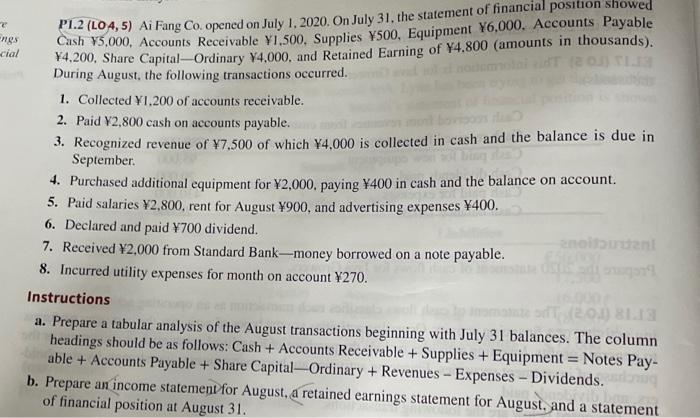

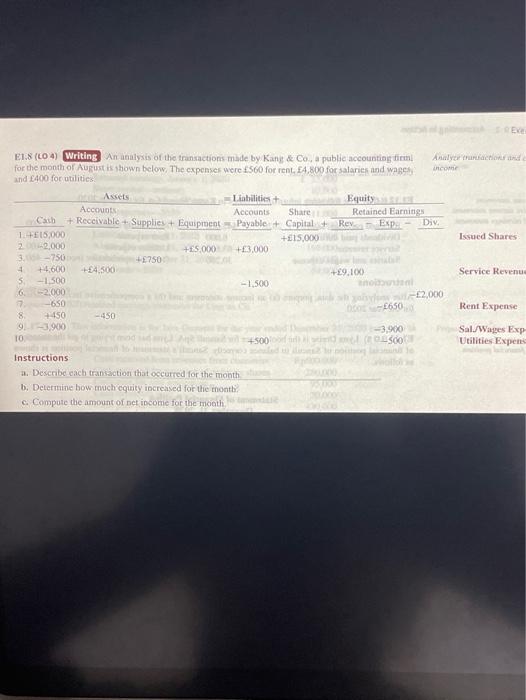

ngs cial P1.2 (L04, 5) Ai Fang Co. opened on July 1, 2020. On July 31, the statement of financial position showed Cash 45.000, Accounts Receivable 1,500, Supplies 4500, Equipment 46,000. Accounts Payable 4.200. Share CapitalOrdinary 14,000, and Retained Earning of Y4.800 (amounts in thousands). During August, the following transactions occurred. 1. Collected 1.200 of accounts receivable. 2. Paid Y2,800 cash on accounts payable. 3. Recognized revenue of 7.500 of which 4,000 is collected in cash and the balance is due in September 4. Purchased additional equipment for 2,000. paying Y400 in cash and the balance on account. 5. Paid salaries 2,800, rent for August 900, and advertising expenses Y400. 6. Declared and paid Y700 dividend. ustan 7. Received Y2,000 from Standard Bank-money borrowed on a note payable. 8. Incurred utility expenses for month on account Y270. Instructions B a. Prepare a tabular analysis of the August transactions beginning with July 31 balances. The column headings should be as follows: Cash + Accounts Receivable + Supplies + Equipment = Notes Pay- able + Accounts Payable+ Share Capital-Ordinary + Revenues - Expenses - Dividends. b. Prepare an income statement for August, a retained earnings statement for August, and a statement of financial position at August 31. Exe E1.8 (L04) Writing An analysis of the transactions made by Kant & Co, a public accounting in for the month of August is shown below. The expenses were 560 for rent 4.800 for salaries and was and 400 for utilitiek Analytics income Issued Shares Service Revenu 22.000 Liabilities + Equity Account Accounts Share Retained Earnings + Receivable + Supplies - Equipment Payable + Capital Rey Div. 115,000 +15,000 22,000 +ES.000) +3.000 3-750 +750 4 +4.600 +4.300 +9,10) 5 - 1.500 -1.500 non 6 --2000 7 -630 -650 8 +450 -450 9.-3.900 -3.900 10 + 500LSO Instructions a. Describe cach transaction that occurred for the month b. Determine how much equity increased for the month c. Compute the amount of net income for the mooth Rent Expense Sal/Wages Exp Utilities Expens