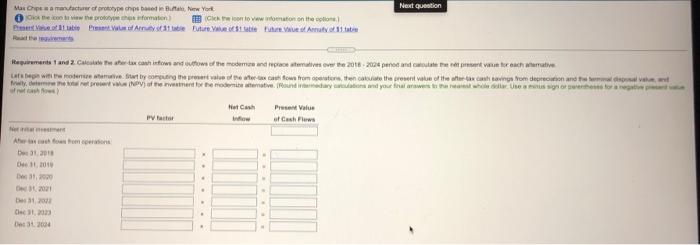

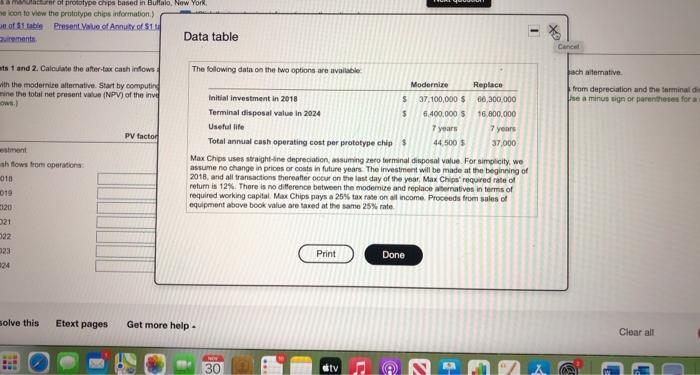

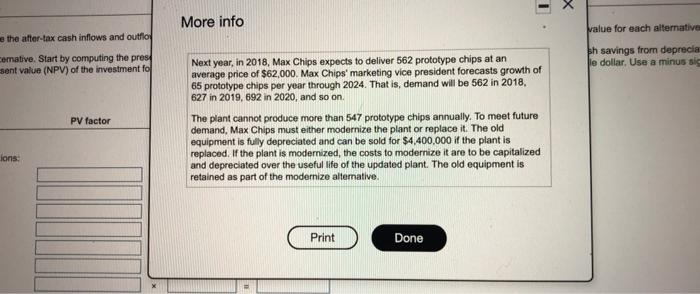

Next question Mashpesamadacturer of prototype chipset B. Niw York Owner the information wwwnation on the Die Pentru Buture Anal Regiments and 2 Catch now and how of the modern and practives wwe 2018-2024 and come to the Laten we met by computing the paralele cow from the case the present value of the rings from den andra, wym w Pof the othemoderne teme na nd your free gore torre Pre Value of Cash Flow PV Det Dec 2010 2020 2021 Cec De 2004 am of prototype chips based in Bulalo, New York icon to view the prototype chips information) of Stable Present Value of Annuity of $15 uirements Data table 1 Cancel ats 1 and 2. Calculate the after-tax cash inflows with the modernize temative Start by computing mine the total net present value (NPVof the ind ws) ach alternative from depreciation and the terminal se a minus tiga or parents for a PV factor The following data on the two options are available Modernize Replace Initial investment in 2018 $ 37,100,000 $ 66,200,000 Terminal disposal value in 2024 $ 6.400,000 $ 16.800.000 Useful life 7 years 7 years Total annual cash operating cost per prototype chips 44.500 5 37,000 Max Chips usos straight-line depreciation, assuming zero terminal disposal value. For simplicity, we assume no change in prices or costs in future years. The investment will be made at the beginning of 2018, and all transactions thereafter out on the last day of the year, Max Chips' required rate of retum is 12%. There is no difference between the modemuze and replace tomatives in terms of required working capital Max Chips pays a 25% tax rate on all income. Proceeds from sales of equipment above book value are taxed at the same 25% rate stment shflows from operations 2018 019 320 521 22 723 24 Print Done solve this Etext pages Get more help Clear all 30 tv F 20 o - x More info value for each alternative the after-tax cash inflows and outflop comative. Start by computing the pres sent value (NPV) of the investment fo sh savings from deprecia le dollar. Use a minus si PV factor Next year, in 2018, Max Chips expects to deliver 562 prototype chips at an average price of $62,000. Max Chips' marketing vice president forecasts growth of 65 prototype chips per year through 2024. That is, demand will be 562 in 2018. 627 in 2019, 692 in 2020, and so on. The plant cannot produce more than 547 prototype chips annually. To meet future demand, Max Chips must either modernize the plant or replace it. The old equipment is fully depreciated and can be sold for $4,400,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the updated plant. The old equipment is retained as part of the modernize alternative. ions: Print Done