Answered step by step

Verified Expert Solution

Question

1 Approved Answer

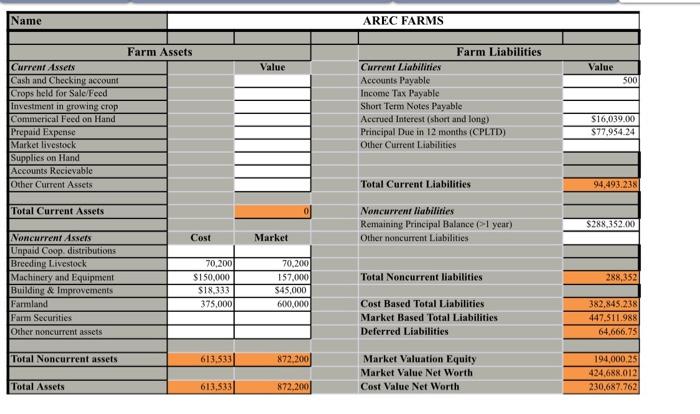

Next, you start developing an ending year balance sheet for 201 7 (or beginning year balance for 201 8 ). As of December 31, 201

Next, you start developing an ending year balance sheet for 2017 (or beginning year balance for 2018). As of December 31, 2017, below outlines your assets and liabilities.

1) The balance in check book of $25,000

2) You have 100 one-ton bales of hay that were cut in 2016in the hay barn that you will sell to nearby producers.The market price for hay is $65/ton.

3) Commercial feed included hay you produced, creep feed,and mineral blocks for calves which was $12,000.

4) Prepaid expenses summed to $1,250.

5) Supplies on hand were $7,500 and you had no accounts receivable.

6) You have 52 calves that are 650 lb/head on average and are valued at $1.20/lb on average. You also have three 1,400 lb cows valued at $0.9/lb that you plan on selling along with the calves in the first of 2017.

7) You purchased the 150 acres in 2011 for $1,500/acre but could be sold today for $1,800/acre. You pasture acres was purchased for $1,000/acre but could be sold for $1,200/acre today.

8) You have 60 breeding cows that weight about 1,300 lb/head and are valued at $0.9/lb on average. Your market and cost values are the same for breeding livestock.

9) The machinery, equipment, and vehicles were purchased in 2011. The current book value (cost minus depreciation) is $150,000 but could be sold for around $157,000.

10) A hay barn sits on the property that was built for $45,000 in 2007. The book value of the barn is $18,333which is the same as the market value.

11) Your accounts payable was $500 by the end of 2017.

12) You accrued interest, remaining principal (1 year), principal due in 12 months is calculated from you outstanding loans.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started