Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Niger Ltd is into flower production. The variable cost and fixed cost are N5 and 50k respectively. The firm is proposing the purchase of a

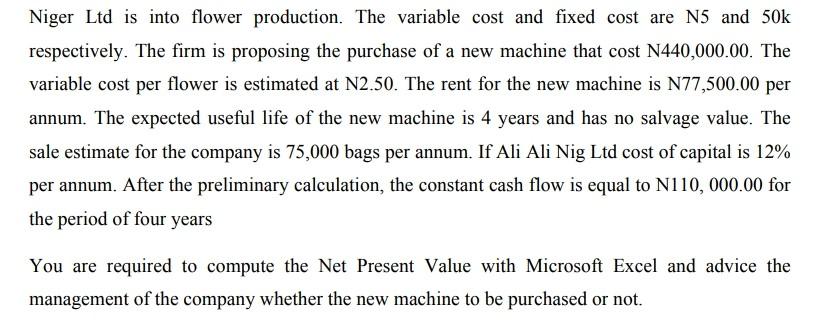

Niger Ltd is into flower production. The variable cost and fixed cost are N5 and 50k respectively. The firm is proposing the purchase of a new machine that cost N440,000.00. The variable cost per flower is estimated at N2.50. The rent for the new machine is N77,500.00 per annum. The expected useful life of the new machine is 4 years and has no salvage value. The sale estimate for the company is 75,000 bags per annum. If Ali Ali Nig Ltd cost of capital is 12% per annum. After the preliminary calculation, the constant cash flow is equal to N110,000.00 for the period of four years You are required to compute the Net Present Value with Microsoft Excel and advice the management of the company whether the new machine to be purchased or not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started