Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Niall started a car valeting business in March 2022. He washes, cleans and polishes cars at the owner's homes or place of work. He has

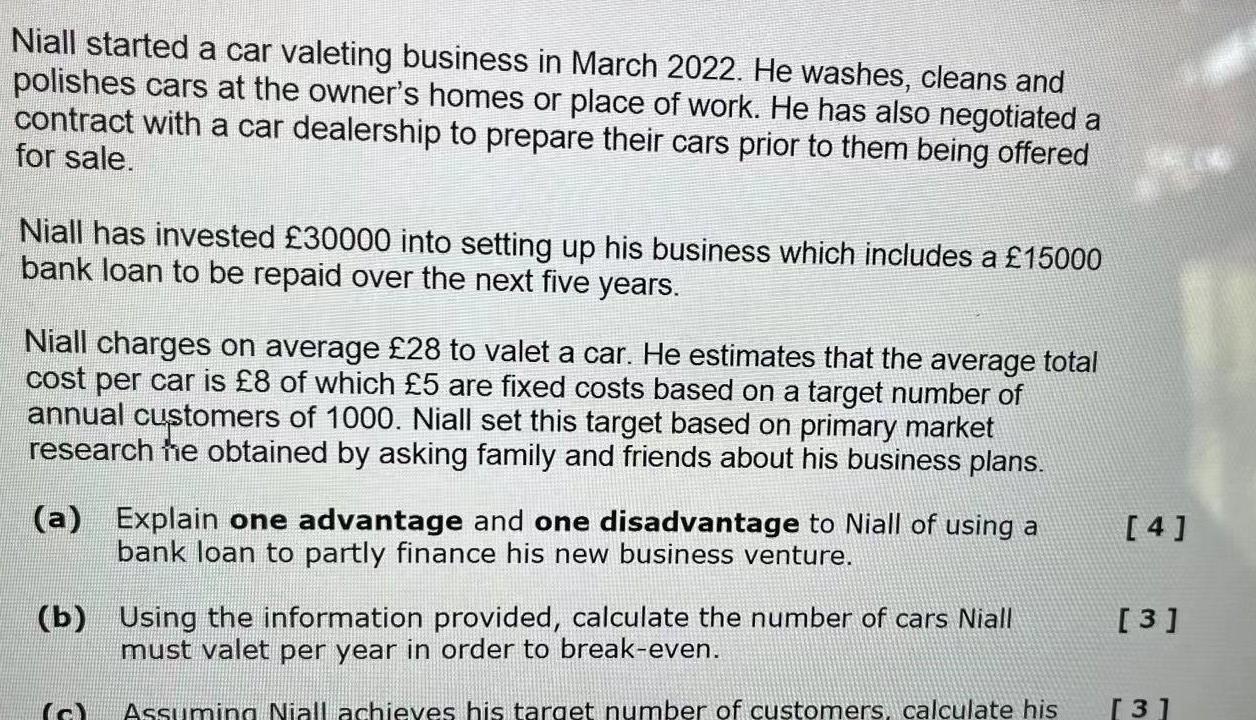

Niall started a car valeting business in March 2022. He washes, cleans and polishes cars at the owner's homes or place of work. He has also negotiated a contract with a car dealership to prepare their cars prior to them being offered for sale. Niall has invested 30000 into setting up his business which includes a 15000 bank loan to be repaid over the next five years. Niall charges on average 28 to valet a car. He estimates that the average total cost per car is 8 of which 5 are fixed costs based on a target number of annual customers of 1000. Niall set this target based on primary market research he obtained by asking family and friends about his business plans. [4] (a) Explain one advantage and one disadvantage to Niall of using a bank loan to partly finance his new business venture. (b) Using the information provided, calculate the number of cars Niall must valet per year in order to break-even. (c) Assuming Niall achieves his target number of customers, calculate his [3] [3]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started