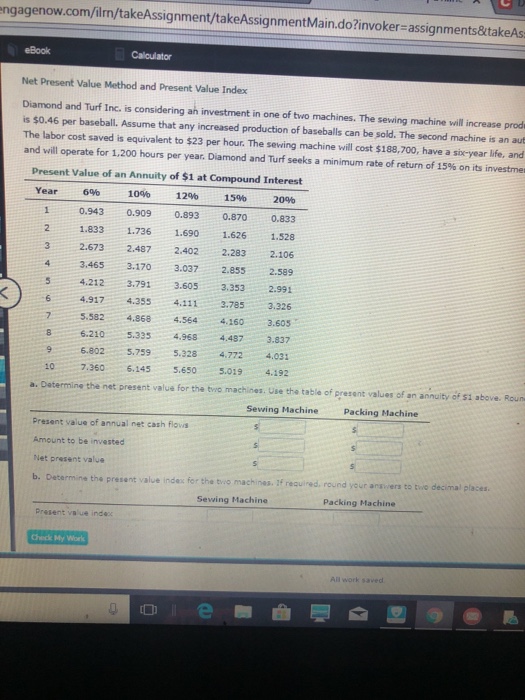

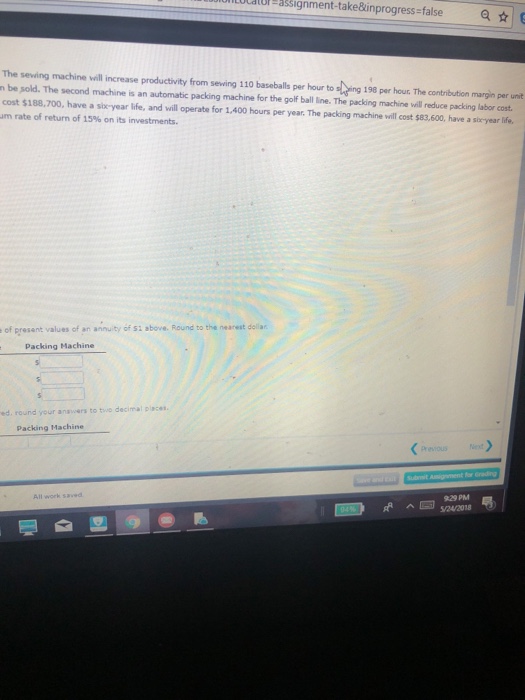

ngagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAs eBook Calculator Net Present Value Method and Present Value Index Diamond and Turf Inc. is considering ah investment in one of two machines. The sewing machine will increase prode is $0.46 per baseball. Assume that any increased production of baseballs can be sold. The second machine is an aut The labor cost saved is equivalent to $23 per hour. The sewing machine will cost $188,700, have a six-year life, and and will operate for 1,200 hours per year. Diamond and Turf seeks a minimum rate of return of 15% on its investme Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 1546 20% 1 0.943 0.909 0.893 0.8700.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.2832.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.3532.991 64.9174.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 86.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.03 10 7.360 6.145 5.650 5.019 4.192 a. Determing the net present value for the tve machines. Use the table of present values of an annuity of s1 above Roun Sewing Machine Packing Machine Present valus of annual net cash flows Amount to be invested Net present value b. Determin e the present value index: for the two machines. 1f required, round your ansivers to tive decimal places Sewing Machine Packing Machine Present value indec Check My Work All work saved ngagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAs eBook Calculator Net Present Value Method and Present Value Index Diamond and Turf Inc. is considering ah investment in one of two machines. The sewing machine will increase prode is $0.46 per baseball. Assume that any increased production of baseballs can be sold. The second machine is an aut The labor cost saved is equivalent to $23 per hour. The sewing machine will cost $188,700, have a six-year life, and and will operate for 1,200 hours per year. Diamond and Turf seeks a minimum rate of return of 15% on its investme Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 1546 20% 1 0.943 0.909 0.893 0.8700.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.2832.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.3532.991 64.9174.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 86.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.03 10 7.360 6.145 5.650 5.019 4.192 a. Determing the net present value for the tve machines. Use the table of present values of an annuity of s1 above Roun Sewing Machine Packing Machine Present valus of annual net cash flows Amount to be invested Net present value b. Determin e the present value index: for the two machines. 1f required, round your ansivers to tive decimal places Sewing Machine Packing Machine Present value indec Check My Work All work saved