Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of

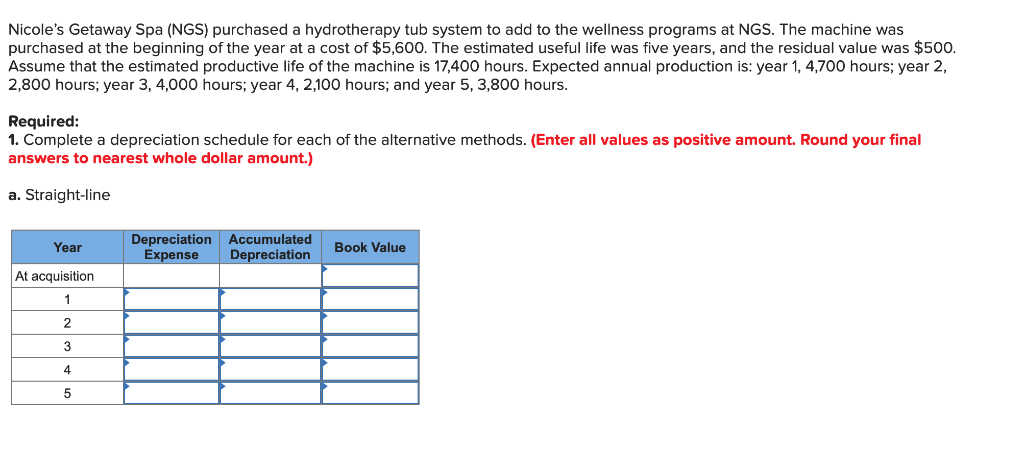

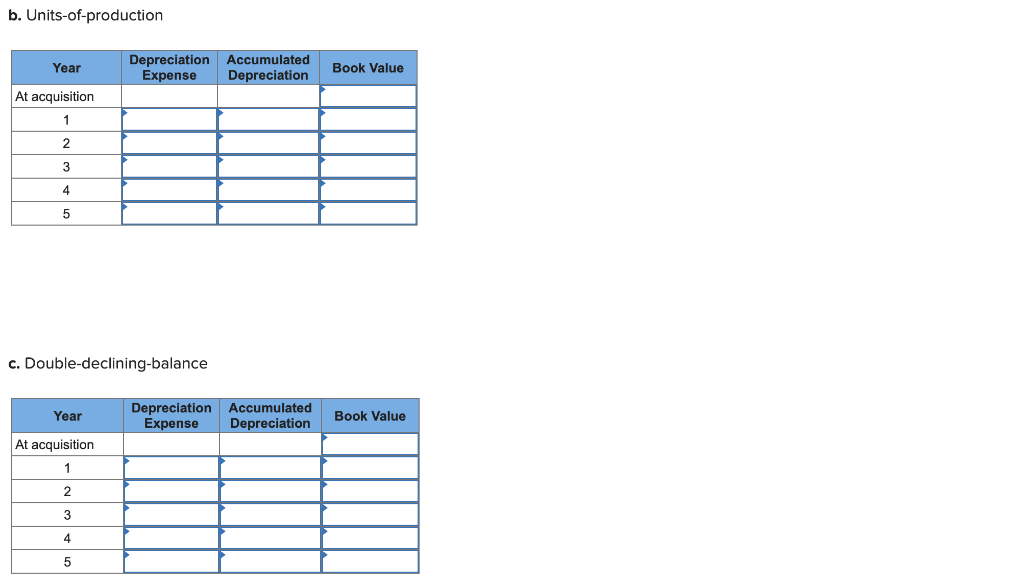

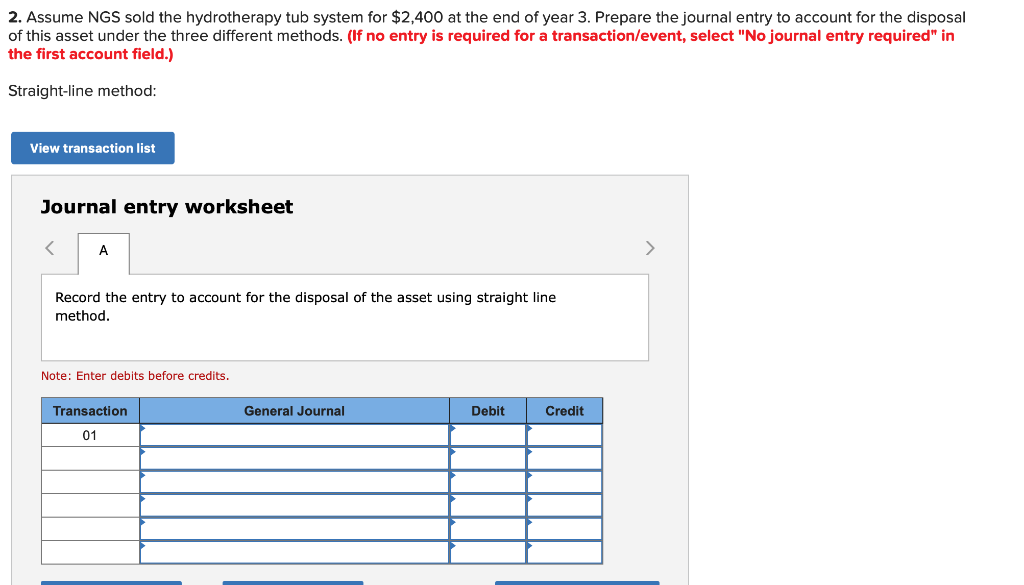

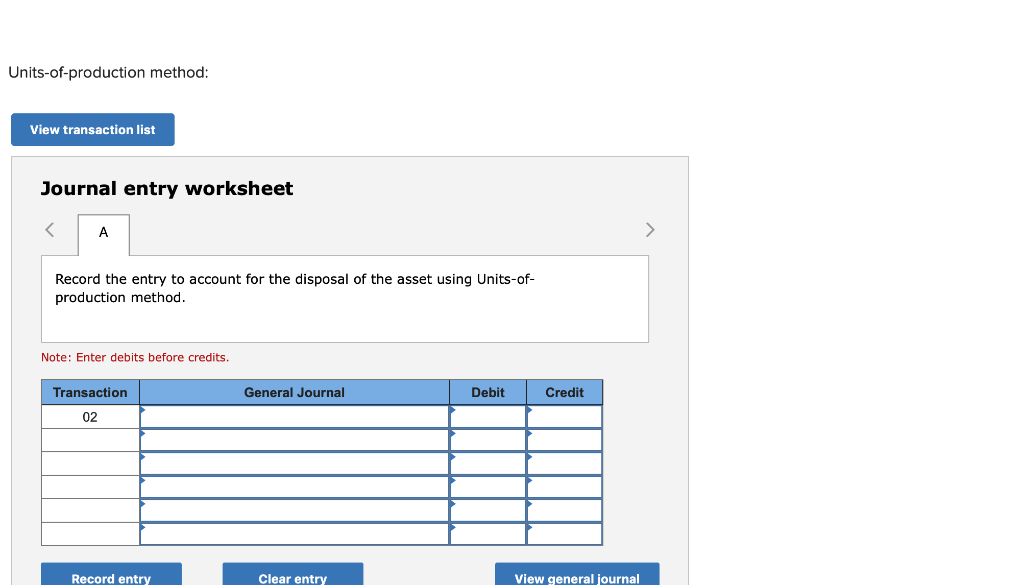

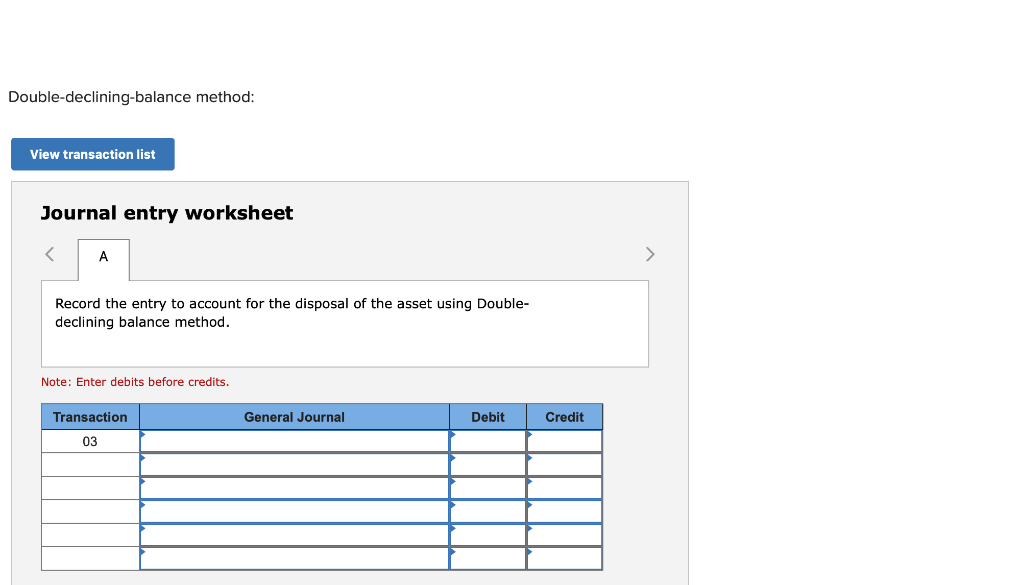

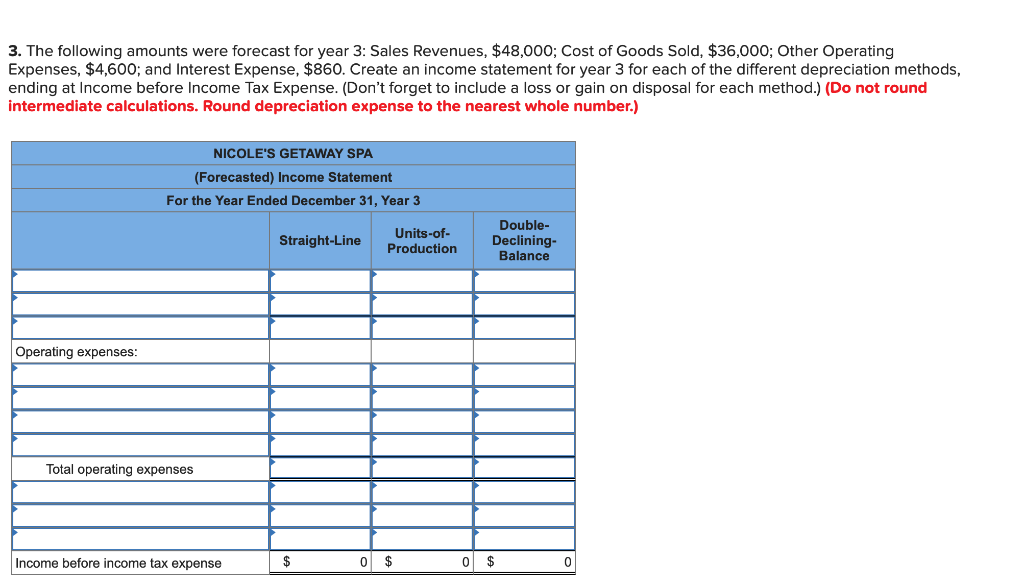

Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $5,600. The estimated useful life was five years, and the residual value was $500. Assume that the estimated productive life of the machine is 17,400 hours. Expected annual production is: year 1, 4,700 hours; year 2, 2,800 hours; year 3, 4,000 hours; year 4, 2,100 hours; and year 5, 3,800 hours. Required: 1. Complete a depreciation schedule for each of the alternative methods. (Enter all values as positive amount. Round your final answers to nearest whole dollar amount.) a. Straight-line Depreciation Accumulated Expense Book Value Year Depreciation At acquisition 1 2 3 4 5 