Answered step by step

Verified Expert Solution

Question

1 Approved Answer

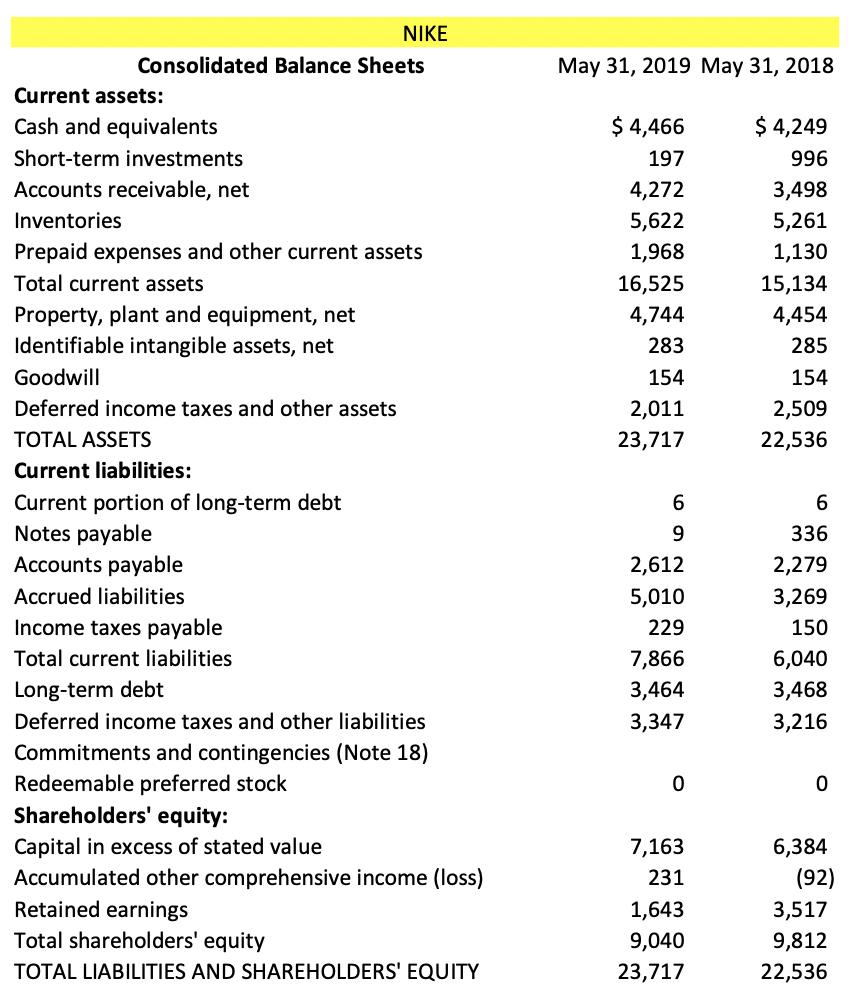

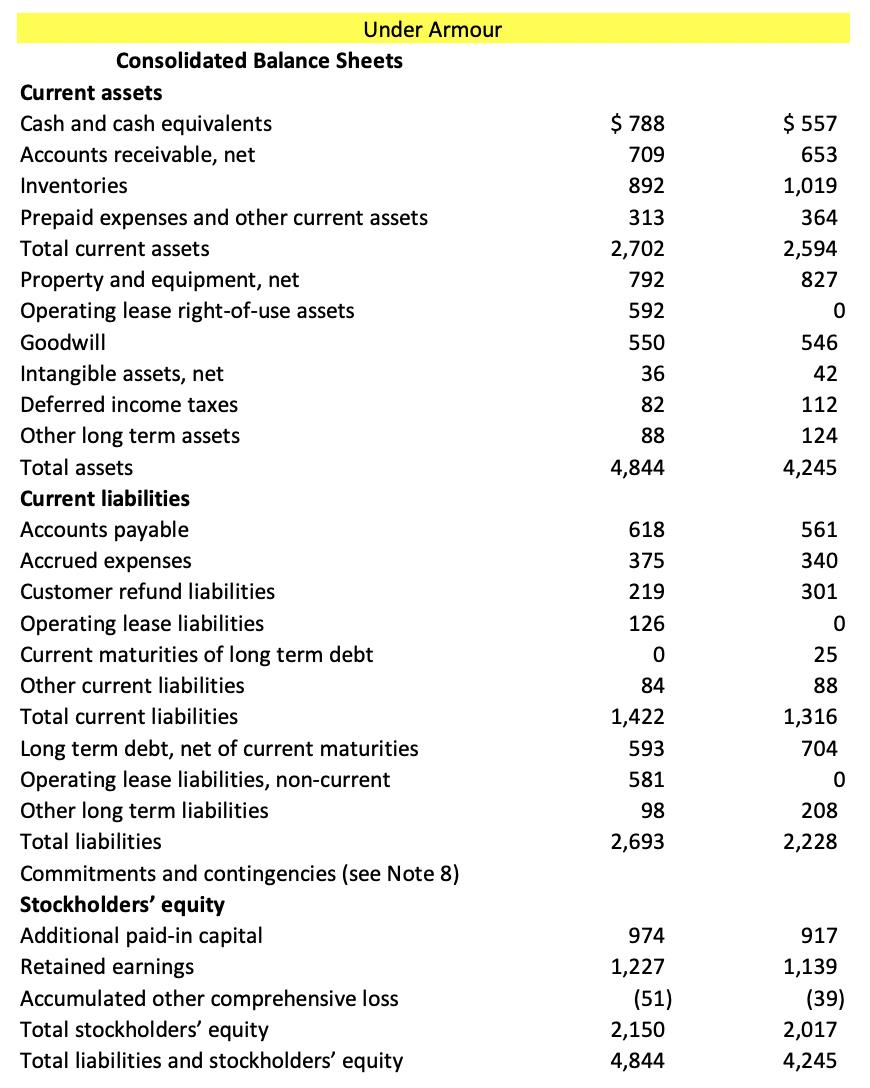

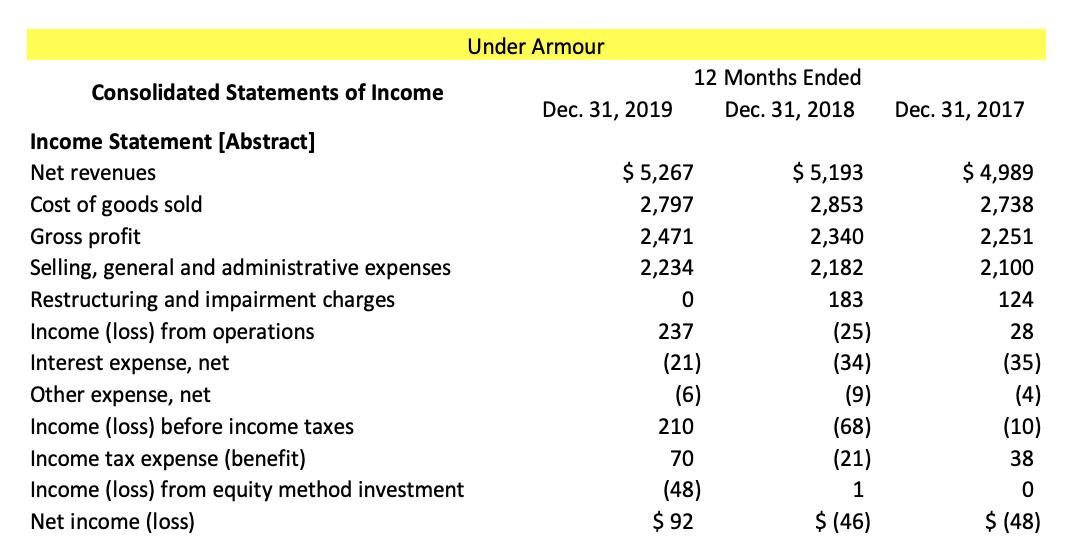

Nike and Under Armour's financial statements are provided below. Using financial statement analysis, assess the short and long term solvency, activity, and profitability of these

Nike and Under Armour's financial statements are provided below. Using financial statement analysis, assess the short and long term solvency, activity, and profitability of these companies. Ensure that you not only calculate the pertinent ratios, but also provide detailed discussion on what information the ratios convey (e.g., company A & B are solvent and have enough liquid assets to cover their expected liabilities).

![NIKE 12 Months Ended May 31, 2019 May 31, 2018 May 31, 2017 Consolidated Statements of Income Income Statement [Abstract] Rev](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/04/608a89bf14742_1619691964423.jpg)

NIKE Consolidated Balance Sheets May 31, 2019 May 31, 2018 Current assets: Cash and equivalents $ 4,466 $ 4,249 Short-term investments 197 996 Accounts receivable, net 4,272 3,498 Inventories 5,622 5,261 Prepaid expenses and other current assets 1,968 1,130 Total current assets 16,525 15,134 Property, plant and equipment, net Identifiable intangible assets, net 4,744 4,454 283 285 Goodwill 154 154 Deferred income taxes and other assets 2,011 2,509 TOTAL ASSETS 23,717 22,536 Current liabilities: Current portion of long-term debt Notes payable Accounts payable 6 336 2,612 2,279 Accrued liabilities 5,010 3,269 Income taxes payable 229 150 Total current liabilities 7,866 6,040 Long-term debt 3,464 3,468 Deferred income taxes and other liabilities 3,347 3,216 Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity: Capital in excess of stated value Accumulated other comprehensive income (loss) 7,163 6,384 231 (92) Retained earnings 1,643 3,517 Total shareholders' equity 9,040 9,812 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 23,717 22,536

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60915c5d9fa7e_208429.pdf

180 KBs PDF File

60915c5d9fa7e_208429.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started