Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nicholas Jan, a sole trader, paid an insurance premium of R12 500 on 1 July 2022 to insure his shop against fire damage for the

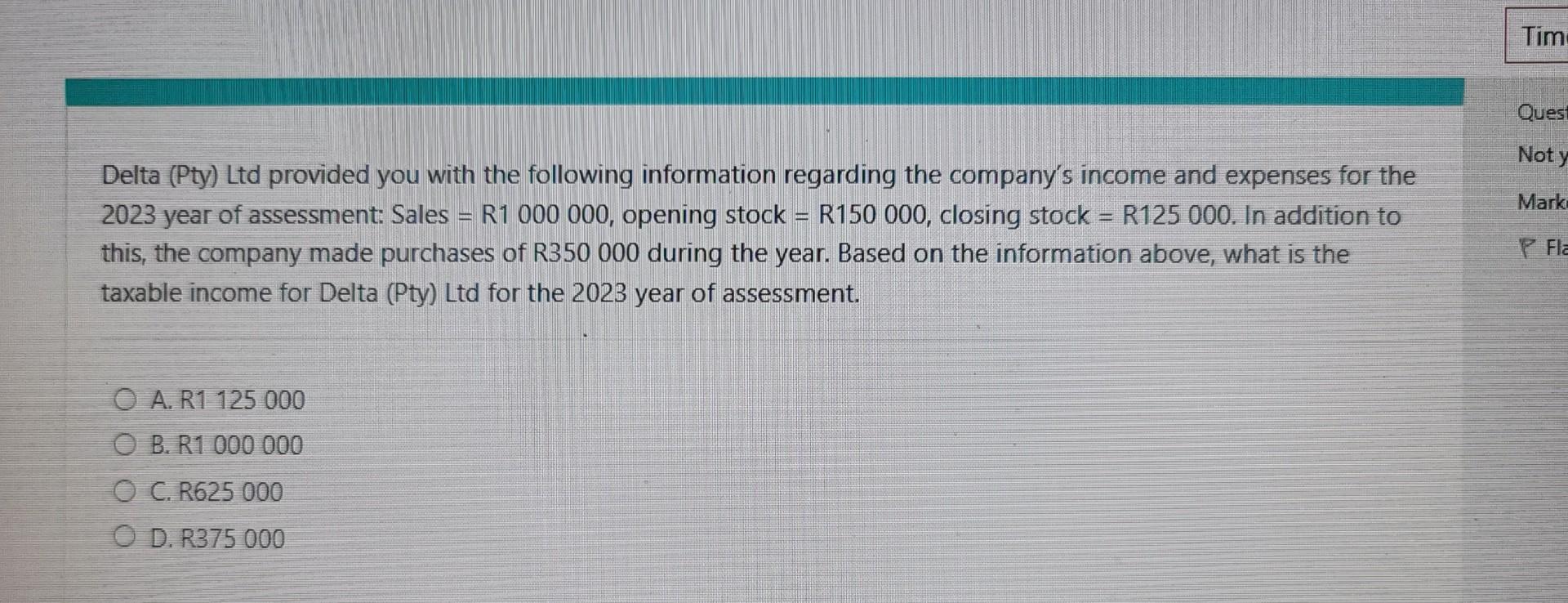

Nicholas Jan, a sole trader, paid an insurance premium of R12 500 on 1 July 2022 to insure his shop against fire damage for the 12 -month period ending on 30 June 2023. He also pays a monthly premium of R4 800 for insurance against the loss of his trading stock and a monthly premium of R1350 for a life insurance policy on his own life. The premium of R1 350 a month paid on a life insurance policy on his own life is a private or domestic expense and its deduction in the determination of his taxable income is specifically prohibited. Select one: True False Isha Singh, a baker, works from her home. She uses her home kitchen that occupies 10% of the floor area of her home, to prepare the food for her catering business. Isha Singh has built an additional storeroom to store only the ingredients used for her trading activities. The interest incurred on funds borrowed by her to build this storeroom is R4 500 for the 2023 year of assessment. During the 2023 year of assessment she repaid R5 000 on the capital outstanding on these borrowed funds. Two-thirds of Isha Singh's account at the local supermarket relates to her catering business. This account is always settled at the end of the month following the month when the purchases were made. Her account is R22 400 a month. The interest portion of Isha Singh's mortgage loan repayments on the mortgage bond on her home is R7 200 for the 2023 year of assessment. Isha Singh pays R13 600 a month to a full-time assistant in her catering business. She also paid her teenage son R6 000 for the 2023 year of assessment for assisting as a waiter at some functions. Had she hired a waiter, she would have had to pay him R8 000 . The interest of R4 500 that she incurred on the loan used to fund the building of her storeroom is not deductible in the determination of her taxable income under the provisions of section 24J. This deduction is prohibited by section 23(b), since the storeroom is not used exclusively for her trade. Demi Daisy successfully passed a swimming instructor's course on 25 February 2022. She can now "officially" give swimming lessons. From 25 to 28 February 2022, she advertised her services. Her first lesson was, however, only given on 3 March 2022. She incurred a cost of R15 800 on the swimming-instructor's course. The expense incurred is not deductible in the determination of the relevant taxpayer's taxable income. Select one: True False Bossi Ltd entered into the following transaction during its 2023 year of assessment (ending on the 28th of February 2023): On 31 January 2023, it paid R76 500 for electricity for the six-month period from 1 February 2023 to 31 July 2023 relating to the property it occupies for the purposes of its trade. How much will the company deduct in terms of the general deduction formula for the year ending 28 February 2023? A. R76500 B. R63750 C. R12 750 D. RO Delta (Pty) Ltd provided you with the following information regarding the company's income and expenses for the 2023 year of assessment: Sales = R1 000 000, opening stock = R150 000, closing stock = R125 000. In addition to this, the company made purchases of R350 000 during the year. Based on the information above, what is the taxable income for Delta (Pty) Ltd for the 2023 year of assessment. A. R1 125000 B. R1 000000 C. R625000 D. R375000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started