Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nike is constructing a mall near industrial estate. The initial investment includes land costs $500,000, working capital $650,000, building costs $550,000 and other materials

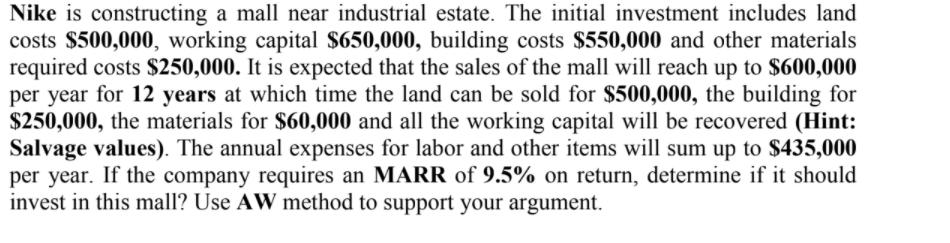

Nike is constructing a mall near industrial estate. The initial investment includes land costs $500,000, working capital $650,000, building costs $550,000 and other materials required costs $250,000. It is expected that the sales of the mall will reach up to $600,000 per year for 12 years at which time the land can be sold for $500,000, the building for $250,000, the materials for $60,000 and all the working capital will be recovered (Hint: Salvage values). The annual expenses for labor and other items will sum up to $435,000 per year. If the company requires an MARR of 9.5% on return, determine if it should invest in this mall? Use AW method to support your argument.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Initial investment Land cost 500000 Working capital 650000 Building cost 550000 Other m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started