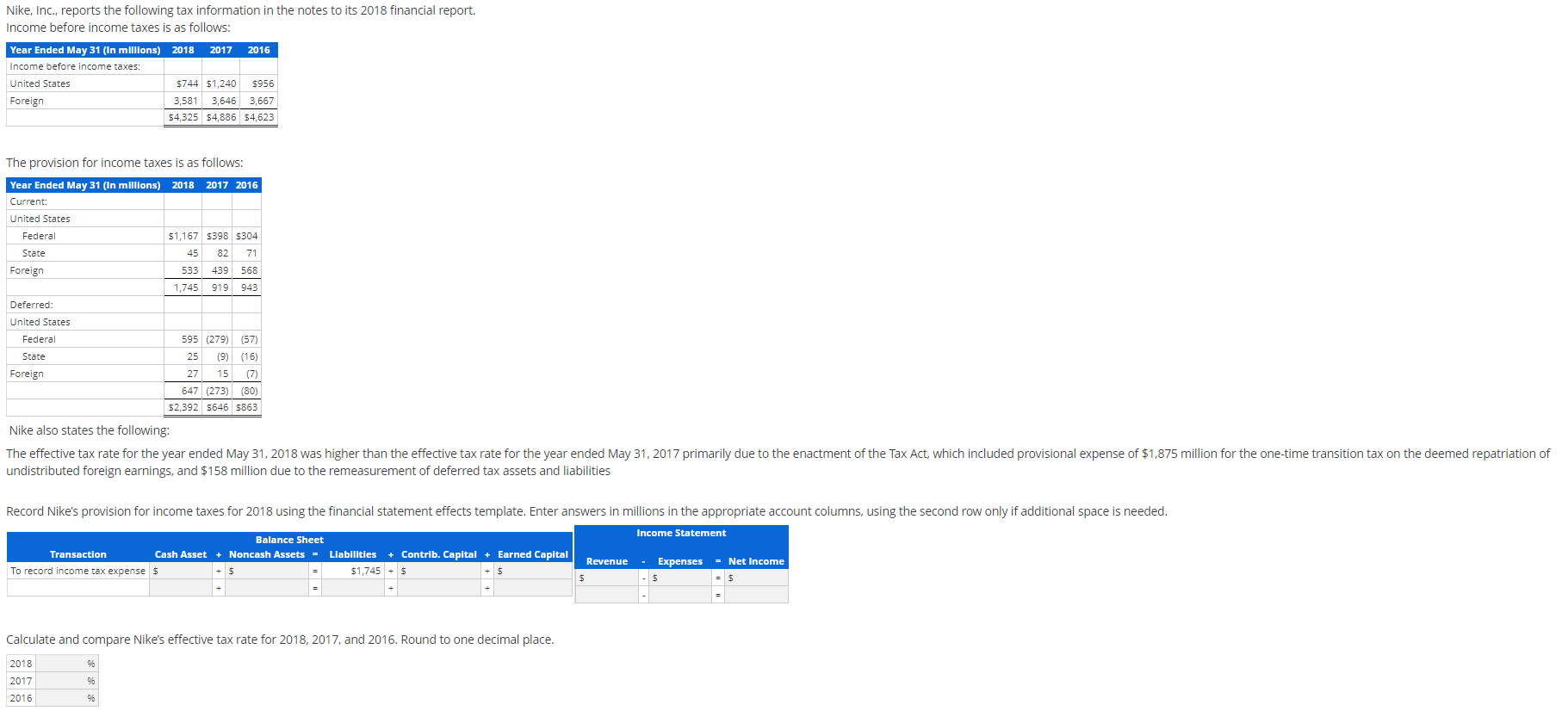

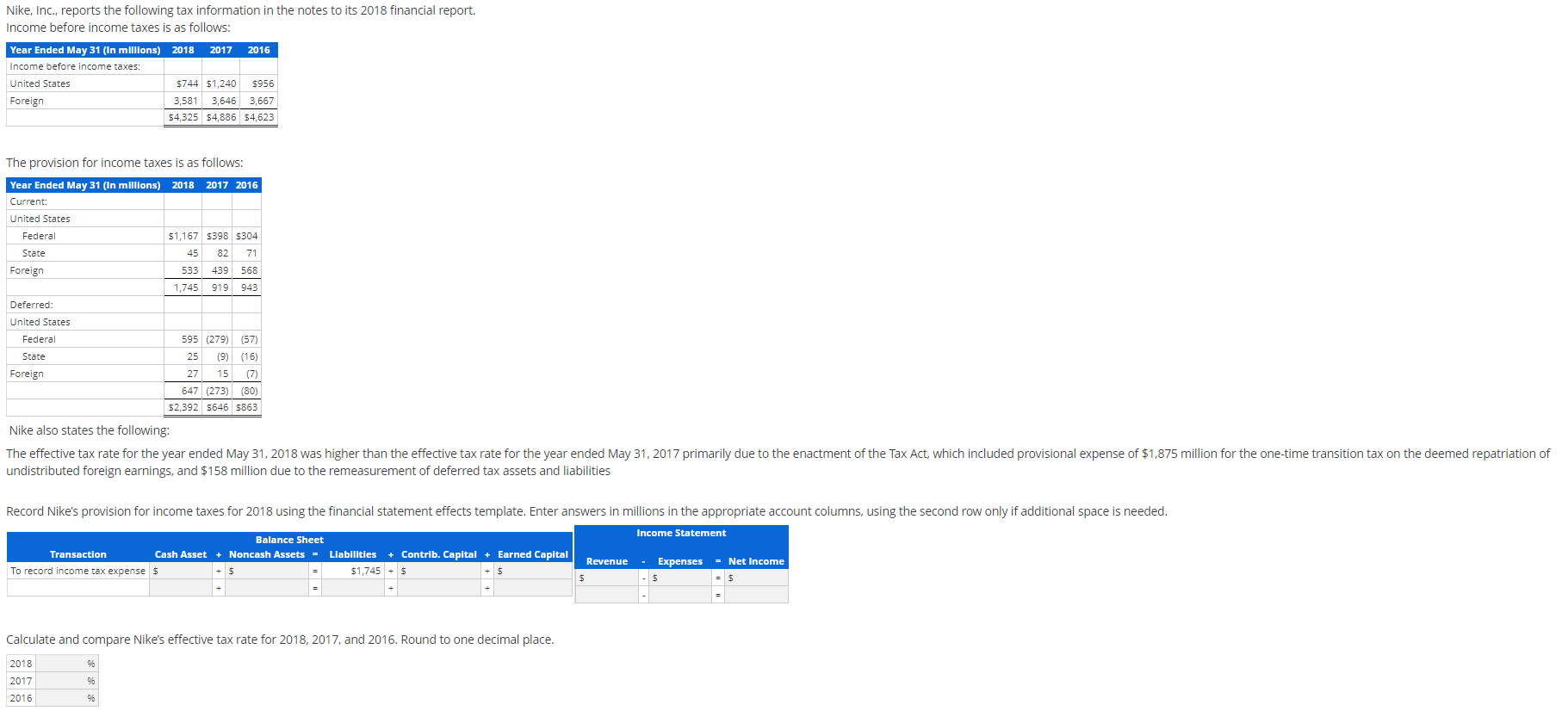

Nike, Inc., reports the following tax information in the notes to its 2018 financial report. Income before income taxes is as follows: Year Ended May 31 (In millions) 2018 2017 2016 Income before income taxes: United States $744 $1,240 $956 Foreign 3,581 3,646 3,667 $4,325 $4,886 $4,623 The provision for income taxes is as follows: Year Ended May 31 (In millions) 2018 2017 2016 Current: United States Federal $1,167 5398 $304 State 45 82 71 Foreign 533 439 568 1,745 919 943 Deferred: United States Federal 595 (279) (57) State 25 (9) (16) Foreign 27 15 647 (273) (80) $2,392 $646 5863 Nike also states the following: The effective tax rate for the year ended May 31, 2018 was higher than the effective tax rate for the year ended May 31, 2017 primarily due to the enactment of the Tax Act, which included provisional expense of $1,875 million for the one-time transition tax on the deemed repatriation of undistributed foreign earnings, and $158 million due to the remeasurement of deferred tax assets and liabilities Record Nike's provision for income taxes for 2018 using the financial statement effects template. Enter answers in millions in the appropriate account columns, using the second row only if additional space is needed. Income Statement Balance Sheet Transaction Cash Asset + Noncash Assets = Liabilities To record income tax expense $ $1,745 + Contrib. Capital + Earned Capital Revenue - Expenses - Net Income Calculate and compare Nike's effective tax rate for 2018, 2017, and 2016. Round to