b. Units-of-production Depreciation Accumulated Expense Book Value Year Depreciation At acquisition 1 2 4 5 c. Double-declining-balance Depreciation Expense Accumulated Book Value Year Depreciation At acquisition 1 4 5 2. Assume NGS sold the hydrotherapy tub system for $2,400 at the end of year 3. Prepare the journal entry to account for the disposal of this asset under the three different methods. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Straight-line method: View transaction list Journal entry worksheet A Record the entry to account for the disposal of the asset using straight line method Note: Enter debits before credits. Credit Transaction General Journal Debit 01 Units-of-production method: View transaction list Journal entry worksheet A Record the entry to account for the disposal of the asset using Units-of- production method. Note: Enter debits before credits Transaction General Journal Debit Credit 02 Record entry Clear entry View general journal Double-declining-balance method: View transaction list Journal entry worksheet A Record the entry to account for the disposal of the asset using Double- declining balance method. Note: Enter debits before credits General Journal Transaction Debit Credit 03 3. The following amounts were forecast for year 3: Sales Revenues, $48,000; Cost of Goods Sold, $36,000; Other Operating Expenses, $4,600; and Interest Expense, $860. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don't forget to include a loss or gain on disposal for each method.) (Do not round intermediate calculations. Round depreciation expense to the nearest whole number.) NICOLE'S GETAWAY SPA (Forecasted) Income Statement For the Year Ended December 31, Year 3 Double- Declin Balance Units-of- Production Straight-Line Operating expenses: Total operating expenses 0 $ 0 Income before income tax expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started