Answered step by step

Verified Expert Solution

Question

1 Approved Answer

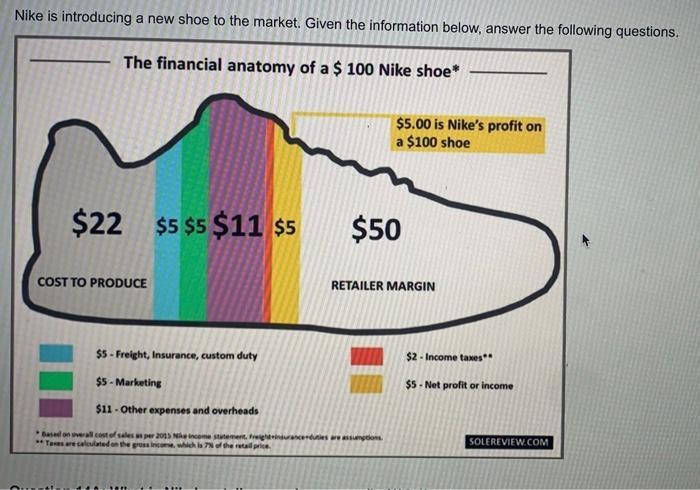

Nike is introducing a new shoe to the market. Given the information below, answer the following questions. The financial anatomy of a $ 100

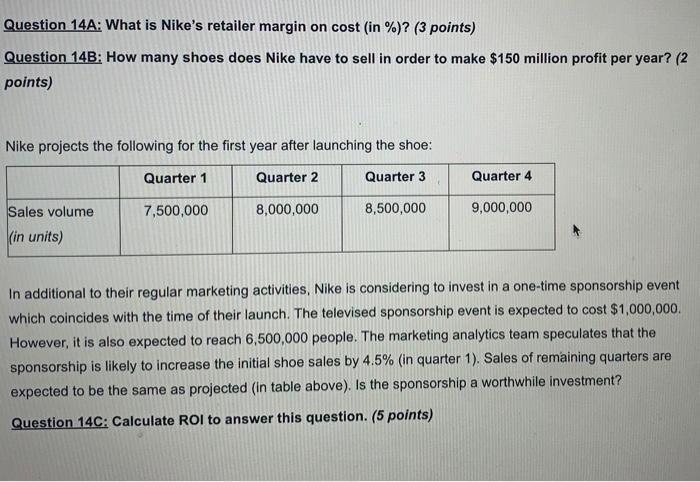

Nike is introducing a new shoe to the market. Given the information below, answer the following questions. The financial anatomy of a $ 100 Nike shoe* $22 $5 $5 $11 $5 COST TO PRODUCE $5.00 is Nike's profit on a $100 shoe $50 RETAILER MARGIN $5-Freight, Insurance, custom duty $5-Marketing $11-Other expenses and overheads Based on overall cost of sales as per 2013 Nike income statement, freight insurance duties are assumptions **Taxes are calculated on the gross income, which is 7% of the retail price $2-Income taxes** $5-Net profit or income SOLEREVIEW.COM Question 14A: What is Nike's retailer margin on cost (in %)? (3 points) Question 14B: How many shoes does Nike have to sell in order to make $150 million profit per year? (2 points) Nike projects the following for the first year after launching the shoe: Quarter 1 Quarter 3 Sales volume. (in units) 7,500,000 Quarter 2 8,000,000 8,500,000 Quarter 4 9,000,000 In additional to their regular marketing activities, Nike is considering to invest in a one-time sponsorship event which coincides with the time of their launch. The televised sponsorship event is expected to cost $1,000,000. However, it is also expected to reach 6,500,000 people. The marketing analytics team speculates that the sponsorship is likely to increase the initial shoe sales by 4.5% (in quarter 1). Sales of remaining quarters are expected to be the same as projected (in table above). Is the sponsorship a worthwhile investment? Question 14C: Calculate ROI to answer this question. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started