Question

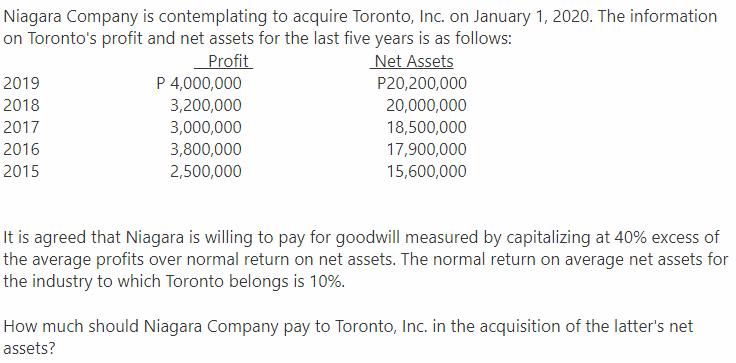

Niagara Company is contemplating to acquire Toronto, Inc. on January 1, 2020. The information on Toronto's profit and net assets for the last five

Niagara Company is contemplating to acquire Toronto, Inc. on January 1, 2020. The information on Toronto's profit and net assets for the last five years is as follows: Profit P 4,000,000 Net Assets 2019 P20,200,000 2018 3,200,000 20,000,000 2017 3,000,000 18,500,000 2016 3,800,000 17,900,000 2015 2,500,000 15,600,000 It is agreed that Niagara is willing to pay for goodwill measured by capitalizing at 40% excess of the average profits over normal return on net assets. The normal return on average net assets for the industry to which Toronto belongs is 10%. How much should Niagara Company pay to Toronto, Inc. in the acquisition of the latter's net assets?

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

2 Year Profit Net Assets 2019 4000000 20200000 2018 3200000 20000000 2017 3000000 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume II

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

16th Canadian edition

1259261433, 978-1260305838

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App