock investments is equal to +1 d. Answer part a where the correlation between the two common stock investments is equal to - 1 e. Using your responses to questions - describe the relationship between the correlation and the risk and retum of the porto . Mary decides to invest 50% of her money in Fim As common stock and 50% in Form 5 Cominon stock and recortation betwee mootou pedd rose of etame the partidas 12% Round to wo decimal places The standard deviation in the portfolio Round to no docietal places 13, Mary decides to invest 50% of her money in Fim Ascommon stock and 50% scono lock and the conter the water from E Round to wo decimal places The standard deviation in the portfolio is Is Round on decimal plant Domaine Next c. It Mary decides to invest 50% of her money in Fim As common stock and 50% in Fim By common stock and the comitation coefficient between the two stocks 1. heheerpected rate of retum in the portfolio is % Round to two decimal places) The standard deviation in the portfolio in se oond to trwa dadienai places) 4. Mary decides to meet 50% of her money in Fim. As common shock and so on Flien B's common stock and era convasion condicionet betreen the two seks is that the expected the creato in portfolio Round to wo decimal places) The standard deviation in the portone * Round to hivo decimat places) c. Using your responses to questions which of the following statements best describes the relationship between the cometason and the risk and return of the protoko? (Selectia beat tobe betowe) The concordient has a negative effect on the expected return of a portfolio and the docent is to negative - 1 B. The incolunt has noted on the expected to a portat the desert cominciatis toeg-1 Night The connected on the expected to a portion but the one the concern hebt The concert has noted on the portion but the concert img Net begin investing her me Ui wo his common stock. She has collected the following info each of the on between t on between t on between t sad, desd Data table - X Expected Return Firm A's common stock 0.13 Firm B's common stock 0.16 Correlation coefficient 0.70 (click on the icon in order to copy its contents to a spreadsheet) Standard Deviation 0.17 0.22 er money in the expected rate ar money in 3) the expected rate of Print Done is % Time Remaining