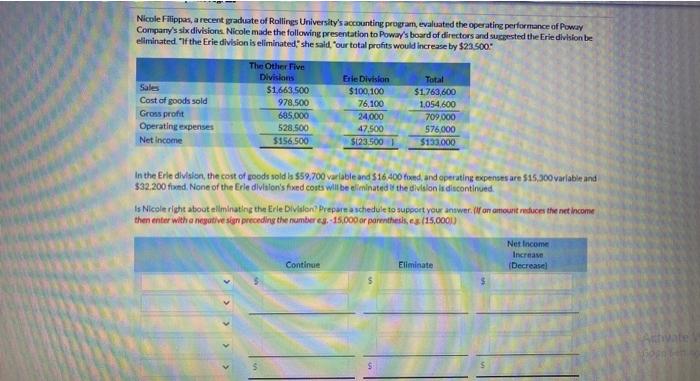

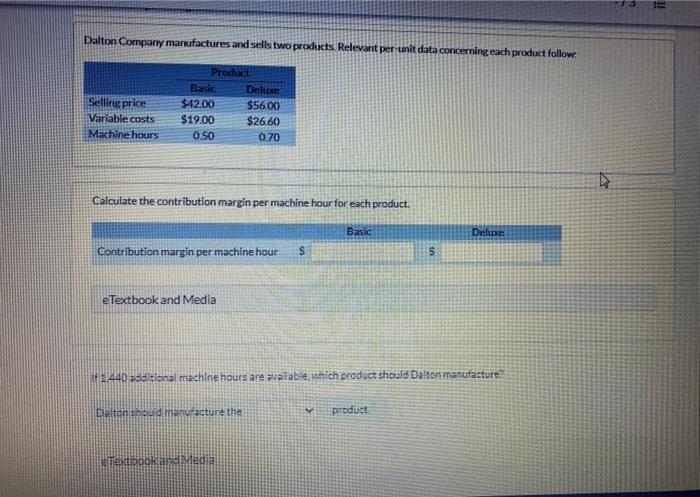

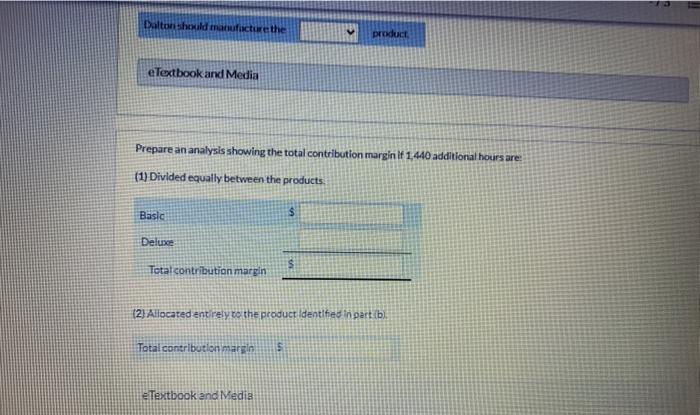

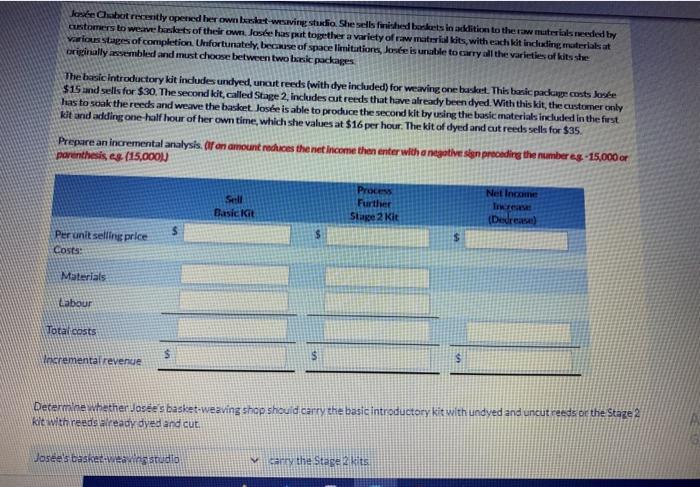

Nicole Flippas, a recent graduate of Rolling University's accounting program, evaluated the operating performance of Poway Company's six divisions. Nicole made the following presentation to Poway's board of directors and suggested the Eredivision be eliminated. "If the Erie division is eliminated" she sald. "our total profits would increase by $23.500 Total Sales Cost of goods sold Gross profit Operating expenses Net Income The Other Five Divisions $1,663,500 978.500 685,000 528.500 $556.500 Erle Division $100,100 76.100 24,000 47.500 $123.500 $1.763,600 1.054.600 709,000 576,000 $133.000 In the Erle division, the cost of goods sold is $59.700 variable and 316 400 found and operating expenses are $15.900 variable and $32.200 fund. None of the Erle division's fixed costs will be eliminated the division la discontinued Is Nicole right about allminating there Division? Prepare a schedule to support your answer.Won amount reduces the net income then enter with a negative si preceding the number 4, 15,000 or parenthesis,es (15,0001) Net Income Increase Decrease Continue Eliminate Dalton Company manufactures and sells two products Relevant per unit data concerning each product follow: Selling price Variable costs Machine hours Product Basic Deline $42.00 S5600 $19.00 $26.60 0.50 0.70 Calculate the contribution margin per machine hour for each product Deli Contribution margin per machine hour s s e Textbook and Media 2440 aditional machine hours are aralaba which product should Dalton manufacture Daltonished manufacture the product Textbook and Media Dalton should manufacture the product e Textbook and Media Prepare an analysis showing the total contribution margin f 1.440 additional hours are: (1) Divided equally between the products Basic Delupe S Total contribution margin (2) Allocated entirely to the product identified in partib Total contribution margin e Textbook and Media Jaribe Csabot recently opened her own but weaving studio Shese fished boks in addition to the raw materials needed to customers to werve baskets of their own. Jose has put together a variety of raw material kits, with each kit including materials at Various stages of completion. Unfortunately, because of space limitations, Jose is unable to carry all the varieties of kits she originally assembled and must choose between two besk packages The basic introductory kit includesundyed, uncut reeds (with dye included) for weaving one basket. This basic package costs Jerse $15 and sells for $30. The second kit, called Stage 2, includes aut reeds that have already been dyed. With this kit, the customer only has to soak the reeds and weave the basket. Jose is able to produce the second kit by using the basic materials included in the first kit and adding one half hour of her own time, which she values at $16 per hour. The kit of dyed and cut reeds sells for $35. Prepare an incremental analysis. Of an amount recices the net Income then enter with a negative sin preceding the number es -15,000 or parenthesis es (15,000) Net Income Sell Basic Process Further Stage 2 Kit (Dedreas) $ Per unit selling price Costs: Materials Labour Total costs $ Yrremental revenue $ Determine whether Joses basket-weaving shop should carry the basic introductory kit with undved and uncut reeds of the Staze 2 kit with reeds aiready dyed and cut. Josee's basket-Wes studio Marty the Stage 2 kits