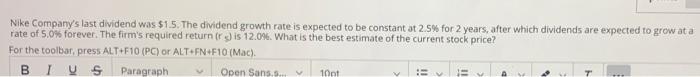

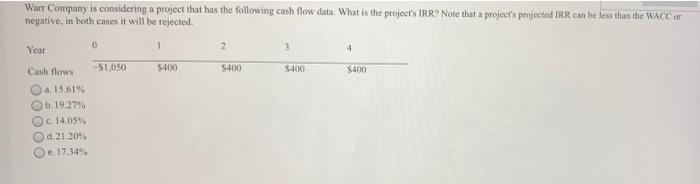

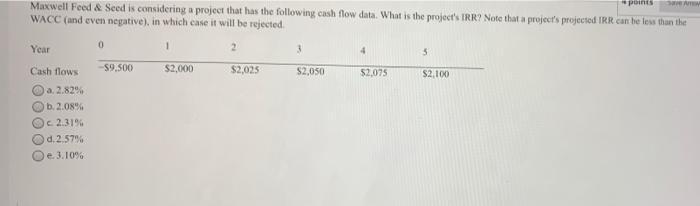

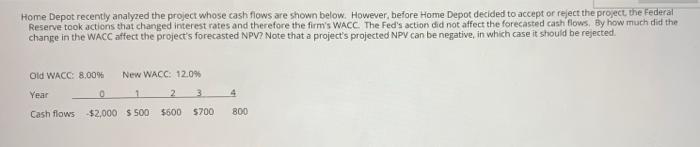

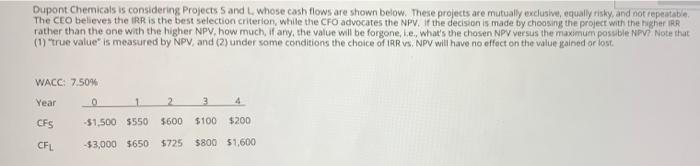

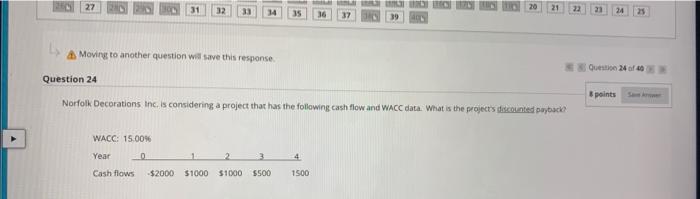

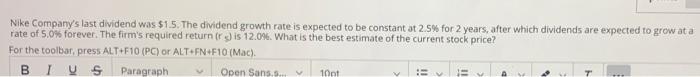

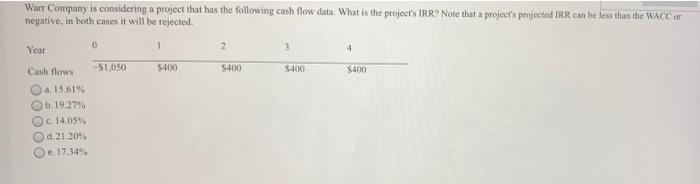

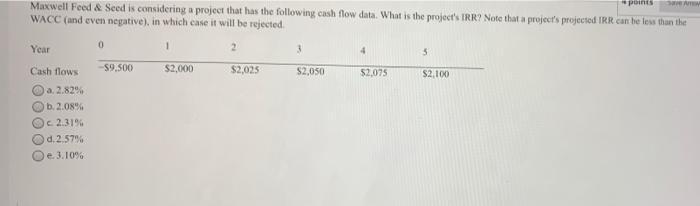

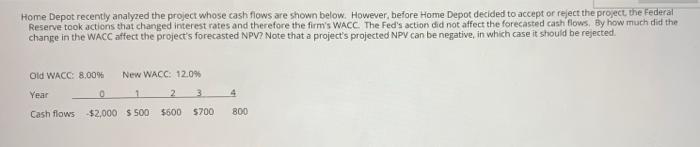

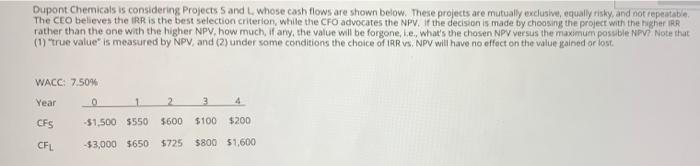

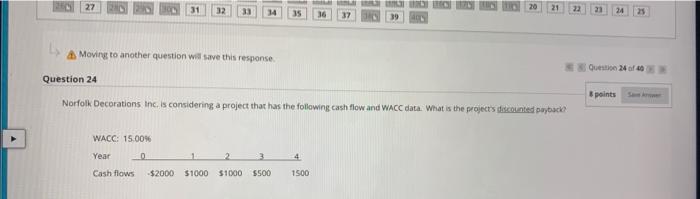

Nike Company's last dividend was $15. The dividend growth rate is expected to be constant at 2.5% for 2 years after which dividends are expected to grow at a rate of 5.0% forever. The firm's required return iris 12.0%. What is the best estimate of the current stock price? For the toolbar, press ALT+F10 (PC) or ALT+FN+E10 (Mac). BIUS Paragraph Open Sans... 10pt = = Warr Company is considering a project that has the following cash flow data. What is the project's IRR Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. 0 1 Year 2 4 $1,050 $400 $400 5400 $400 Cash flow 15.61% b.19.27% OC 14.0590 d. 21. 20% e. 173494 points Maxwell Feed & Seed is considering a project that has the following cash flow data. What is the project' IRR? Note that a projects projected IRR can be less than the WACC (and even negative), in which case it will be rejected. 0 Year 1 2 4 5 Cash flows S9.500 $2,000 $2,025 S2,050 $2,075 S2,100 a 2.829 b.2.0896 2.31% d. 2.57% e 3.10% Home Depot recently analyzed the project whose cash flows are shown below. However, before Home Depot decided to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected Old WACC: 8,00% New WACC: 12.0% Year 0 1 2 3 4 Cash flows $2,000 $500 $500 5700 800 Dupont Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky and not repeatable The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, the value will be forgone, le, what's the chosen NPV versus the maximum possible NPV Note that (1) "true value is measured by NPV and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost WACC: 7.50% Year 0 2 3 CES -$1,500 $550 5600 $100 $200 CFL -$3,000 $650 5725 5800 51,600 27 31 21 33 14 35 24 36 Moving to another question will save this response Question 24 points Norfolk Decorations Inc. is considering a project that has the following cash flow and WACC data. What is the projects descounted Payback WACC: 15.00% Year 4 Cash flows -$2000 51000 51000 5500 1500