one decimal place. %6 2018 2017 2016 % %6 Nike, Inc., reports the following tax information in the notes to its 2018 financial report. Income before income taxes is as follows: Year Ended May 31 (In millions) 2018 2017 2016 Income before income taxes: United States $744 $1,240 $956 Foreign 3,581 3,646 3,667 $4,325 $4,886 $4,623 The provision for income taxes is as follows: Year Ended May 31 (In millions) 2018 2017 2016 Current: United States Federal $1,167 5398 $304 State 45 82 71 Foreign 533 439 568 1,745 919 943 Deferred: United States Federal 595 (279) (57) State 25 (9) (16) Foreign 27 15 647 (273) (80) $2,392 $646 5863 Nike also states the following: The effective tax rate for the year ended May 31, 2018 was higher than the effective tax rate for the year ended May 31, 2017 primarily due to the enactment of the Tax Act, which included provisional expense of $1,875 million for the one-time transition tax on the deemed repatriation of undistributed foreign earnings, and $158 million due to the remeasurement of deferred tax assets and liabilities Record Nike's provision for income taxes for 2018 using the financial statement effects template. Enter answers in millions in the appropriate account columns, using the second row only if additional space is needed. Income Statement Balance Sheet Transaction Cash Asset + Noncash Assets = Liabilities To record income tax expense $ $1,745 + Contrib. Capital + Earned Capital Revenue - Expenses - Net Income Calculate and compare Nike's effective tax rate for 2018, 2017, and 2016. Round to one decimal place. %6 2018 2017 2016 % %6