Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NIKE, Inc. is an American corporation that is engaged in the design, development, manufacturing, and worldwide marketing and sales high quality of footwear, apparel, equipment,

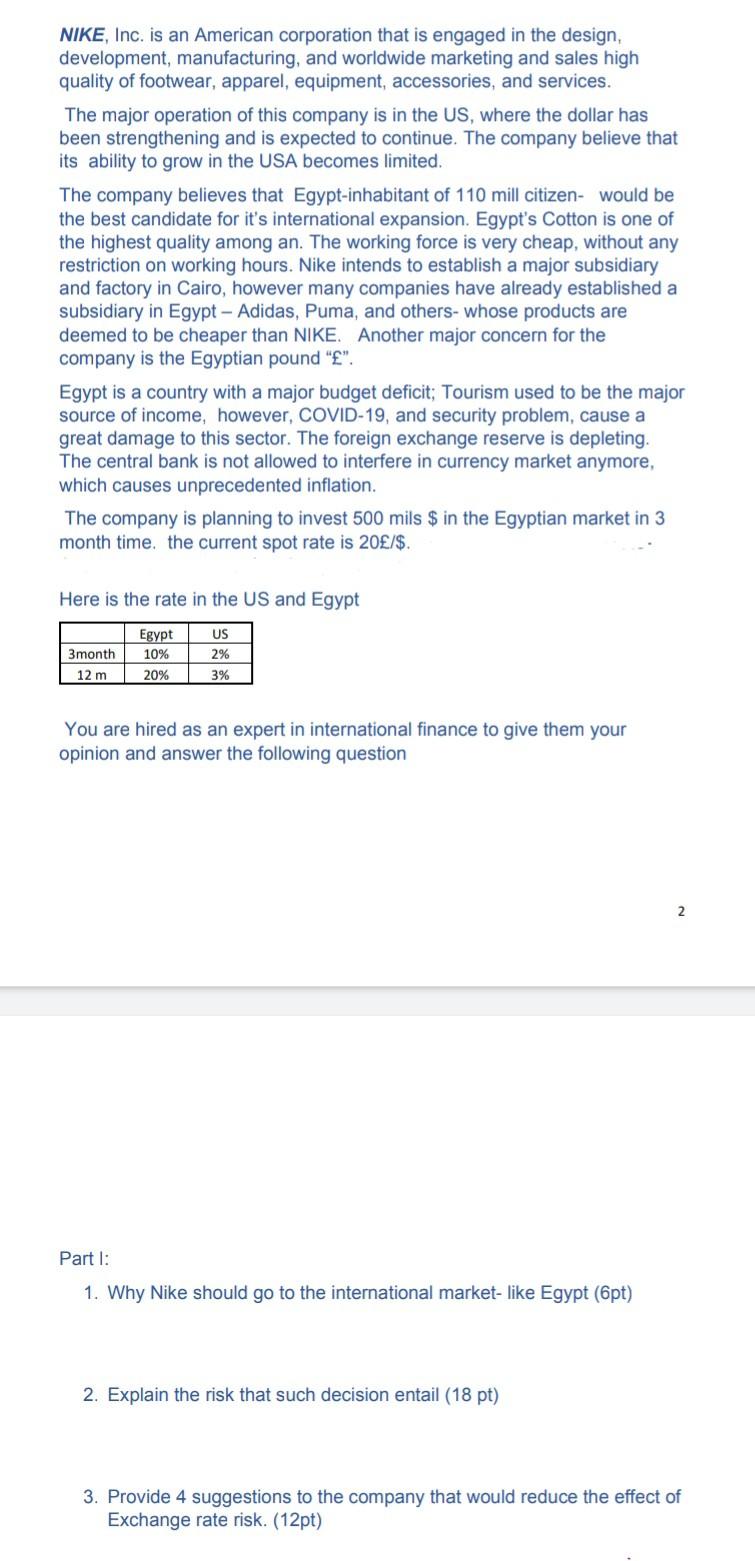

NIKE, Inc. is an American corporation that is engaged in the design, development, manufacturing, and worldwide marketing and sales high quality of footwear, apparel, equipment, accessories, and services. The major operation of this company is in the US, where the dollar has been strengthening and is expected to continue. The company believe that its ability to grow in the USA becomes limited. The company believes that Egypt-inhabitant of 110 mill citizen- would be the best candidate for it's international expansion. Egypt's Cotton is one of the highest quality among an. The working force is very cheap, without any restriction on working hours. Nike intends to establish a major subsidiary and factory in Cairo, however many companies have already established a subsidiary in Egypt - Adidas, Puma, and others- whose products are deemed to be cheaper than NIKE. Another major concern for the company is the Egyptian pound "E". Egypt is a country with a major budget deficit; Tourism used to be the major source of income, however, COVID-19, and security problem, cause a great damage to this sector. The foreign exchange reserve is depleting. The central bank is not allowed to interfere in currency market anymore, which causes unprecedented inflation. The company is planning to invest 500 mils $ in the Egyptian market in 3 month time, the current spot rate is 20/$. Here is the rate in the US and Egypt Egypt US 3month 10% 2% 12 m 20% 3% You are hired as an expert in international finance to give them your opinion and answer the following question 2 Part I: 1. Why Nike should go to the international market-like Egypt (pt) 2. Explain the risk that such decision entail (18 pt) 3. Provide 4 suggestions to the company that would reduce the effect of Exchange rate risk. (12pt) NIKE, Inc. is an American corporation that is engaged in the design, development, manufacturing, and worldwide marketing and sales high quality of footwear, apparel, equipment, accessories, and services. The major operation of this company is in the US, where the dollar has been strengthening and is expected to continue. The company believe that its ability to grow in the USA becomes limited. The company believes that Egypt-inhabitant of 110 mill citizen- would be the best candidate for it's international expansion. Egypt's Cotton is one of the highest quality among an. The working force is very cheap, without any restriction on working hours. Nike intends to establish a major subsidiary and factory in Cairo, however many companies have already established a subsidiary in Egypt - Adidas, Puma, and others- whose products are deemed to be cheaper than NIKE. Another major concern for the company is the Egyptian pound "E". Egypt is a country with a major budget deficit; Tourism used to be the major source of income, however, COVID-19, and security problem, cause a great damage to this sector. The foreign exchange reserve is depleting. The central bank is not allowed to interfere in currency market anymore, which causes unprecedented inflation. The company is planning to invest 500 mils $ in the Egyptian market in 3 month time, the current spot rate is 20/$. Here is the rate in the US and Egypt Egypt US 3month 10% 2% 12 m 20% 3% You are hired as an expert in international finance to give them your opinion and answer the following question 2 Part I: 1. Why Nike should go to the international market-like Egypt (pt) 2. Explain the risk that such decision entail (18 pt) 3. Provide 4 suggestions to the company that would reduce the effect of Exchange rate risk. (12pt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started