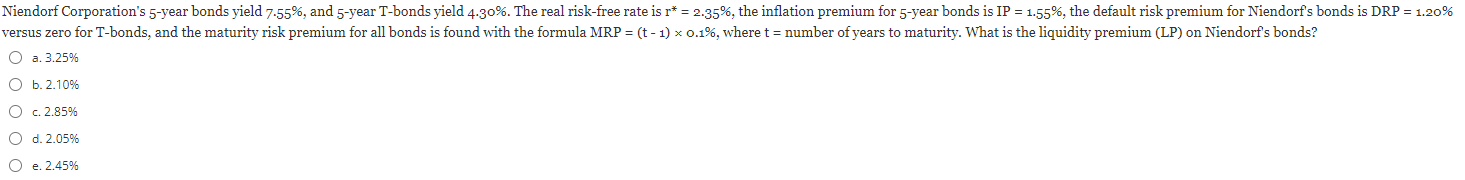

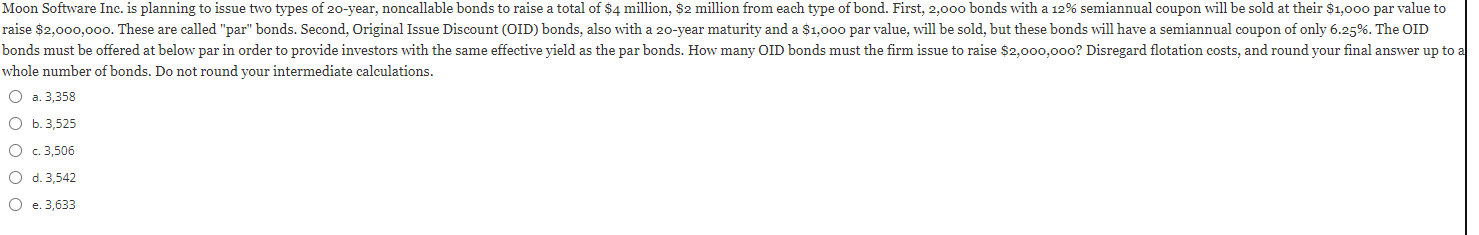

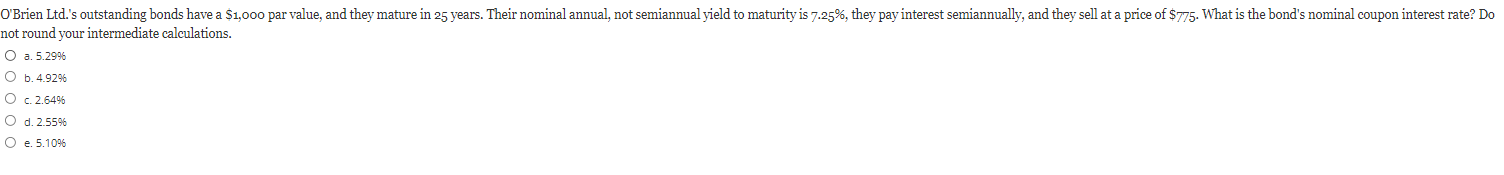

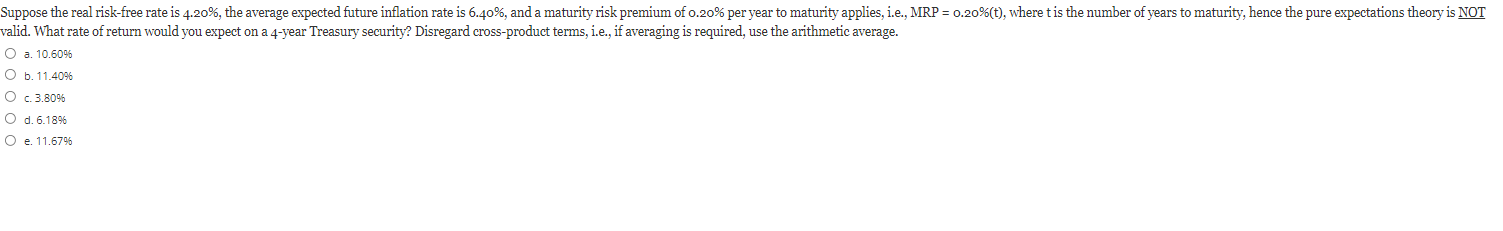

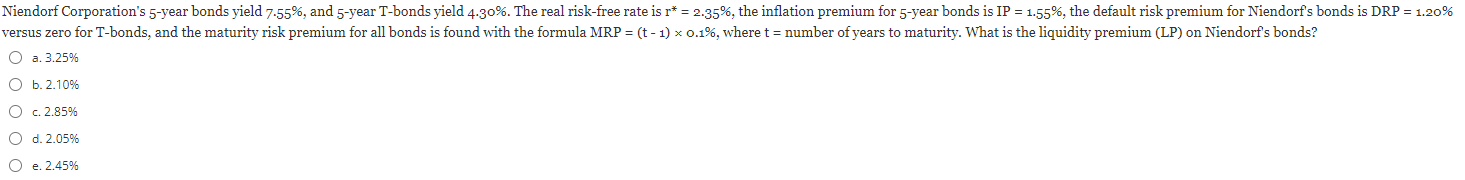

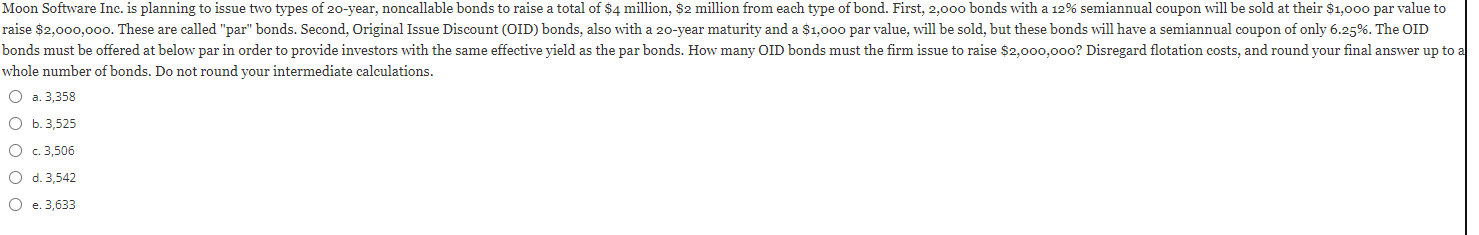

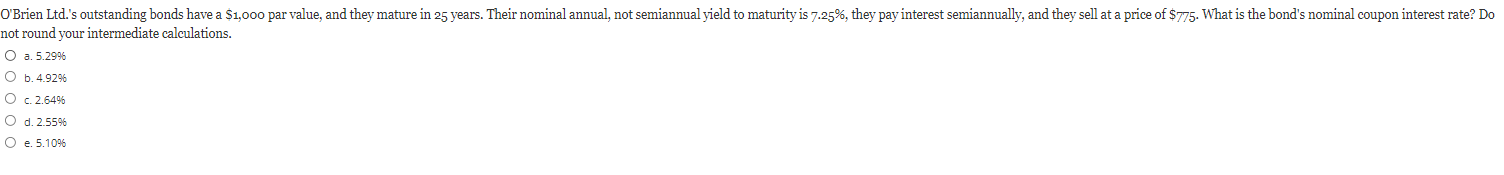

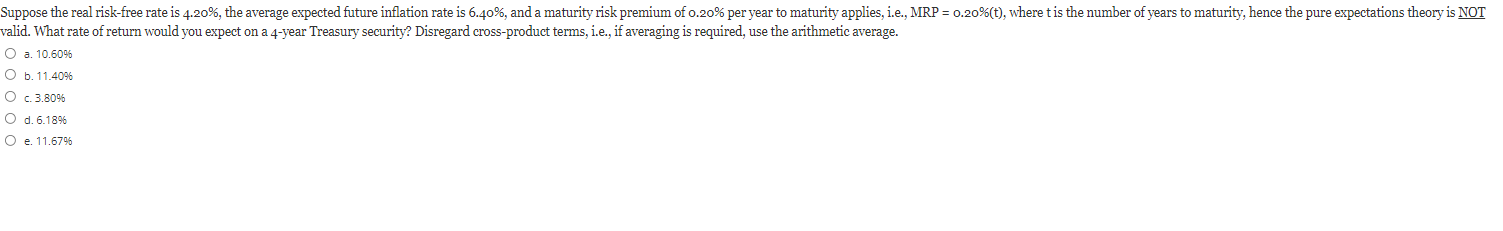

Niendorf Corporation's 5-year bonds yield 7-55%, and 5-year T-bonds yield 4.30%. The real risk-free rate is r* = 2.35%, the inflation premium for 5-year bonds is IP = 1.55%, the default risk premium for Niendorf's bonds is DRP = 1.20% versus zero for T-bonds, and the maturity risk premium for all bonds is found with the formula MRP = (t - 1) * 0.1%, where t = number of years to maturity. What is the liquidity premium (LP) on Niendorf's bonds? O a. 3.25% O b. 2.10% O c. 2.85% O d. 2.05% O e. 2.45% Moon Software Inc. is planning to issue two types of 20-year, noncallable bonds to raise a total of $4 million, $2 million from each type of bond. First, 2,000 bonds with a 12% semiannual coupon will be sold at their $1,000 par value to raise $2,000,000. These are called "par" bonds. Second, Original Issue Discount (OID) bonds, also with a 20-year maturity and a $1,000 par value, will be sold, but these bonds will have a semiannual coupon of only 6.25%. The OID bonds must be offered at below par in order to provide investors with the same effective yield as the par bonds. How many OID bonds must the firm issue to raise $2,000,000? Disregard flotation costs, and round your final answer up to a whole number of bonds. Do not round your intermediate calculations. O a. 3,358 O b. 3,525 O c. 3,506 O d. 3,542 O e. 3,633 O'Brien Ltd.'s outstanding bonds have a $1,000 par value, and they mature in 25 years. Their nominal annual, not semiannual yield to maturity is 7.25%, they pay interest semiannually, and they sell at a price of $775. What is the bond's nominal coupon interest rate? Do not round your intermediate calculations. O a. 5.2996 O b. 4.9296 O c. 2.6496 O d. 2.55% O e. 5.1096 Suppose the real risk-free rate is 4.20%, the average expected future inflation rate is 6.40%, and a maturity risk premium of 0.20% per year to maturity applies, i.e., MRP = 0.20%(t), where t is the number of years to maturity, hence the pure expectations theory is NOT valid. What rate of return would you expect on a 4-year Treasury security? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average. O a. 10.6096 O b. 11.4096 O c 3.80% O d. 6.18% O e. 11.67%