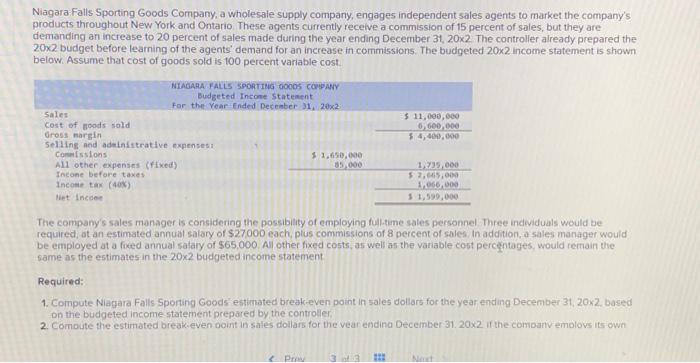

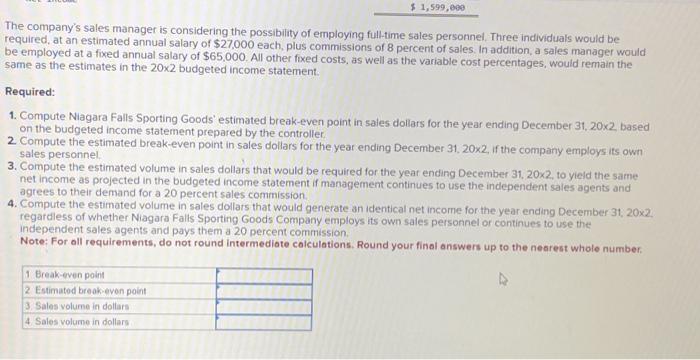

Niagara Falls Sporting Goods Company, a wholesale supply company, engages independent sales agents to market the company's products throughout New York and Ontario These agents currently receive a commission of 15 percent of sales, but they are demanding an increase to 20 percent of sales made during the year ending December 31,202. The controller already prepared the 202 budget before learning of the agents' demand for an increase in commissions. The budgeted 202 income statement is shown below. Assume that cost of goods sold is 100 percent variable cost. The company's sales manager is considering the possibility of employing fult-time sales personnel. Three individuals would be required, at an estimated annual salary of $27000 each, plus commissions of 8 percent of sales. In addition, a sales manager would be employed at a fixed annual satary of $65,000. All other fixed costs, as well as the variable cost percntages, would remain the same as the estimates in the 202 budgeted income statement Required: 1. Compute Niagara Falls Sporting Goods' estimated breakeven point in sales dollars for the year ending December 31, 20k2, based on the budgeted income statement prepared by the controller. 2. Comoute the estimated breakeven ooint in sales dollars for the vear endina December 31.202 if the comoanv emolovs its own The company's sales manager is considering the possibility of employing full-time sales personnel. Three individuals would be required, at an estimated annual salary of $27,000 each, plus commissions of 8 percent of sales. In addition, a sales manager would be employed at a fixed annual salary of $65,000. All other fixed costs, as well as the variable cost percentages, would remain the same as the estimates in the 202 budgeted income statement. Required: 1. Compute Niagara Falls Sporting Goods' estimated break-even point in sales dollars for the year ending December 31,202 based on the budgeted income statement prepared by the controller. 2 Compute the estimated break-even point in sales dollars for the year ending December 31,202, if the company employs its own sales personnel. 3. Compute the estimated volume in sales dollars that would be required for the year ending December 31,202, to yield the same net income as projected in the budgeted income statement if management continues to use the independent sales agents and agrees to their demand for a 20 percent sales commission. 4. Compute the estimated volume in sales dollars that would generate an identical net income for the year ending December 31,202. regardless of whether Niagara Falis Sporting Goods Company employs its own sales personnel or continues to use the independent sales agents and pays them a 20 percent commission. Note: For all requirements, do not round intermediate calculations. Round your final answers up to the nearest whole number